News

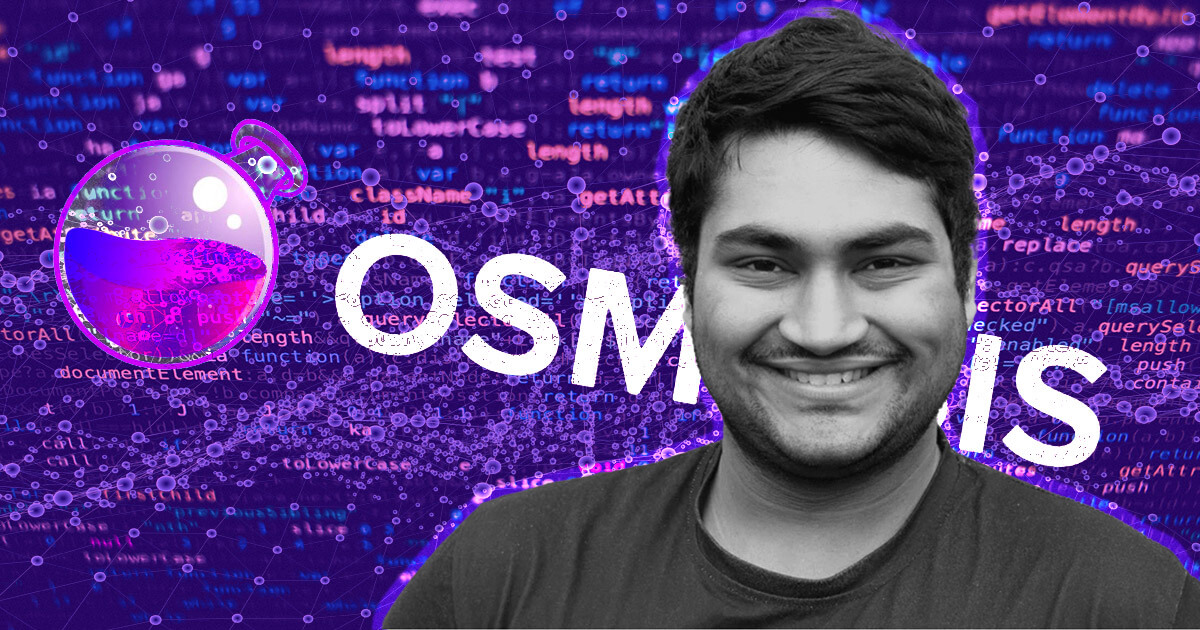

Osmosis Co-Founder Sunny Aggarwal Talks Customs, Cosmos, and the ‘Bitcoin Renaissance’

Even if you are not an avid “cosmonaut”, you are probably familiar with Sunny Aggarwalthe co-founder of Osmosis laboratories. With an infectious smile and upbeat personality, Sunny’s name is surprisingly fitting. She is the kind of person whose deep intellect, wit, and unbridled passion illuminate the spaces around him.

We had planned to meet at Cosmos Dubai during Token2049, but life had other plans. The Cosmos side event shouldn’t have happened. Dubai has been hit by the worst floods in 75 years, reducing the deserted, high-rise metropolis into a lake and submerging entire neighborhoods. “There’s always Cosmoverse in October,” smiles Sunny. “Then we can see each other in person.”

The rise and rise of osmosis

I couldn’t wait to see what outfit Sunny would wear; she has quite the collection, wearing a range of eye-popping costumes, from her to 40 lb chainmail armor to a Byzantine general costume with a striking red-crested helmet. “Ah, I save the best clothes for bigger events like Cosmoverse or Osmocon,” he explains, “if I wore a new one for every event, my costume budget would become too high,” he laughs. On the other side of the screen, from Sunny’s apartment in New York, he seems decidedly more discreet today.

Since the Cosmos ecosystem is the largest decentralized exchange (DEX)Osmosis has announced the passing $32 billion in all-time trading volume that day. I ask how it feels to come up with Cosmos’ most popular project and reach such an impressive milestone.

“I think he said Osmosis DEX wanted to get to $40 billion, [in the tweet]”, he replies, “but I’m waiting for 100 billion dollars.”

Sunny is unashamedly ambitious. Did you always know that Osmosis would be so successful? He reflects:

“The immediate success it achieved upon launch was truly amazing. Cosmos had a lot of high-value assets that weren’t listed on centralized exchanges, but we didn’t realize how big of a deal it would be.”

Growth hacking and the obstacles along the way

It hasn’t all been easy getting this far. Sunny has been in the web3 industry since 2017. Like all hardened OGs, he has experienced his fair share of ups and downs: cryptocurrency crashes, bear markets, and outright implosions like Terra (LUNA) and FTX. I ask him what is the most stressful situation he has experienced so far and he pauses:

“I guess I would have to say the week of the launch of Osmosis. It was the first time I launched a project, a company and a blockchain at the same time. There are a lot of last mile things you don’t think about.

Osmosis had publicly announced its launch date, and unlike the plethora of software projects that push launch dates like the proverbial can, Sunny was adamant about not moving hers. But as more and more last-mile items continued to accumulate, the launch date loomed over the team’s head like a dark, ominous cloud.

“Osmosis went from idea to launch very quickly,” he says. “We went from development to launch in just three or four months, and we procrastinated on a lot of important things until the last couple of weeks.”

Would he have done anything differently in hindsight?

“I would have planned things further in advance. When you launch a project, there’s more to it than just code. There are a lot of operational aspects to consider and it takes longer than you think… I would have done it all a lot sooner.”

Osmosis launched with a team of six and, despite a bumpy start, now has 45 full-time employees:

“I like the dimension we’re in now,” he says. “We’re small enough that we know everyone and can build a full team off-site, but we’re large enough that we’re pursuing multiple unique product lines in parallel.”

How do you handle the stress of being on the cutting edge of an ever-changing industry? Jumping from planes. Sunny is an aviation enthusiast and she is learning to fly a plane and taking a skydiving course.

“I find it best to put yourself in a position where you can’t touch your phone, like flying in a plane or scuba diving” (or hurtling towards the earth at 120 miles per hour). “Cryptocurrency markets are not volatile enough, I need to add more adrenaline,” she laughs.

Travel, idols and a mind “conducive to vitality”.

Spending so much time in the air, Sunny also enjoys travelling, and if there’s one place closest to her heart, it’s Switzerland. He has always been fascinated by the mountainous Alpine country and its rich history, culture, politics and economy.

He also taught a course on Switzerland while studying at Berkeley. He wouldn’t want to live there, though, because he’s “just a little too boring”. Sunny prefers the frenetic pace of a city like New York or “being at the forefront of technological innovation” in San Francisco’s Silicon Valley. She also loves Berlin, where her co-founder lives, and has many friends. “It’s like a second home.”

In addition to continuously improving Osmosis, helping other projects in the Cosmos ecosystem, and earning pilot miles, Sunny is an avid reader. One of her biggest idols is Peter Thiel, whose writing and “way of thinking” have greatly influenced Sunny’s worldview. Beyond Thiel From zero to onerecommends the book In swarm by Rick Falkvinge, the founder of Pirate Party political movement in Europe. The book is about how Falkvinge founded a political party and transformed it into a decentralized force through a concept called “swarms.”

He elaborates:

“In consensus protocols, there’s this concept of protocols that foster safety and viability. In promoting security, you can never shell out, you reach consensus on everything and then you make progress. Viability-enhancing protocols are constantly bifurcating but making rapid progress, you don’t need to get approval from the entire group to make a move… In the early stages of an organization where you’re focused on growth, you need that liveliness that encourages so you don’t get bogged down in bureaucracy.

A “Bitcoin Maxi” of a different kind

Being a self-declared “Bitcoin Maxi,” Sunny has no doubt that the original cryptocurrency is the best money for the world; but the glacial pace of development doesn’t match her need for constant innovation. That’s why you first worked on the Cosmos infrastructure, “building the appchain layer for Bitcoin.” What are you most excited about right now?

“Definitely the rebirth of Bitcoin. Ordinals changed everything, there was a cultural shift with all the Bitcoin L2s that happened. I’m confident we’ll have a good soft fork in the next year or two.

Wouldn’t this be a detriment to the qualities of sound money and the adoption of Bitcoin as an asset? “It is the limitations of Bitcoin that have caused the need for so many other money-like assets, but now Bitcoin can adapt to more people and offer more features, such as introducing DeFi, privacy, social… there is so much more we can do above Bitcoin now.”

What would Sunny do if he didn’t spend his time disrupting traditional finance? “Hardware.” Before working in the cryptocurrency industry, Sunny studied robotics in school and one day she would like to return to her roots.

“There are several ideas I’ve had. I’ve spent a lot of time thinking about smart guns, about having safer firearms, with security systems, like fingerprint scanners so people can’t steal them. He pauses: “I’m really interested in anything that has an important political impact. This is why I got into cryptocurrencies.”

If you want to meet Sunny, follow his staff Twitter OR Osmosis account, or jump on his website for ideas and inspiration. You can also explore the cutting edge of DeFi by trying the Osmosis DES.

Mentioned in this article

News

Cryptocurrency Price August 1: Bitcoin Dips Below $65K; Solana, XRP Down Up To 8%

Major cryptocurrencies fell in Thursday trading following the Federal Reserve’s decision to keep its key interest rate unchanged. Overnight, the U.S. Federal Reserve kept its key interest rate at 5.25-5.5% for the eighth consecutive time, as expected, while also signaling the possibility of a rate cut at its next meeting in September. The unanimous decision by the Federal Open Market Committee reflects a continued wait-and-see approach as it monitors inflation trends.

CoinSwitch Markets Desk said: “Bitcoin has fallen below $65,000 after the US Federal Reserve announced it would keep interest rates unchanged. However, with markets now anticipating rate cuts at the next Federal Reserve meeting in September, the outlook for a Bitcoin rally by the end of the year has strengthened.”

Meanwhile, CoinDCX research team said: “The crypto market has plunged after the Fed decision. Tomorrow’s US unemployment rate announcement is expected to induce more volatility, with the ‘actual’ figure coming in higher than the ‘expected’ one, which is positive for cryptocurrencies.”

At 12:21 pm IST, Bitcoin (BTC) was down 3.2% at $64,285, while Ethereum was down nearly 4.5% at $3,313. Meanwhile, the global market cryptocurrency The market capitalization fell 3.6% to around $2.3 trillion in the last 24 hours.

“Bitcoin needs to clear its 200-day EMA at $64,510 to consolidate further. Otherwise, a retest of $62,000 could be in the cards,” said Vikram Subburaj, CEO of Giottus.

Altcoins and meme coins, such as BNB (3%), Solana (8%), XRP (5.7%), Dogecoin (5%), Cardano (4.6%), Avalanche (4.3%), Shiba Inu (3.8%), Polkadot (3.4%), and Chainlink (4%) also saw declines.

The volume of all stablecoins is now $71.64 billion, which is 92.19% of the total cryptocurrency market volume in 24 hours, according to data available on CoinMarketCap. Bitcoin’s dominance is currently 54.99%. BTC volume in the last 24 hours increased by 23.3% to $35.7 billion.

(Disclaimer: Recommendations, suggestions, opinions and views provided by experts are personal. They do not represent the views of the Economic Times)

(You can now subscribe to our ETMarkets WhatsApp Channel)

News

Altcoins WIF, BONK, RUNE, JUP Down 10% While Bitcoin Drops 4%

Altcoins dogwifhat, Bonk, THORChain, and Jupiter have suffered losses of more than 10%, while Bitcoin is down 4% in the last 24 hours.

After a period of relative calm yesterday, July 31, Bitcoin (BTC) price action has seen a drastic change as the cryptocurrency dropped by more than $3,500, bringing its value to $63,300. At the same time, altcoins mirrored this trend, with the total value of liquidated positions rising to nearly $225 million over the course of the day.

Initially, the week started on a positive note for Bitcoin, which reached its highest point since early June, hitting $70,000. However, this peak was short-lived, as it was quickly rejected, leading to a substantial decline, with Bitcoin falling below $65,500.

The cryptocurrency managed to regain some stability, trading comfortably at around $66,800. However, following a Press conference According to Federal Reserve Chairman Jerome Powell, the value of Bitcoin has fallen again to $64,300, down more than 3% in 24 hours.

BTC Price Chart 24 Hours | Source: crypto.news

The recession coincided with a relationship from the New York Times stating that Iran had called for retaliatory measures against Israel following the assassination of Hamas leader Ismail Haniyeh in Tehran, increasing the risk of further conflict in the region.

Meanwhile, on the economic front, the Federal Reserve decided to keep its benchmark interest rates in place, offering little information on a planned September rate cut. Powell also hinted that while no concrete decisions have been made on the September adjustment, there is growing consensus that a rate cut is likely.

Amid Bitcoin’s decline, altcoins have suffered even more significant losses. For example, dogwifhat (Wife) saw a 12.4% drop and (DISGUST) has suffered a 10% drop. Other altcoins such as THORChain (RUNE) also fell by 10%, while Jupiter (JUPITER) and the Ethereum naming service (ENS) decreased by 8% and 9% respectively.

Among the largest-cap cryptocurrencies, the biggest losers are Solana (SOL) with a decrease of 8%, (Exchange rate risk) down 6%, Cardano (ADA) down 4%, and both Ethereum (ETH) and Dogecoin (DOGE) recording a decrease of 4.4%.

Data from CoinGlass indicates that approximately 67,000 traders have been negatively impacted by this increased volatility. BTC positions have seen $61.85 million in liquidations, while ETH positions have faced $61 million. In total, the value of liquidated positions stands at $225.4 million at the time of writing.

News

Riot Platforms Sees 52% Drop in Bitcoin Production in Q2

Bitcoin mining firm Riot Platforms has released its second-quarter financial results, highlighting a decline in cryptocurrency mined due to the recent halving.

Colorado-based Bitcoin (BTC) mining company Riot platforms revealed its second quarter financial results, highlighting a significant reduction in mined cryptocurrencies attributed to the recent halving event that took place in early April.

The company reported total revenue of $70 million for the quarter ended July 31, a decline of 8.7% compared to the same period in 2023. Riot Platforms attributed the revenue decline primarily to a $9.7 million decrease in engineering revenue, which was partially mitigated by a $6 million increase in Bitcoin extraction income.

During the quarter, the company mined 844 BTC, representing a decline of over 50% from Q2 2023, citing the halving event and increasing network difficulty as major factors behind the decline. Riot Platforms reported a net loss of $84.4 million, or $0.32 per share, missing Zacks Research forecast a loss of $0.16 per share.

Halving increases competitive pressure

The Colorado-based firm said the average cost of mining one BTC in the second quarter, including energy credits, rose to $25,327, a remarkable 341% increase from $5,734 per BTC in the same quarter of 2023. Despite this significant increase in production costs, the firm remains optimistic about maintaining competitiveness through recent deals.

For example, following the Recent acquisition Cryptocurrency firm Block Mining, Riot has increased its distributed hash rate forecast from 31 EH/s to 36 EH/s by the end of 2024, while also increasing its 2025 forecast from 40 EH/s to 56 EH/s.

Riot Platforms Hashrate Growth Projections by 2027 | Source: Riot Platforms

Commenting on the company’s financials, Riot CEO Jason Les said that despite the halving, the mining company still managed to achieve “significant operational growth and execution of our long-term strategy.”

“Despite this reduction in production available to all Bitcoin miners, Riot reported $70 million in revenue for the quarter and maintained strong gross margins in our core Bitcoin mining business.”

Jason Les

Following its Q2 financial report, Riot Platforms shares fell 1.74% to $10.19, according to Google Finance data. Meanwhile, the American miner continues to chase Canadian rival Bitfarms, recently acquiring an additional 10.2 million BITF shares, increasing its stake in Bitfarms to 15.9%.

As previously reported by crypto.news, Riot was the first announced a $950 million takeover bid for Bitfarms in late May, arguing that Bitfarms’ founders were not acting in the best interests of all shareholders. They said their proposal was rejected by Bitfarms’ board without substantive engagement.

In response, Bitfarms She said that Riot’s offer “significantly understates” its growth prospects. Bitfarms subsequently implemented a shareholder rights plan, also known as a “poison pill,” to protect its strategic review process from hostile takeover attempts.

News

Aave Price Increases Following Whales Accumulation and V3.1 Launch

Decentralized finance protocol Aave is seeing a significant spike in whale activity as the market looks to recover from the recent crash that pushed most altcoins into key support areas earlier this week.

July 31, Lookonchain shared details indicating that the whales had aggressively accumulated Aave (AAVE) over the past two days. According to the data, whales have withdrawn over 58,848 AAVE worth $6.47 million from exchanges during this period.

In one instance, whale address 0x9af4 withdrew 11,185 AAVE worth $1.23 million from Binance. Meanwhile, another address moved 21,619 AAVE worth over $2.38 million from the exchange and deposited the tokens into Aave.

These withdrawals follow a previous transfer of 26,044 AAVE from whale address 0xd7c5, amounting to over $2.83 million withdrawn from Binance.

AAVE price has surged over 7% in the past 24 hours amid buy-side pressure from these whales. The DeFi token is currently trading around $111 after jumping over 18% in the past week.

Recently, the price of AAVE increased by over 8% after Aave founder Marc Zeller announced a proposed fee change aimed at adopting a buyback program for AAVE tokens.

Aave v3.1 is available

The total value locked in the Aave protocol currently stands at around $22 billion. According to DeFiLlamaApproximately $19.9 billion is on Aave V3, while the V2 chain still holds approximately $1.9 billion in TVL and V1 approximately $14.6 million.

Aave Labs announced Previously, Aave V3.1 was made available on all networks with active Aave V3 instances.

V3.1 features improvements that are intended to improve the overall security of the DeFi protocol. The Aave DAO governance has approved the v3.1 improvements, which also include operational efficiency and usability for the network.

Meanwhile, Aave Labs recently outlined a ambitious roadmap for the projectwith a 2030 vision for Aave V4, among other developments.

-

Regulation7 months ago

Regulation7 months agoRipple CTO and Cardano founder clash over XRP’s regulatory challenges ⋆ ZyCrypto

-

Regulation5 months ago

Regulation5 months agoNancy Pelosi Considers Supporting Republican Crypto Bill FIT21 – London Business News

-

Videos6 months ago

Videos6 months agoCryptocurrency News: Bitcoin, ETH ETF, AI Crypto Rally, AKT, TON & MORE!!

-

Regulation6 months ago

Regulation6 months agoBitcoin’s future is ‘bleak’ and ripe for regulation, says lead developer

-

News6 months ago

News6 months agoThe trader earned $46 million with PEPE after reaching a new ATH

-

Blockchain6 months ago

Blockchain6 months agoSolana ranks the fastest blockchain in the world, surpassing Ethereum, Polygon ⋆ ZyCrypto

-

Blockchain6 months ago

Blockchain6 months agoSolana Surpasses Ethereum and Polygon as the Fastest Blockchain ⋆ ZyCrypto

-

Regulation6 months ago

Regulation6 months ago🔒 Crypto needs regulation to thrive: Tyler Cowen

-

Videos6 months ago

Videos6 months agoWho Really CONTROLS THE MARKETS!! Her plans REVEALED!!

-

Videos7 months ago

Videos7 months agoKucoin safe?? Exchange REVIEW and beginner’s guide!!

-

Blockchain6 months ago

Blockchain6 months ago“Liquid vesting” is an oxymoronic feature of blockchain that allows early investors to sell without waiting

-

Videos6 months ago

Videos6 months agoInstitutions purchasing MEMECOINS?! Everything you need to know!