Bitcoin

Bitcoin Soars 8.33% to $65,000, Ethereum Holds Strong at $3,177, Up 6%, Furrever Token Presale Reaches $1M Amid 15X Return Potential

Furrever Token

New York, NY, May 7, 2024 (GLOBE NEWSWIRE) — In the dynamic and ever-evolving world of cryptocurrencies, recent market movements show the resilience and potential of leading digital assets. Bitcoin (Bitcoin) recently experienced a surge from $60,000 to $65,000 predicted by the Bitcoin Fundamental Index (BFI). Ethereum (ETH), maintaining stability above the US$3,000 mark, shows strong signs of retention by investors, while Furrever Token (SKIN) demonstrates the fusion of cuteness with crypto, reaching a significant pre-sale milestone.

Recent Bitcoin (BTC) Surge Predicted by Fundamental Index, What’s Next?

The recent increase in Bitcoin’s price, rising from approximately $60,000 on May 1st to $65,000 on May 6th, was successfully predicted by the Bitcoin Fundamental Index (BFI) developed by Swissblock. This innovative analytical tool correlated fundamental metrics of the Bitcoin network with its price movements, signaling a potential reversal just before the rally begins.

On-chain data from the period leading up to the price increase showed a significant increase in transactions exceeding $100,000 along with balanced inflows and outflows across cryptocurrency exchanges. Specifically, the exchanges recorded total inflows of around 8.3 billion dollars and slightly lower outflows of 7.23 billion dollars. This pattern reflected healthy market sentiment, with substantial buying pressure offsetting profit-taking by some investors.

Interestingly, the BFI highlighted that the concentration of Bitcoin by large holders was relatively low at 11%, suggesting that the recent price movement was not predominantly driven by whale activity. This is significant as movements driven by large stakeholders can often introduce greater volatility into the market. Furthermore, Bitcoin’s price correlation has remained stable, with a perfect correlation score of 1, indicating predictable movements in line with key market indicators.

As Bitcoin navigates various economic and market conditions, tools like the Bitcoin Fundamental Index offer valuable information for predicting potential price movements. With the recent rally now in line with fundamental and on-chain analysis, the cryptocurrency community continues to watch closely, using these indicators to effectively assess future market directions. As always, investors are encouraged to consider this comprehensive data when making investment decisions in the volatile crypto market.

Ethereum (ETH) Shows Strong Resistance as Prices Rise Above $3,000

Ethereum (ETH), a major player in the cryptocurrency market, is currently showing signs of strong investor confidence as its price stabilizes above the crucial $3,000 mark. With the current trading price at $3,177, Ethereum is approaching the 23.6% Fibonacci retracement level, which is recognized as a vital support zone.

The story continues

Ethereum investors are increasingly choosing to hold their assets rather than sell them, contributing to bullish sentiment in the market. This behavior is evidenced by a significant reduction in active deposits, which decreased by 27% in the last week. Active deposits are essentially the unique addresses that transfer Ethereum from personal wallets to exchanges, and this decrease marks an eight-month low in potential sales activity.

However, if Ethereum fails to hold the $3,000 support, it could face a correction to $2,539, challenging the current bullish outlook and potentially magnifying losses for investors.

As Ethereum continues to navigate these crucial price points, the market response to these holder behaviors and technical levels will play a crucial role in determining the near-term trajectory of this leading cryptocurrency. Investors and market watchers are advised to closely monitor these developments as they could significantly impact Ethereum prices and market positioning in the coming weeks.

Exploring the enchanting world of Furrever Token (FURR): a mix of cuteness and cryptographic innovation

Furrever Token (FURR) offers a unique twist on the cryptocurrency scene by integrating the charming charm of cats into its platform. At the heart of Furrever Token’s strategy is a commitment to improving user interaction with charming cat images. By incorporating cat-themed stickers, emojis, and visuals, FURR transforms everyday transactions into fun and exciting interactions. The focus of the project goes beyond mere aesthetics; actively promotes community engagement through various challenges and initiatives that encourage users to express their affinity for cats and cuteness.

Having raised over $1 million in just two months and currently in stage 8 of a 10-stage pre-sale, Furrever Token is priced at $0.000648. The token offers potential returns of up to 15x, attracting investors looking for fun and financial growth. Ensuring security and transparency, Furrever Token has undergone a smart contract audit by Securi Lab and maintains active engagement with its community on platforms such as Telegram.

Adding an element of excitement, Furrever Token launched the $10,000 Frenzy Bonanza Competition, captivating participants across the world. Hosted on the Gleam platform, this contest offers a total prize pool of $10,000 in FURR tokens. Participants increase their chances of winning by completing various tasks, and the more tasks are completed, the greater the chance of securing a prominent place.

Scheduled to run from May 2, 2024, 12:00 PM (UTC +1) to May 9, 2024, 12:00 PM (UTC +1), the week-long event allows plenty of time for participants to participate and gather points. At the end of the competition, three winners will be chosen at random to receive $5,000, $3,000 and $2,000 in $FURR tokens respectively, potentially increasing their cryptocurrency holdings significantly.

Furrever Token is proving to be a standout in the world of cryptocurrencies by merging the appeal of playful themes with great financial potential, promising to be an attractive venture for cat enthusiasts and crypto investors alike.

For more information or any assistance regarding Furrever Token, please contact only through the official channel at support@furrevertoken.com to avoid possible fraud.

Join the Furrever Token presale now:

Furrever Token official website

Visit the Furrever Token pre-sale

Participate in the Furrever Token $10,000 Bonanza Competition

Join the official Telegram group

Follow the official account

Disclaimer: The information provided in this press release is not a solicitation for investment, nor is it intended as investment advice, financial advice or trading advice. It is highly recommended that you practice due diligence, including consulting with a professional financial advisor, before investing or trading cryptocurrencies and securities.

CONTACT: Media Contact: Robert Smith https://furrevertoken.com/ support(at)furrevertoken.com

Bitcoin

‘This is huge’ — Billionaire Mark Cuban issues ‘incredible’ Bitcoin and crypto prediction amid price slump

Bitcoin has surged again this year under former President Donald Trump Cryptocurrency boosts US presidential election in November with ‘revolutionary’ plan.

The price of bitcoin has surged to more than its all-time high in recent months, surpassing $70,000 per bitcoin and triggering a wave of mega-optimistic predictions about the price of bitcoinalthough it fell again this week to below $65,000 after the Federal Reserve kept interest rates steady.

Now, as Elon Musk suddenly breaks his silence on bitcoin and cryptocurrenciesBillionaire investor Mark Cuban called a California plan to digitize 42 million car titles using blockchain an “incredible step forward” and “huge” for cryptocurrencies.

Sign up for free CryptoCodex now—A daily five-minute newsletter for traders, investors, and crypto curious people that will keep you up to date and ahead of the bitcoin and crypto bull market

Mark Cuban, famous Shark Tank investor and billionaire owner of the NBA team Dallas Mavericks, has… [+] called a cryptocurrency update “amazing” amid bitcoin’s price slump.

Getty Images

The California Department of Motor Vehicles (DMV) has digitized 42 million car titles using blockchain, it was reported by Reuters, through technology company Oxhead Alpha on the Avalanche blockchain and designed to detect fraud and facilitate the securities transfer process.

“This is an incredible development for crypto,” Cuban, best known as an investor on TV’s Shark Tank and owner of the Dallas Mavericks NBA team, posted on X, joking that U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler could sue the state as part of his hostility toward cryptocurrencies and blockchain technology.

“The reason this is huge for crypto is because people who hold the tokens will have an app with an Avalanche wallet,” Cuban said. “Tens of millions of Californians having and using a crypto wallet in the next five years, or however long it takes, normalizes the use of wallets and crypto.”

John Wu, president of Avalanche developer Ava Labs, told Reuters that California’s DMV is “creating a wallet that you can download on your phone.”

Sign up for CryptoCodex now—A free daily newsletter for the crypto-curious

Bitcoin’s price has rallied this year, triggering a wave of bullish bitcoin price predictions from… [+] people like billionaire Mark Cuban.

Forbes Digital Assets

Last month, Cuban predicted that if the US dollar falls as the global reserve currency, bitcoin could become “a global ‘safe haven’” and a “global currency.” potentially sending the price of bitcoin to a much higher level.

According to Cuban, bitcoin could become what its most ardent supporters “envision” — a means “of protecting our economies… This is already happening in countries facing hyperinflation.”

The price of bitcoin has skyrocketed over the past year, largely due to the world’s largest asset manager, BlackRock, leading a bitcoin attack on Wall Street.

Bitcoin

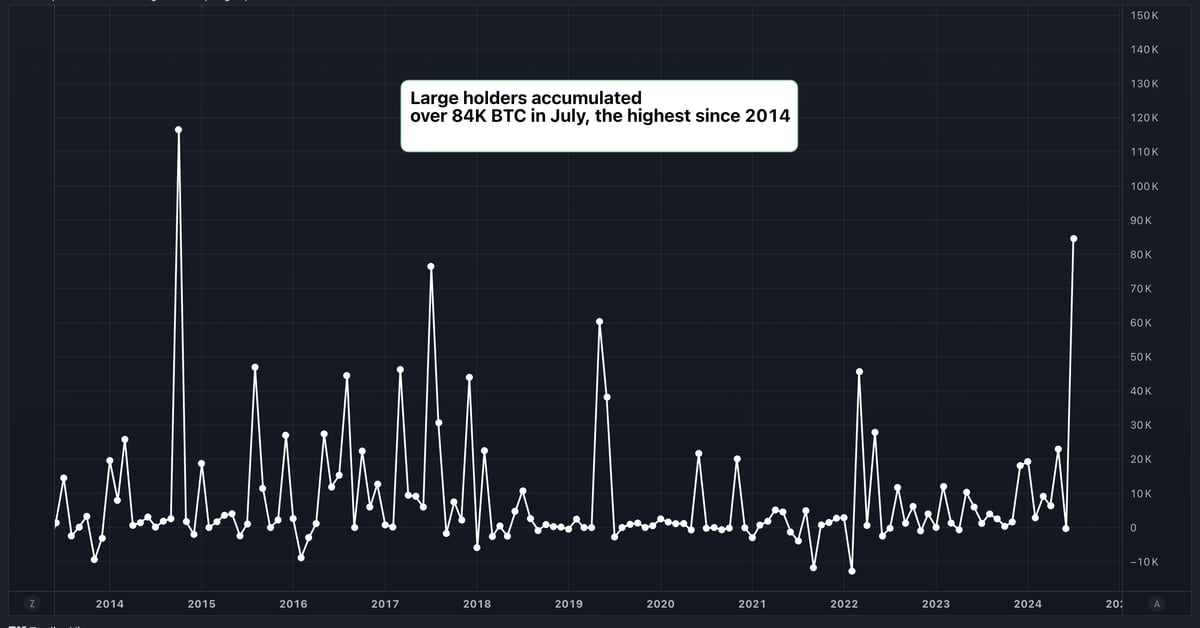

Large Bitcoin (BTC) Holders Added $5.4 Billion Worth of BTC in July, Data Shows

Please note that our Privacy Policy, terms of use, cookiesIt is do not sell my personal information Has been updated.

CoinDesk is a awarded media outlet that covers the cryptocurrency industry. Its journalists follow a strict set of editorial policies. In November 2023, CoinDesk has been acquired by the Bullish group, owner of Optimistica regulated digital asset exchange. The Bullish Group is majority owned by Block.one; both companies have interests CoinDesk has a portfolio of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as an independent subsidiary with an editorial board to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

Bitcoin

Peter Schiff criticizes Michael Saylor’s Bitcoin hype by U.Today

U.Today – Renowned economist and cryptocurrency critic Peter Schiff has criticized Michael Saylor’s recent hype about the growing adoption of cryptocurrencies as a strategic treasury asset by corporations.

Michael Saylor, a well-known Bitcoin advocate and president of MicroStrategy, recently shared his enthusiasm on X about the growing adoption of Bitcoin as a strategic treasury asset.

Citing a comment made by Bitcoin investor Bill Miller in a recent interview with CNBC, Saylor tweeted: “We now have more companies coming forward and saying we will put Bitcoin on our balance sheet as a strategic treasury asset.”

However, not everyone shares Saylor’s enthusiasm. Schiff, a vocal Bitcoin critic and gold bull, was quick to respond with his usual skepticism. In a pointed tweet, Schiff argued: “Bitcoin is neither strategic nor appropriate as a treasury asset. Companies should not risk shareholder funds. They should pay dividends and let shareholders risk their own money.”

Bitcoin enthusiasts are not intimidated

However, Schiff’s criticism shouldn’t deter Bitcoin enthusiasts, who often take Schiff’s words with a pinch of salt. To put things in context, Michael Saylor began buying Bitcoin in 2020 as an inflation hedge and alternative to money. Saylor’s company, MicroStrategy, is among the largest public holders of Bitcoin in the world. As of June 20, it held 226,331 BTC, purchased for around $8.33 billion at an average price of $36,798.

Over the weekend, Schiff was surprised when 87% of the more than 11,000 Bitcoin holders who responded to his X survey said they would not sell any of their Bitcoin even if the price dropped more than 99% to $120. They said not only would they not sell, but that they would continue to buy even when prices dropped.

Schiff unexpectedly revealed that “the main selling point for investors to buy Bitcoin is its excellent past performance record.”

At the time of writing, Bitcoin is trading at $66,067, having reached all-time highs of nearly $74,000 in mid-March.

Bitcoin

Bitcoin Falls as ETF Flows Reverse, Mt. Gox Moves Billions

In a week of drastic fluctuations, the price of Bitcoin (BTC) has retreated from its highs and is currently trading at US$66,250, down 0.9% in European trading.

This volatility comes on the heels of a significant surge above $70,000 earlier in the week, fueled by former President Donald Trump’s ambitious cryptocurrency plans announced in a Bitcoin Conference in Nashville.

Trump’s announcement to fire Securities and Exchange Commission Chairman Gary Gensler and establish a strategic Bitcoin reserve if elected president has temporarily sent the cryptocurrency market into a frenzy.

However, the excitement was short-lived as a series of events unfolded which caused investor sentiment to sour.

A significant sell-off of about 8% was triggered when the US Marshals Service moved $2 billion in Bitcoin for new wallets.

This move has reignited fears of a potential large-scale liquidation, compounded by lingering concerns over a possible Bitcoin liquidation from Mt. Gox. Early this morning, Mt. Gox administrator transferred US$2.2 billion value of your BTC assets in a new wallet.

Meanwhile, the US Bitcoin ETF spot market is showing signs of fluctuation, according to data from SoSo Value. On July 30, Bitcoin spot funds experienced their first net outflow in five days, totaling $18.3 million.

The Grayscale Bitcoin Trust (GBTC) saw outflows of $73.6 million, while the BlackRock iShares Bitcoin Trust (IBIT) attracted $74.9 million in inflows. But outflows from other funds left the category in the red at the end of Tuesday’s trading session. The total net asset value of spot Bitcoin ETFs currently stands at a substantial $58.5 billion.

In other crypto news, Ripple (XRP) is up 8.6% in the past 24 hours, hitting over 64 cents – its highest point since March 25, according to CoinGecko. data.

This rally comes amid a scheduled token unlock and growing optimism around a potential deal in the long-running SEC vs. Ripple lawsuit.

The crypto community is closely watching the SEC’s actions, particularly its intention to amend its complaint against Binance regarding “Third-Party Cryptocurrency Securities,” which some interpret as a positive sign for Ripple.

On a market analysis noteSingapore-based cryptocurrency trading desk QCP Capital wrote that while election headlines continue to dominate, several crucial macroeconomic events loom on the horizon.

“Election headlines will continue to be a key focus, but several key macroeconomic events are also on the horizon. Key events starting with the FOMC meeting on Wednesday, megacap tech earnings (Apple, Amazon, Meta) throughout the week, and unemployment data on Friday,” QCP Capital wrote.

Edited by Stacy Elliott.

-

Regulation12 months ago

Regulation12 months agoRipple CTO and Cardano founder clash over XRP’s regulatory challenges ⋆ ZyCrypto

-

Regulation10 months ago

Regulation10 months agoNancy Pelosi Considers Supporting Republican Crypto Bill FIT21 – London Business News

-

Videos11 months ago

Videos11 months agoCryptocurrency News: Bitcoin, ETH ETF, AI Crypto Rally, AKT, TON & MORE!!

-

Regulation11 months ago

Regulation11 months agoBitcoin’s future is ‘bleak’ and ripe for regulation, says lead developer

-

News9 months ago

News9 months agoAave Price Increases Following Whales Accumulation and V3.1 Launch

-

Regulation9 months ago

Regulation9 months agoSouth Korea Imposes New ‘Monitoring’ Fees on Cryptocurrency Exchanges

-

Regulation9 months ago

Regulation9 months agoA Blank Sheet for Cryptocurrencies: Kamala Harris’ Regulatory Opportunity

-

Regulation9 months ago

Regulation9 months agoCryptocurrency Regulations in Slovenia 2024

-

News11 months ago

News11 months agoThe trader earned $46 million with PEPE after reaching a new ATH

-

Regulation11 months ago

Regulation11 months agoCrypto needs regulation to thrive: Tyler Cowen

-

Blockchain11 months ago

Blockchain11 months agoSolana ranks the fastest blockchain in the world, surpassing Ethereum, Polygon ⋆ ZyCrypto

-

Blockchain11 months ago

Blockchain11 months agoSolana Surpasses Ethereum and Polygon as the Fastest Blockchain ⋆ ZyCrypto