Bitcoin

Bitcoin ETFs are not winning the hearts and minds of financial advisors

Omer Taha Satin | Anadolú | Getty Images

“It’s something I’m researching because I think I’ll eventually recommend it, but I’m not there yet,” Lee Baker, founder and president of Apex Financial Services in Atlanta, said in an interview. “For me and other advisors, if we get more track record, it increases the likelihood that it will end up in clients’ portfolios.”

CNBC spoke to a dozen members of the CNBC Advisory Board, which includes Baker, to learn why so many financial planners are still turned off by bitcoin and bitcoin ETFs, and what could cause them to change their minds. It all comes down to two main things: time on market and regulatory compliance.

“When [bitcoin] becomes more regulated, you will see more adoption,” said Ted Jenkin, founder and CEO of oXYGen Financial in Atlanta. “That being said, even if there is no regulation, if over time this can prove to be as stable an asset as a technology – because my point of view on this is more early technology than money – you will see more adoption.”

Most advisers said they are not initiating conversations or responding to client questions about ETFs — and most do not have more than one client who has made an allocation to the funds. Of these advisors, some are proactively educating themselves about bitcoin investing, while others – often those with an older, more traditional and conservative client base – are more dismissive.

Some of these advisors work with younger clients who have a greater appetite for risk and a longer investment horizon. They say their clients were already interested and informed about exposure to cryptocurrencies before this year and that the arrival of ETFs did not motivate them to join.

Performance evaluation

At 15 years old, bitcoin is at a stage of maturity comparable to that of a teenager – it has great potential, but still presents a lot of volatility. Bitcoin is up more than 59% this year and about 230% since its 2022 low, which deepened during the FTX collapse. Over the past three, five and 10 years, the cryptocurrency has gained 85%, 704% and 10,854% respectively. It has also suffered several 70% drawdowns over the years, which not all investors have been able to tolerate.

Many hope that consistent flows into bitcoin ETFs over the years can reduce this volatility, but for now, it is still a deterrent for some.

“Financial advisors now have a way to give clients access [to bitcoin] this is safe, reliable and regulated,” said Bradley Klontz, managing director of YMW Advisors in Boulder, Colo. “I love it…that it’s a tool in our toolbox for clients who want it. I just don’t see, at this point, most firms recommending that because they’re not recommending any asset class, or any specific asset, that has that much volatility.”

Rianka Dorsainvil, co-founder and co-CEO of 2050 Wealth Partners, said that the majority of her clients prioritize long-term stability and growth over high-risk opportunities, and that bitcoin ETFs’ “relatively early stage in the landscape financial and the ongoing volatility associated with bitcoin” are the main factors that keep bitcoin ETFs out of your investment strategies.

Cathy Curtis, founder of Curtis Financial Planning in Oakland, California, said she doesn’t know if bitcoin will ever be a stable asset class, but that she would consider adding it to client portfolios if it shows stable returns over at least 15 years.

“If it proves to be a true diversifier in stocks, for example, maybe,” she said. “The history of this asset did not show me that.”

Apex Financial’s Baker highlighted that investors have decades of software and tools to show them how a certain percentage of a particular bond, ETF or other asset in a portfolio can improve returns or increase volatility and more.

“As a group, we are quite conservative and somewhat risk averse,” Baker said. “We are so used to pulling graphics and [asking] how this thing worked and in what types of markets – it’s almost the way we’re wired.”

With a few more years on the market, investors will be able to do similar modeling with bitcoin, he added, which will help advisors become interested in the funds. He also said board members’ buy-in is a matter of when, not if.

“Right now… everyone should be convinced that [bitcoin’s] here to stay, [they’re] we just don’t understand some of the metrics in terms similar to how we might look at and value stocks or bonds,” he said. “We simply don’t have that foundation, and that’s an additional reason why uptake is slow.”

“My guess is it will be slow adoption,” he added. “I truly believe we will start to see an increase or increase in the use of consultants somewhere in the next two to three years.”

Not regulated enough

While bitcoin ETFs now exist in the U.S. as a regulated investment vehicle, it’s still not always clear if or when advisors can recommend them, according to Douglas Boneparth, founder and president of Bone Fide Wealth in New York City.

“A lot of this still has to do with compliance offices and what the brokerage will allow when it comes to advisors and offering ETFs,” he said. “Just because the ETF was launched doesn’t mean the floodgates were open or that allocation capacity for it was easy.”

Jenkin said some brokerages have approved the purchase of bitcoin ETFs but restrict how much of it can be purchased, and other firms do not allow advisors to sell bitcoin ETFs.

Some say this is due to crypto’s notorious reputation for fraud, scandal and crime – a situation that gets a little cleaner every year but has undoubtedly left a scar on the industry. More point to the lack of regulation in the sector, which increases the chances of consumer complaints, potential lawsuits against brokers and potentially fines from the Financial Industry Regulatory Authority, or FINRA.

“Part of the reason this isn’t popular yet is that there are serious compliance issues in the industry,” Jenkin said. “Many firms are very nervous about the communications that financial advisors are having with their clients about digital assets, and none of them want to have violations with FINRA.”

“Most brokers are risk mitigators,” he added. “They want to allow advisors to do things for clients, but they certainly don’t want the spotlight to be on them to take more risks. That’s why you’re seeing there’s such a slow uptake on this.”

Building trust

Bitcoin and its ETFs need more time on the market to gain trust and adoption by big players like Vanguard, which earlier this year said it has no plans to offer them and will not change its stance unless the asset changes to become less speculative.

“That’s coming,” Boneparth said of customer confidence. This will come with “more time – moving from the early days to the more mature days. We are coming out of years where exchanges failed – this is not Bitcoin’s failure, but it muddies the water [and] people’s trust.”

Until then, the best position consultants can occupy is one where they educate their clients, he added.

“Even though bitcoin ETFs may fundamentally present a less risky and more regulated way of investing in digital assets… the association with bitcoin still tends to deter [clients]said Dorsainvil.

Advisors will likely be further deterred by ether ETFs, given the added complexity of this cryptocurrency’s use cases and functionality. Last week, the Securities and Exchange Commission gave the green light to US exchanges to list Spot Ether ETFswhich many investors predict will also be successful, but perhaps a fraction of what bitcoin ETFs have enjoyed.

“ETFs have made everything very easy for institutions, from pensions to large funds,” said Boneparth. “That’s where we’re seeing most of the flows going into these bitcoin ETFs. … It’s still very complicated at the retail consultant client level.”

Don’t miss these stories from CNBC PRO:

Bitcoin

‘This is huge’ — Billionaire Mark Cuban issues ‘incredible’ Bitcoin and crypto prediction amid price slump

Bitcoin has surged again this year under former President Donald Trump Cryptocurrency boosts US presidential election in November with ‘revolutionary’ plan.

The price of bitcoin has surged to more than its all-time high in recent months, surpassing $70,000 per bitcoin and triggering a wave of mega-optimistic predictions about the price of bitcoinalthough it fell again this week to below $65,000 after the Federal Reserve kept interest rates steady.

Now, as Elon Musk suddenly breaks his silence on bitcoin and cryptocurrenciesBillionaire investor Mark Cuban called a California plan to digitize 42 million car titles using blockchain an “incredible step forward” and “huge” for cryptocurrencies.

Sign up for free CryptoCodex now—A daily five-minute newsletter for traders, investors, and crypto curious people that will keep you up to date and ahead of the bitcoin and crypto bull market

Mark Cuban, famous Shark Tank investor and billionaire owner of the NBA team Dallas Mavericks, has… [+] called a cryptocurrency update “amazing” amid bitcoin’s price slump.

Getty Images

The California Department of Motor Vehicles (DMV) has digitized 42 million car titles using blockchain, it was reported by Reuters, through technology company Oxhead Alpha on the Avalanche blockchain and designed to detect fraud and facilitate the securities transfer process.

“This is an incredible development for crypto,” Cuban, best known as an investor on TV’s Shark Tank and owner of the Dallas Mavericks NBA team, posted on X, joking that U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler could sue the state as part of his hostility toward cryptocurrencies and blockchain technology.

“The reason this is huge for crypto is because people who hold the tokens will have an app with an Avalanche wallet,” Cuban said. “Tens of millions of Californians having and using a crypto wallet in the next five years, or however long it takes, normalizes the use of wallets and crypto.”

John Wu, president of Avalanche developer Ava Labs, told Reuters that California’s DMV is “creating a wallet that you can download on your phone.”

Sign up for CryptoCodex now—A free daily newsletter for the crypto-curious

Bitcoin’s price has rallied this year, triggering a wave of bullish bitcoin price predictions from… [+] people like billionaire Mark Cuban.

Forbes Digital Assets

Last month, Cuban predicted that if the US dollar falls as the global reserve currency, bitcoin could become “a global ‘safe haven’” and a “global currency.” potentially sending the price of bitcoin to a much higher level.

According to Cuban, bitcoin could become what its most ardent supporters “envision” — a means “of protecting our economies… This is already happening in countries facing hyperinflation.”

The price of bitcoin has skyrocketed over the past year, largely due to the world’s largest asset manager, BlackRock, leading a bitcoin attack on Wall Street.

Bitcoin

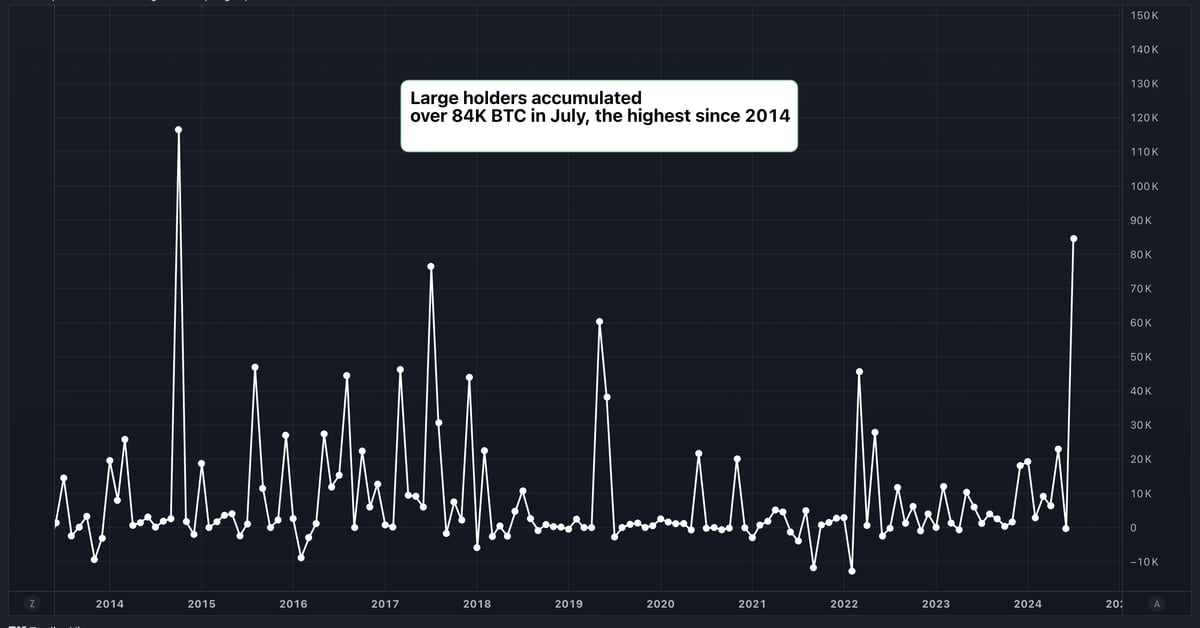

Large Bitcoin (BTC) Holders Added $5.4 Billion Worth of BTC in July, Data Shows

Please note that our Privacy Policy, terms of use, cookiesIt is do not sell my personal information Has been updated.

CoinDesk is a awarded media outlet that covers the cryptocurrency industry. Its journalists follow a strict set of editorial policies. In November 2023, CoinDesk has been acquired by the Bullish group, owner of Optimistica regulated digital asset exchange. The Bullish Group is majority owned by Block.one; both companies have interests CoinDesk has a portfolio of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as an independent subsidiary with an editorial board to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

Bitcoin

Peter Schiff criticizes Michael Saylor’s Bitcoin hype by U.Today

U.Today – Renowned economist and cryptocurrency critic Peter Schiff has criticized Michael Saylor’s recent hype about the growing adoption of cryptocurrencies as a strategic treasury asset by corporations.

Michael Saylor, a well-known Bitcoin advocate and president of MicroStrategy, recently shared his enthusiasm on X about the growing adoption of Bitcoin as a strategic treasury asset.

Citing a comment made by Bitcoin investor Bill Miller in a recent interview with CNBC, Saylor tweeted: “We now have more companies coming forward and saying we will put Bitcoin on our balance sheet as a strategic treasury asset.”

However, not everyone shares Saylor’s enthusiasm. Schiff, a vocal Bitcoin critic and gold bull, was quick to respond with his usual skepticism. In a pointed tweet, Schiff argued: “Bitcoin is neither strategic nor appropriate as a treasury asset. Companies should not risk shareholder funds. They should pay dividends and let shareholders risk their own money.”

Bitcoin enthusiasts are not intimidated

However, Schiff’s criticism shouldn’t deter Bitcoin enthusiasts, who often take Schiff’s words with a pinch of salt. To put things in context, Michael Saylor began buying Bitcoin in 2020 as an inflation hedge and alternative to money. Saylor’s company, MicroStrategy, is among the largest public holders of Bitcoin in the world. As of June 20, it held 226,331 BTC, purchased for around $8.33 billion at an average price of $36,798.

Over the weekend, Schiff was surprised when 87% of the more than 11,000 Bitcoin holders who responded to his X survey said they would not sell any of their Bitcoin even if the price dropped more than 99% to $120. They said not only would they not sell, but that they would continue to buy even when prices dropped.

Schiff unexpectedly revealed that “the main selling point for investors to buy Bitcoin is its excellent past performance record.”

At the time of writing, Bitcoin is trading at $66,067, having reached all-time highs of nearly $74,000 in mid-March.

Bitcoin

Bitcoin Falls as ETF Flows Reverse, Mt. Gox Moves Billions

In a week of drastic fluctuations, the price of Bitcoin (BTC) has retreated from its highs and is currently trading at US$66,250, down 0.9% in European trading.

This volatility comes on the heels of a significant surge above $70,000 earlier in the week, fueled by former President Donald Trump’s ambitious cryptocurrency plans announced in a Bitcoin Conference in Nashville.

Trump’s announcement to fire Securities and Exchange Commission Chairman Gary Gensler and establish a strategic Bitcoin reserve if elected president has temporarily sent the cryptocurrency market into a frenzy.

However, the excitement was short-lived as a series of events unfolded which caused investor sentiment to sour.

A significant sell-off of about 8% was triggered when the US Marshals Service moved $2 billion in Bitcoin for new wallets.

This move has reignited fears of a potential large-scale liquidation, compounded by lingering concerns over a possible Bitcoin liquidation from Mt. Gox. Early this morning, Mt. Gox administrator transferred US$2.2 billion value of your BTC assets in a new wallet.

Meanwhile, the US Bitcoin ETF spot market is showing signs of fluctuation, according to data from SoSo Value. On July 30, Bitcoin spot funds experienced their first net outflow in five days, totaling $18.3 million.

The Grayscale Bitcoin Trust (GBTC) saw outflows of $73.6 million, while the BlackRock iShares Bitcoin Trust (IBIT) attracted $74.9 million in inflows. But outflows from other funds left the category in the red at the end of Tuesday’s trading session. The total net asset value of spot Bitcoin ETFs currently stands at a substantial $58.5 billion.

In other crypto news, Ripple (XRP) is up 8.6% in the past 24 hours, hitting over 64 cents – its highest point since March 25, according to CoinGecko. data.

This rally comes amid a scheduled token unlock and growing optimism around a potential deal in the long-running SEC vs. Ripple lawsuit.

The crypto community is closely watching the SEC’s actions, particularly its intention to amend its complaint against Binance regarding “Third-Party Cryptocurrency Securities,” which some interpret as a positive sign for Ripple.

On a market analysis noteSingapore-based cryptocurrency trading desk QCP Capital wrote that while election headlines continue to dominate, several crucial macroeconomic events loom on the horizon.

“Election headlines will continue to be a key focus, but several key macroeconomic events are also on the horizon. Key events starting with the FOMC meeting on Wednesday, megacap tech earnings (Apple, Amazon, Meta) throughout the week, and unemployment data on Friday,” QCP Capital wrote.

Edited by Stacy Elliott.

-

Regulation12 months ago

Regulation12 months agoRipple CTO and Cardano founder clash over XRP’s regulatory challenges ⋆ ZyCrypto

-

Regulation10 months ago

Regulation10 months agoNancy Pelosi Considers Supporting Republican Crypto Bill FIT21 – London Business News

-

Videos11 months ago

Videos11 months agoCryptocurrency News: Bitcoin, ETH ETF, AI Crypto Rally, AKT, TON & MORE!!

-

Regulation11 months ago

Regulation11 months agoBitcoin’s future is ‘bleak’ and ripe for regulation, says lead developer

-

News8 months ago

News8 months agoAave Price Increases Following Whales Accumulation and V3.1 Launch

-

Regulation8 months ago

Regulation8 months agoSouth Korea Imposes New ‘Monitoring’ Fees on Cryptocurrency Exchanges

-

Regulation8 months ago

Regulation8 months agoA Blank Sheet for Cryptocurrencies: Kamala Harris’ Regulatory Opportunity

-

Regulation8 months ago

Regulation8 months agoCryptocurrency Regulations in Slovenia 2024

-

News11 months ago

News11 months agoThe trader earned $46 million with PEPE after reaching a new ATH

-

Regulation11 months ago

Regulation11 months agoCrypto needs regulation to thrive: Tyler Cowen

-

Blockchain11 months ago

Blockchain11 months agoSolana ranks the fastest blockchain in the world, surpassing Ethereum, Polygon ⋆ ZyCrypto

-

Blockchain11 months ago

Blockchain11 months agoSolana Surpasses Ethereum and Polygon as the Fastest Blockchain ⋆ ZyCrypto