Bitcoin

Bitcoin Billionaire Michael Saylor, Company Settles DC Tax Fraud Lawsuit

Billionaire Bitcoin Investor Michael Saylor and the Software Company He Founded have agreed to pay $40 million to settle a lawsuit filed by the D.C. attorney general alleging he defrauded the city of millions in taxes by falsely claiming to live in Virginia or Florida, D.C. officials said.

Attorney General Brian L. Schwalb said the resolution marked the largest income tax recovery in the city’s history and should serve as a message to district residents trying to dodge tax bills by pretending to live elsewhere.

“No one in the District of Columbia, no matter how rich or powerful, is above the law,” Schwalb said in a statement.

Under the agreement, Saylor and MicroStrategy, an enterprise software company he founded in 1989, deny violating district law and have not admitted any wrongdoing.

In a statement released Monday, Saylor said he moved to Florida in 2012 and has made Miami Beach his home. “I continue to dispute the claim that I was ever a resident of the District of Columbia. I agreed to resolve this matter to avoid the continued burden of litigation on friends, family and myself,” Saylor said.

In court filings, lawyers from the attorney general’s office argued that Saylor lived in a 7,000-square-foot penthouse on the Georgetown waterfront or on yachts docked in the Potomac River. But they said that from 2005 to 2021 he paid no income taxes to the city.

According to Forbes, Saylor has a net worth of $4.6 billion, driven by large investments in bitcoin.

Saylor first misrepresented himself as a resident of Virginia, where taxes are lower, and then Florida, where there is no personal income tax, the District alleged in court filings. DC said MicroStrategy knowingly submitted false records as part of the effort. In all, Saylor avoided paying more than $25 million in district taxes, the city argued.

“Saylor openly boasted about his tax evasion scheme, encouraging his friends to follow his example and arguing that anyone who paid taxes to the District was stupid,” Schwalb said in Monday’s statement.

The city’s lawsuit included a 2012 Facebook post by Saylor evoking another billionaire inventor — albeit a fictional inventor from the “Iron Man” films. Saylor’s post came with a photo of his Georgetown apartment building, where he combined three penthouse apartments into one. It said he was “looking wistfully at my future home” as he waited for his architect to “crack the whip at the contractors and herd the cats. I wonder if Tony Stark would be so patient…”

The district said Excel records of Saylor’s location maintained by his company showed he met the threshold for needing to pay income taxes to the city. For example, he was present for 313 days in 2015, they said. The limit is 183 days.

Saylor’s lawyers, led by Eugene Scalia — Secretary of Labor in the Trump administration and son of former Supreme Court Justice Antonin Scalia — argued in court filings last year that the city’s case was a “speculative story of collusion” riddled with flaws. fatal legalities.

In a 2023 filing in D.C. Superior Court, Saylor’s lawyers argued that he “suffered reputational harm” due to fraud allegations brought by the attorney general’s office. They said the allegations were “considered with remarkable indifference given their seriousness” and Saylor’s prominent role at MicroStrategy, a public company based in the Tysons area of Fairfax County, Virginia.

His attorneys argued that the district’s claims against Saylor should have been dismissed for procedural and legal reasons. “The District’s tax claims are subject to rejection because there has been no tax assessment, which is a necessary prerequisite,” they wrote in a filing.

The district joined the case after whistleblowers sued Saylor under the city’s False Claims Act. This law allows people to sue in cases of alleged tax fraud – and then receive a large payout from whatever the city eventually collects.

Saylor’s lawyers said this pointed to another legal problem in the city’s approach. The change in the law that allows “vindictive” private individuals to “prosecute tax-related actions… has fundamentally changed district government” and, therefore, violates the Home Rule Act that governs their affairs, they argued in court filings.

But rather than fight over the adequacy of the provisions of the False Claims Act, the sides reached a settlement.

How much money What whistleblowers will receive is subject to negotiation with the city hall. If they can’t reach an agreement, a judge will decide. The money will come out of the $40 million total Saylor agreed to pay over 14 days. He also agreed to comply with the district’s tax laws.

The agreement prohibits any future action against Saylor or MicroStrategy On this matter.

The agreement said Saylor, executive chairman of MicroStrategy, would file a return and pay income taxes in the city “in any current or future tax year” where he owned or rented a residence and was physically present in the city for at least 183 days.

Bitcoin

‘This is huge’ — Billionaire Mark Cuban issues ‘incredible’ Bitcoin and crypto prediction amid price slump

Bitcoin has surged again this year under former President Donald Trump Cryptocurrency boosts US presidential election in November with ‘revolutionary’ plan.

The price of bitcoin has surged to more than its all-time high in recent months, surpassing $70,000 per bitcoin and triggering a wave of mega-optimistic predictions about the price of bitcoinalthough it fell again this week to below $65,000 after the Federal Reserve kept interest rates steady.

Now, as Elon Musk suddenly breaks his silence on bitcoin and cryptocurrenciesBillionaire investor Mark Cuban called a California plan to digitize 42 million car titles using blockchain an “incredible step forward” and “huge” for cryptocurrencies.

Sign up for free CryptoCodex now—A daily five-minute newsletter for traders, investors, and crypto curious people that will keep you up to date and ahead of the bitcoin and crypto bull market

Mark Cuban, famous Shark Tank investor and billionaire owner of the NBA team Dallas Mavericks, has… [+] called a cryptocurrency update “amazing” amid bitcoin’s price slump.

Getty Images

The California Department of Motor Vehicles (DMV) has digitized 42 million car titles using blockchain, it was reported by Reuters, through technology company Oxhead Alpha on the Avalanche blockchain and designed to detect fraud and facilitate the securities transfer process.

“This is an incredible development for crypto,” Cuban, best known as an investor on TV’s Shark Tank and owner of the Dallas Mavericks NBA team, posted on X, joking that U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler could sue the state as part of his hostility toward cryptocurrencies and blockchain technology.

“The reason this is huge for crypto is because people who hold the tokens will have an app with an Avalanche wallet,” Cuban said. “Tens of millions of Californians having and using a crypto wallet in the next five years, or however long it takes, normalizes the use of wallets and crypto.”

John Wu, president of Avalanche developer Ava Labs, told Reuters that California’s DMV is “creating a wallet that you can download on your phone.”

Sign up for CryptoCodex now—A free daily newsletter for the crypto-curious

Bitcoin’s price has rallied this year, triggering a wave of bullish bitcoin price predictions from… [+] people like billionaire Mark Cuban.

Forbes Digital Assets

Last month, Cuban predicted that if the US dollar falls as the global reserve currency, bitcoin could become “a global ‘safe haven’” and a “global currency.” potentially sending the price of bitcoin to a much higher level.

According to Cuban, bitcoin could become what its most ardent supporters “envision” — a means “of protecting our economies… This is already happening in countries facing hyperinflation.”

The price of bitcoin has skyrocketed over the past year, largely due to the world’s largest asset manager, BlackRock, leading a bitcoin attack on Wall Street.

Bitcoin

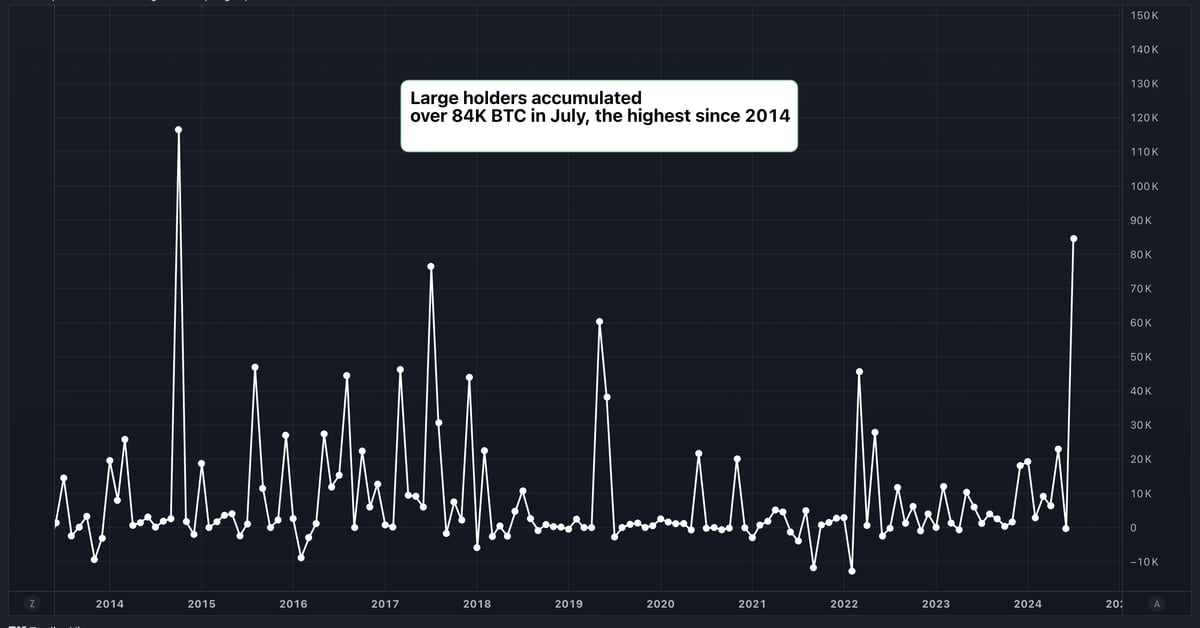

Large Bitcoin (BTC) Holders Added $5.4 Billion Worth of BTC in July, Data Shows

Please note that our Privacy Policy, terms of use, cookiesIt is do not sell my personal information Has been updated.

CoinDesk is a awarded media outlet that covers the cryptocurrency industry. Its journalists follow a strict set of editorial policies. In November 2023, CoinDesk has been acquired by the Bullish group, owner of Optimistica regulated digital asset exchange. The Bullish Group is majority owned by Block.one; both companies have interests CoinDesk has a portfolio of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as an independent subsidiary with an editorial board to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

Bitcoin

Peter Schiff criticizes Michael Saylor’s Bitcoin hype by U.Today

U.Today – Renowned economist and cryptocurrency critic Peter Schiff has criticized Michael Saylor’s recent hype about the growing adoption of cryptocurrencies as a strategic treasury asset by corporations.

Michael Saylor, a well-known Bitcoin advocate and president of MicroStrategy, recently shared his enthusiasm on X about the growing adoption of Bitcoin as a strategic treasury asset.

Citing a comment made by Bitcoin investor Bill Miller in a recent interview with CNBC, Saylor tweeted: “We now have more companies coming forward and saying we will put Bitcoin on our balance sheet as a strategic treasury asset.”

However, not everyone shares Saylor’s enthusiasm. Schiff, a vocal Bitcoin critic and gold bull, was quick to respond with his usual skepticism. In a pointed tweet, Schiff argued: “Bitcoin is neither strategic nor appropriate as a treasury asset. Companies should not risk shareholder funds. They should pay dividends and let shareholders risk their own money.”

Bitcoin enthusiasts are not intimidated

However, Schiff’s criticism shouldn’t deter Bitcoin enthusiasts, who often take Schiff’s words with a pinch of salt. To put things in context, Michael Saylor began buying Bitcoin in 2020 as an inflation hedge and alternative to money. Saylor’s company, MicroStrategy, is among the largest public holders of Bitcoin in the world. As of June 20, it held 226,331 BTC, purchased for around $8.33 billion at an average price of $36,798.

Over the weekend, Schiff was surprised when 87% of the more than 11,000 Bitcoin holders who responded to his X survey said they would not sell any of their Bitcoin even if the price dropped more than 99% to $120. They said not only would they not sell, but that they would continue to buy even when prices dropped.

Schiff unexpectedly revealed that “the main selling point for investors to buy Bitcoin is its excellent past performance record.”

At the time of writing, Bitcoin is trading at $66,067, having reached all-time highs of nearly $74,000 in mid-March.

Bitcoin

Bitcoin Falls as ETF Flows Reverse, Mt. Gox Moves Billions

In a week of drastic fluctuations, the price of Bitcoin (BTC) has retreated from its highs and is currently trading at US$66,250, down 0.9% in European trading.

This volatility comes on the heels of a significant surge above $70,000 earlier in the week, fueled by former President Donald Trump’s ambitious cryptocurrency plans announced in a Bitcoin Conference in Nashville.

Trump’s announcement to fire Securities and Exchange Commission Chairman Gary Gensler and establish a strategic Bitcoin reserve if elected president has temporarily sent the cryptocurrency market into a frenzy.

However, the excitement was short-lived as a series of events unfolded which caused investor sentiment to sour.

A significant sell-off of about 8% was triggered when the US Marshals Service moved $2 billion in Bitcoin for new wallets.

This move has reignited fears of a potential large-scale liquidation, compounded by lingering concerns over a possible Bitcoin liquidation from Mt. Gox. Early this morning, Mt. Gox administrator transferred US$2.2 billion value of your BTC assets in a new wallet.

Meanwhile, the US Bitcoin ETF spot market is showing signs of fluctuation, according to data from SoSo Value. On July 30, Bitcoin spot funds experienced their first net outflow in five days, totaling $18.3 million.

The Grayscale Bitcoin Trust (GBTC) saw outflows of $73.6 million, while the BlackRock iShares Bitcoin Trust (IBIT) attracted $74.9 million in inflows. But outflows from other funds left the category in the red at the end of Tuesday’s trading session. The total net asset value of spot Bitcoin ETFs currently stands at a substantial $58.5 billion.

In other crypto news, Ripple (XRP) is up 8.6% in the past 24 hours, hitting over 64 cents – its highest point since March 25, according to CoinGecko. data.

This rally comes amid a scheduled token unlock and growing optimism around a potential deal in the long-running SEC vs. Ripple lawsuit.

The crypto community is closely watching the SEC’s actions, particularly its intention to amend its complaint against Binance regarding “Third-Party Cryptocurrency Securities,” which some interpret as a positive sign for Ripple.

On a market analysis noteSingapore-based cryptocurrency trading desk QCP Capital wrote that while election headlines continue to dominate, several crucial macroeconomic events loom on the horizon.

“Election headlines will continue to be a key focus, but several key macroeconomic events are also on the horizon. Key events starting with the FOMC meeting on Wednesday, megacap tech earnings (Apple, Amazon, Meta) throughout the week, and unemployment data on Friday,” QCP Capital wrote.

Edited by Stacy Elliott.

-

Regulation12 months ago

Regulation12 months agoRipple CTO and Cardano founder clash over XRP’s regulatory challenges ⋆ ZyCrypto

-

Regulation10 months ago

Regulation10 months agoNancy Pelosi Considers Supporting Republican Crypto Bill FIT21 – London Business News

-

Videos11 months ago

Videos11 months agoCryptocurrency News: Bitcoin, ETH ETF, AI Crypto Rally, AKT, TON & MORE!!

-

Regulation11 months ago

Regulation11 months agoBitcoin’s future is ‘bleak’ and ripe for regulation, says lead developer

-

News9 months ago

News9 months agoAave Price Increases Following Whales Accumulation and V3.1 Launch

-

Regulation9 months ago

Regulation9 months agoSouth Korea Imposes New ‘Monitoring’ Fees on Cryptocurrency Exchanges

-

Regulation9 months ago

Regulation9 months agoA Blank Sheet for Cryptocurrencies: Kamala Harris’ Regulatory Opportunity

-

Regulation9 months ago

Regulation9 months agoCryptocurrency Regulations in Slovenia 2024

-

News11 months ago

News11 months agoThe trader earned $46 million with PEPE after reaching a new ATH

-

Regulation11 months ago

Regulation11 months agoCrypto needs regulation to thrive: Tyler Cowen

-

Blockchain11 months ago

Blockchain11 months agoSolana ranks the fastest blockchain in the world, surpassing Ethereum, Polygon ⋆ ZyCrypto

-

Blockchain11 months ago

Blockchain11 months agoSolana Surpasses Ethereum and Polygon as the Fastest Blockchain ⋆ ZyCrypto