News

Coinbase State of Cryptocurrency Report: Here’s What We Learned

A staggering 86% of Fortune 500 executives believe tokenization could be valuable to their companies, and The State of Crypto report says they are bullish on stablecoins as well.

Coinbase’s latest The State of Crypto report is here, and as always, it’s an interesting read.

The exchange’s research struck a bullish tone and noted ETFs based on That of Bitcoin The spot price in the United States has absorbed “significant pent-up demand” allowing investors to gain exposure to the world’s largest cryptocurrency. Assets under management in these funds now stand at $63 billion, and Coinbase expects a healthy appetite for that Ether ETFs are expected to get the green light from the US Securities and Exchange Commission.

Beyond that, it wasn’t the buoyant recovery in cryptocurrency markets that was Coinbase’s focus relationshipbut the high levels of enthusiasm for on-chain projects found among some of America’s largest companies.

Data suggests that the number of on-chain projects among Fortune 100 companies has increased by 39% over the past 12 months. Additionally, 56% of executives at Fortune 500 companies say they are starting to experiment and build using this technology, with “consumer-facing payment applications” a pressing priority for some. They aren’t afraid to spend money, with the typical on-chain project boasting a budget of $9.5 million.

Source: Coinbase

Second Coinbasethere is a wide range of benefits stablecoins AND tokenization that entrepreneurs find attractive.

When it comes to digital assets pegged to the US dollar, the prospect of instant settlements was found to be the main benefit identified by Fortune 500 executives. There is also optimism that accepting stablecoins as a payment method could help reduce fees for merchants with razor-thin profit margins, but given the known scalability issues plaguing major blockchains, this is not always a given. The list also includes the most efficient transfers within a company, as well as immediate cross-border payments.

The report also highlights how tokenization of real-world assets has the potential to transform the global economy in the years to come. In this case, the key benefits and use cases that fascinate senior executives include reduced transaction times, operational efficiency, increased transparency, simplified regulatory processes and the ability to drag loyalty programs into the 21st century by improving audience engagement target. Coinbase cited data suggesting the value of tokenized assets could reach $16 trillion by the start of the next decade. Illustrating how significant this is, the exchange pointed out that this is equivalent to the GDP of the European Union.

Tokenization in action

To borrow an often used item cryptocurrency phrase here, “we are still early” when it comes to seeing how the push towards tokenization will develop. Many potential use cases have not yet emerged. But a company that has great ambitions here is MasterCard.

Earlier this week, the payments giant revealed that it is working to radically modernize the world of e-commerce and ultimately make the need to type in long credit card numbers when purchasing something online a thing of the past .

It’s about more than just saving shoppers some time at the checkout, as this approach could prove to be the silver bullet in the fight against fraud. Artificial intelligence and the growing demand for e-commerce in emerging markets have seen an increase in the value of fake and illegal transactions taking place online. Mastercard cited Juniper Research data that estimated merchants worldwide will lose $362 billion between 2023 and 2028.

In practice, Mastercard wants to make the 16 digits on payment cards obsolete by replacing them with a secure token. The company believes tokenization also has the potential to turn smartphones and cars into “commercial devices,” building on the great progress made with contactless payments.

As part of the company’s plans, e-commerce will be 100% tokenized in Europe by 2030, with Mastercard executive vice president Valerie Nowak describing this as a “win-win-win for shoppers, retailers and card issuers”.

“In Europe we have seen tokenization gain momentum across the ecosystem, the convenience and reduced fraud rates sell themselves.”

Valerie Nowak

Returning to Coinbase and its report, it was noted that on-chain government bonds have emerged as a particularly popular use case, with the value of tokenized US Treasury products now reaching $1.29 billion, a 1,000% increase since the beginning of last year.

Franklin Templeton, who was highlighted in The State of Crypto as a case study due to his tokenized money market funds, described the adoption of this technology as a necessity.

“The market infrastructure on which we issue, trade and package assets into wallets is 50 years old… What we are starting to see with blockchain technologies is that there are ways to improve them tremendously. There are ways to reduce processing time, get more real-time information, and enable 24/7/365 trading, because we live in a global world where our businesses operate 24 hours a day. 24″.

Sandy Kaull, head of digital assets at Franklin Templeton

Overall, the report indicates that 86% of Fortune 500 executives believe tokenization could be valuable to their operations – a remarkable figure.

The power of stablecoins

Elsewhere, Coinbase reflected on how stablecoins are gradually starting to play an increasingly important role in the global economy, with daily stablecoin transfer volumes breaking records and reaching $150 billion in the first quarter of this year. Of course, this exchange plays an important role as it has a stake in Circle, which issues USD Coin.

The authors of the report highlighted how the companies behind USDC and USDT now hold huge amounts of US Treasuries in reserve, equivalent to Norway, Saudi Arabia and South Korea combined.

This has also coincided with concerted efforts to simplify the process of using stablecoins, which is especially important for consumers who are unfamiliar with digital assets.

“Through Circle, merchants on Stripe can now accept USDC payments via Ethereum, Solana, and Polygon, with payments automatically converted to fiat currency. PayPal supports cross-border transfers for stablecoin users in approximately 160 countries, with no transaction fees.”

Coinbase

Remittances, which sees foreign workers send funds home to loved ones, are one particular area where stablecoins could offer a faster and fairer service.

As Coinbase notes, this is an $860 billion market. But at the moment, cross-border payments made through traditional channels often incur fees of up to 6.39%. In other words, this means that hard-working consumers, their families and local economies lose up to $55 billion every year.

There was another fascinating use case in the form of a Washington DC chain called Compass Coffee. With many of its customers switching from cash to cards, the company said it is fed up with paying high transaction fees, funds that could be reinvested in the business. It has now started offering stablecoins as an alternative payment method.

“Accepting cryptocurrency payments could be transformative for our business. We hope to help transform retail experiences by accepting USDC.”

Michael Haft, founder of Compass Coffee

Challenges that await us

While there is a lot to be optimistic about and a lot of traction in the cryptocurrency industry, Coinbase has warned that there are external factors holding back progress.

“The increase in activity increases the urgency for clear cryptocurrency rules that help keep cryptocurrency developers and other talent in the United States, deliver on the promise of better access, and enable U.S. leadership in the cryptocurrency industry globally.”

Coinbase

Illustrating the impact of regulatory paralysis that has seen several companies move overseas, the exchange warned that the American share of cryptocurrency developers has plummeted 14 percentage points since 2019, meaning only 26% are now based in the United States

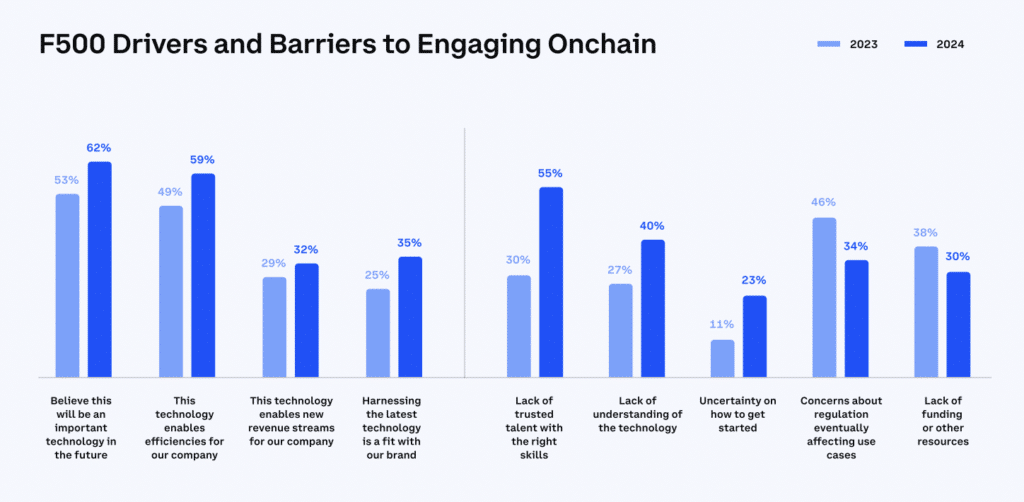

Interestingly, 55% of Fortune 500 executives surveyed said a lack of trusted talent with the right skills was the biggest barrier to implementing an on-chain project, up from 30% in 2023. This obstacle then changed. a ripple effect in other ways. For example, 40% of respondents admitted they don’t fully understand how this technology works and a further 23% wouldn’t know how to start developing their idea.

Source: Coinbase

With crypto-literate legislation starting to make its way through Congress and the SEC softening its stance on Bitcoin and Ether ETFs, it’s telling that only 34% of entrepreneurs now cite regulation as a barrier, declining by 12 percentage points compared to the previous year.

We have already seen how digital assets are becoming a highly controversial issue in the upcoming presidential election, with Donald Trump – who had once spoken of his disdain for Bitcoin due to its competition with the dollar – now declaring that he would like every single one of the remaining 1.3 million BTC to be mined in US Reports suggest that Joe Biden is also now considering whether or not to accept cryptocurrency donations from supporters.

For its part, Coinbase has also stepped up its efforts to advocate for the industry and give its customers the resources they need to make their voices heard.

After a turbulent few years, there are only three words to describe the current state of cryptocurrencies: an impressive turnaround.

News

Cryptocurrency Price August 1: Bitcoin Dips Below $65K; Solana, XRP Down Up To 8%

Major cryptocurrencies fell in Thursday trading following the Federal Reserve’s decision to keep its key interest rate unchanged. Overnight, the U.S. Federal Reserve kept its key interest rate at 5.25-5.5% for the eighth consecutive time, as expected, while also signaling the possibility of a rate cut at its next meeting in September. The unanimous decision by the Federal Open Market Committee reflects a continued wait-and-see approach as it monitors inflation trends.

CoinSwitch Markets Desk said: “Bitcoin has fallen below $65,000 after the US Federal Reserve announced it would keep interest rates unchanged. However, with markets now anticipating rate cuts at the next Federal Reserve meeting in September, the outlook for a Bitcoin rally by the end of the year has strengthened.”

Meanwhile, CoinDCX research team said: “The crypto market has plunged after the Fed decision. Tomorrow’s US unemployment rate announcement is expected to induce more volatility, with the ‘actual’ figure coming in higher than the ‘expected’ one, which is positive for cryptocurrencies.”

At 12:21 pm IST, Bitcoin (BTC) was down 3.2% at $64,285, while Ethereum was down nearly 4.5% at $3,313. Meanwhile, the global market cryptocurrency The market capitalization fell 3.6% to around $2.3 trillion in the last 24 hours.

“Bitcoin needs to clear its 200-day EMA at $64,510 to consolidate further. Otherwise, a retest of $62,000 could be in the cards,” said Vikram Subburaj, CEO of Giottus.

Altcoins and meme coins, such as BNB (3%), Solana (8%), XRP (5.7%), Dogecoin (5%), Cardano (4.6%), Avalanche (4.3%), Shiba Inu (3.8%), Polkadot (3.4%), and Chainlink (4%) also saw declines.

The volume of all stablecoins is now $71.64 billion, which is 92.19% of the total cryptocurrency market volume in 24 hours, according to data available on CoinMarketCap. Bitcoin’s dominance is currently 54.99%. BTC volume in the last 24 hours increased by 23.3% to $35.7 billion.

(Disclaimer: Recommendations, suggestions, opinions and views provided by experts are personal. They do not represent the views of the Economic Times)

(You can now subscribe to our ETMarkets WhatsApp Channel)

News

Altcoins WIF, BONK, RUNE, JUP Down 10% While Bitcoin Drops 4%

Altcoins dogwifhat, Bonk, THORChain, and Jupiter have suffered losses of more than 10%, while Bitcoin is down 4% in the last 24 hours.

After a period of relative calm yesterday, July 31, Bitcoin (BTC) price action has seen a drastic change as the cryptocurrency dropped by more than $3,500, bringing its value to $63,300. At the same time, altcoins mirrored this trend, with the total value of liquidated positions rising to nearly $225 million over the course of the day.

Initially, the week started on a positive note for Bitcoin, which reached its highest point since early June, hitting $70,000. However, this peak was short-lived, as it was quickly rejected, leading to a substantial decline, with Bitcoin falling below $65,500.

The cryptocurrency managed to regain some stability, trading comfortably at around $66,800. However, following a Press conference According to Federal Reserve Chairman Jerome Powell, the value of Bitcoin has fallen again to $64,300, down more than 3% in 24 hours.

BTC Price Chart 24 Hours | Source: crypto.news

The recession coincided with a relationship from the New York Times stating that Iran had called for retaliatory measures against Israel following the assassination of Hamas leader Ismail Haniyeh in Tehran, increasing the risk of further conflict in the region.

Meanwhile, on the economic front, the Federal Reserve decided to keep its benchmark interest rates in place, offering little information on a planned September rate cut. Powell also hinted that while no concrete decisions have been made on the September adjustment, there is growing consensus that a rate cut is likely.

Amid Bitcoin’s decline, altcoins have suffered even more significant losses. For example, dogwifhat (Wife) saw a 12.4% drop and (DISGUST) has suffered a 10% drop. Other altcoins such as THORChain (RUNE) also fell by 10%, while Jupiter (JUPITER) and the Ethereum naming service (ENS) decreased by 8% and 9% respectively.

Among the largest-cap cryptocurrencies, the biggest losers are Solana (SOL) with a decrease of 8%, (Exchange rate risk) down 6%, Cardano (ADA) down 4%, and both Ethereum (ETH) and Dogecoin (DOGE) recording a decrease of 4.4%.

Data from CoinGlass indicates that approximately 67,000 traders have been negatively impacted by this increased volatility. BTC positions have seen $61.85 million in liquidations, while ETH positions have faced $61 million. In total, the value of liquidated positions stands at $225.4 million at the time of writing.

News

Riot Platforms Sees 52% Drop in Bitcoin Production in Q2

Bitcoin mining firm Riot Platforms has released its second-quarter financial results, highlighting a decline in cryptocurrency mined due to the recent halving.

Colorado-based Bitcoin (BTC) mining company Riot platforms revealed its second quarter financial results, highlighting a significant reduction in mined cryptocurrencies attributed to the recent halving event that took place in early April.

The company reported total revenue of $70 million for the quarter ended July 31, a decline of 8.7% compared to the same period in 2023. Riot Platforms attributed the revenue decline primarily to a $9.7 million decrease in engineering revenue, which was partially mitigated by a $6 million increase in Bitcoin extraction income.

During the quarter, the company mined 844 BTC, representing a decline of over 50% from Q2 2023, citing the halving event and increasing network difficulty as major factors behind the decline. Riot Platforms reported a net loss of $84.4 million, or $0.32 per share, missing Zacks Research forecast a loss of $0.16 per share.

Halving increases competitive pressure

The Colorado-based firm said the average cost of mining one BTC in the second quarter, including energy credits, rose to $25,327, a remarkable 341% increase from $5,734 per BTC in the same quarter of 2023. Despite this significant increase in production costs, the firm remains optimistic about maintaining competitiveness through recent deals.

For example, following the Recent acquisition Cryptocurrency firm Block Mining, Riot has increased its distributed hash rate forecast from 31 EH/s to 36 EH/s by the end of 2024, while also increasing its 2025 forecast from 40 EH/s to 56 EH/s.

Riot Platforms Hashrate Growth Projections by 2027 | Source: Riot Platforms

Commenting on the company’s financials, Riot CEO Jason Les said that despite the halving, the mining company still managed to achieve “significant operational growth and execution of our long-term strategy.”

“Despite this reduction in production available to all Bitcoin miners, Riot reported $70 million in revenue for the quarter and maintained strong gross margins in our core Bitcoin mining business.”

Jason Les

Following its Q2 financial report, Riot Platforms shares fell 1.74% to $10.19, according to Google Finance data. Meanwhile, the American miner continues to chase Canadian rival Bitfarms, recently acquiring an additional 10.2 million BITF shares, increasing its stake in Bitfarms to 15.9%.

As previously reported by crypto.news, Riot was the first announced a $950 million takeover bid for Bitfarms in late May, arguing that Bitfarms’ founders were not acting in the best interests of all shareholders. They said their proposal was rejected by Bitfarms’ board without substantive engagement.

In response, Bitfarms She said that Riot’s offer “significantly understates” its growth prospects. Bitfarms subsequently implemented a shareholder rights plan, also known as a “poison pill,” to protect its strategic review process from hostile takeover attempts.

News

Aave Price Increases Following Whales Accumulation and V3.1 Launch

Decentralized finance protocol Aave is seeing a significant spike in whale activity as the market looks to recover from the recent crash that pushed most altcoins into key support areas earlier this week.

July 31, Lookonchain shared details indicating that the whales had aggressively accumulated Aave (AAVE) over the past two days. According to the data, whales have withdrawn over 58,848 AAVE worth $6.47 million from exchanges during this period.

In one instance, whale address 0x9af4 withdrew 11,185 AAVE worth $1.23 million from Binance. Meanwhile, another address moved 21,619 AAVE worth over $2.38 million from the exchange and deposited the tokens into Aave.

These withdrawals follow a previous transfer of 26,044 AAVE from whale address 0xd7c5, amounting to over $2.83 million withdrawn from Binance.

AAVE price has surged over 7% in the past 24 hours amid buy-side pressure from these whales. The DeFi token is currently trading around $111 after jumping over 18% in the past week.

Recently, the price of AAVE increased by over 8% after Aave founder Marc Zeller announced a proposed fee change aimed at adopting a buyback program for AAVE tokens.

Aave v3.1 is available

The total value locked in the Aave protocol currently stands at around $22 billion. According to DeFiLlamaApproximately $19.9 billion is on Aave V3, while the V2 chain still holds approximately $1.9 billion in TVL and V1 approximately $14.6 million.

Aave Labs announced Previously, Aave V3.1 was made available on all networks with active Aave V3 instances.

V3.1 features improvements that are intended to improve the overall security of the DeFi protocol. The Aave DAO governance has approved the v3.1 improvements, which also include operational efficiency and usability for the network.

Meanwhile, Aave Labs recently outlined a ambitious roadmap for the projectwith a 2030 vision for Aave V4, among other developments.

-

Regulation8 months ago

Regulation8 months agoNancy Pelosi Considers Supporting Republican Crypto Bill FIT21 – London Business News

-

Regulation10 months ago

Regulation10 months agoRipple CTO and Cardano founder clash over XRP’s regulatory challenges ⋆ ZyCrypto

-

Videos10 months ago

Videos10 months agoCryptocurrency News: Bitcoin, ETH ETF, AI Crypto Rally, AKT, TON & MORE!!

-

Regulation9 months ago

Regulation9 months agoBitcoin’s future is ‘bleak’ and ripe for regulation, says lead developer

-

News9 months ago

News9 months agoThe trader earned $46 million with PEPE after reaching a new ATH

-

News7 months ago

News7 months agoAave Price Increases Following Whales Accumulation and V3.1 Launch

-

Regulation7 months ago

Regulation7 months agoSouth Korea Imposes New ‘Monitoring’ Fees on Cryptocurrency Exchanges

-

Regulation7 months ago

Regulation7 months agoA Blank Sheet for Cryptocurrencies: Kamala Harris’ Regulatory Opportunity

-

Regulation7 months ago

Regulation7 months agoCryptocurrency Regulations in Slovenia 2024

-

Regulation9 months ago

Regulation9 months ago🔒 Crypto needs regulation to thrive: Tyler Cowen

-

Blockchain9 months ago

Blockchain9 months agoSolana ranks the fastest blockchain in the world, surpassing Ethereum, Polygon ⋆ ZyCrypto

-

Blockchain9 months ago

Blockchain9 months agoSolana Surpasses Ethereum and Polygon as the Fastest Blockchain ⋆ ZyCrypto