Regulation

Global Cryptocurrency Regulations – Wild West to Outright Ban

What is Cryptocurrency?

Cryptocurrency is a digital asset that operates on a blockchain. A blockchain is a public ledger of transactions that’s visible to anyone and does not rely on a central authority. Unlike cash, crypto is impossible to counterfeit because it uses cryptography for transaction verification.

The first crypto, Bitcoin, emerged in 2009. Its creator, known by the pseudonym Satoshi Nakamoto, wanted to create a currency free from government or bank control.

This concept appeals to those who prefer privacy in their transactions and distrust traditional financial institutions.

Crypto’s accessibility has sparked crypto adoption in developing countries.

Fast and borderless transactions are another reason for using crypto.

There’s no need for a bank account – anyone can access their crypto wallet with an internet connection.

There are thousands of cryptocurrencies, each with its own features and purposes. Some act as payment methods, others as long-term stores of value, similar to gold.

Utility tokens unlock specific features within a project, while meme coins are created for fun and quick gains (or losses) on speculation.

What Does Regulation for Cryptocurrency Mean?

Cryptocurrencies operate outside the traditional financial system, allowing anyone with an internet connection to make payments globally.

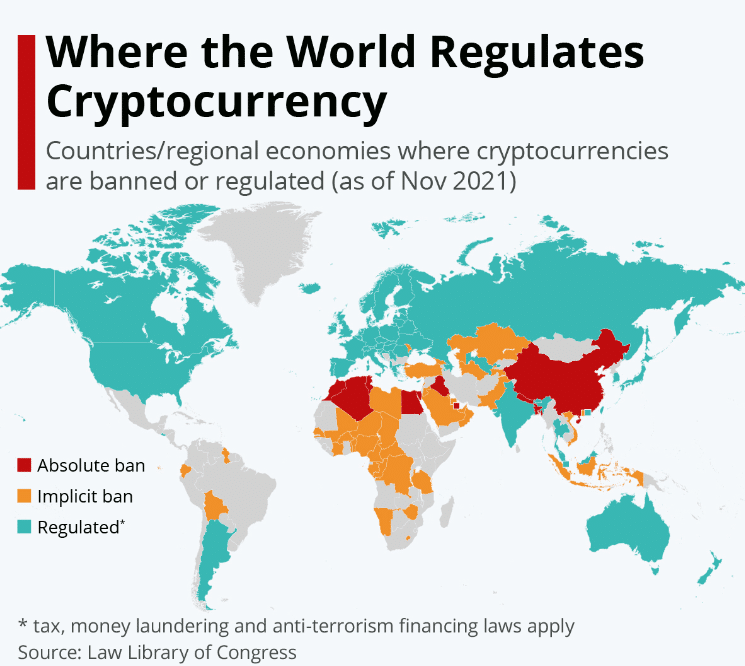

Governments try to catch up with this new asset class and gain some control by establishing legal frameworks. These regulations are all over the place, differing wildly between countries and constantly evolving.

But why regulate something that was created to bypass regulations? Well, it’s not that simple. Here are some of the reasons.

Crypto’s anonymity can be a double-edged sword

Regulations aim to crack down on illicit activities like money laundering and tax evasion. For example, centralized crypto exchanges must verify user identities and monitor transactions for suspicious activity.

To create a fair environment for investors

Blockchain regulation strives to create a level playing field by preventing artificial price inflation and weeding out scams through licensing laws.

For tax purposes

Governments can treat crypto as property, securities, or something else to specify how capital gains, losses, and income generated from crypto activities are taxed.

To build investor confidence

Consumer protection laws encourage more people to participate in trade, increasing market liquidity and tax revenue.

To counter volatility

Dramatic crypto price swings can cause tremors in the broader financial system. Regulations act like an anchor, preventing sudden price drops that might force investors to flee to safer havens.

To foster innovation safely

Regulations outline how companies can experiment with blockchain technology and raise capital while protecting investors from fraudulent offerings.

Consequently, crypto legislation might encompass the following:

- Licensing and registration of crypto exchanges, custodians (services that hold your crypto for you), and initial coin offering (ICO) platforms

- Know your customer (KYC) and anti-money laundering (AML) procedures to verify user identities and monitor transactions to prevent financial crime

- Consumer protections, like risk disclosures, limitations on misleading marketing practices, and dispute resolution procedures

- Taxation, for example, some countries don’t collect any tax on crypto transactions, whereas others tax crypto as capital gains

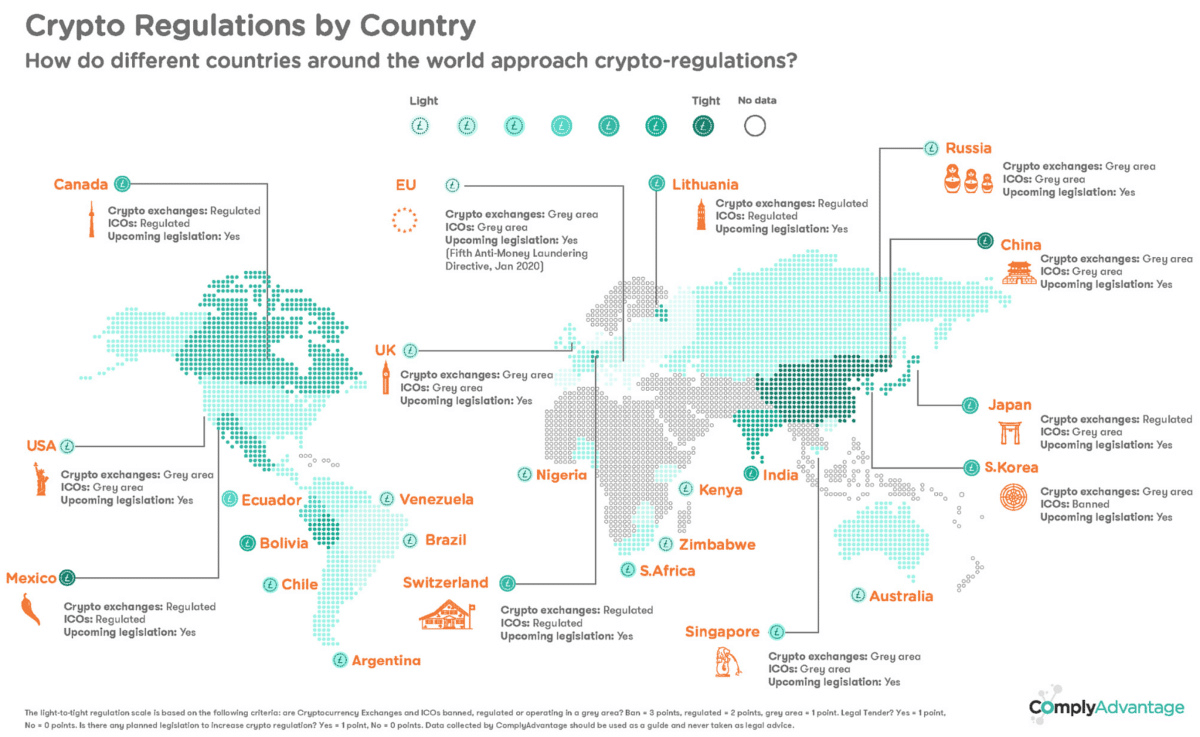

Some governments employ extensive regulations for crypto businesses. For example, Japan enforces strict KYC, taxation, consumer protection, and licensing rules. Others have almost none.

Likewise, some governments encourage crypto trading and blockchain development, while others, like China, ban it entirely. That’s why you should do your due diligence before engaging in any crypto-related activity.

Naturally, such disparity can challenge global trade. This is where the International Monetary Fund (IMF), an international organization with 190 member countries, comes into play.

There’s no one-size-fits-all ‘IMF crypto law.’ Instead, the IMF gives individual countries policy recommendations and encourages them to cooperate. We can only hope that its members will eventually reach a consensus.

How is Crypto Regulated in the United States?

Now that you know the reasons behind digital asset laws, let’s unpack specific US crypto regulations.

The US regulatory landscape for cryptocurrency is a work in progress. The emergence of Bitcoin caught authorities off guard. There were absolutely no laws governing virtual currencies, which created grounds for speculation and manipulation.

As crypto gained popularity, the US government appointed three agencies to oversee the market and protect investors.

Securities and Exchange Commission (SEC)

The SEC focuses on securities – crypto investments made to raise capital. Therefore, cryptocurrencies that function as a medium of exchange or utility tokens don’t count as securities.

Commodity Futures Trading Commission (CFTC)

The CFTC oversees derivatives markets. Put simply, derivatives are financial instruments whose value depends on the underlying asset. For example, if you believe Bitcoin’s ($BTC) price will rise, you could enter into a futures contract with another investor.

In this contract, you agree to buy or sell $BTC at a set price on a specific date. You make a profit if the $BTC price goes up by that date. In this case, $BTC is the underlying asset, and the futures contract derives its value from $BTC price fluctuations.

Internal Revenue Service (IRS)

The IRS is interested in crypto’s tax implications and requires US residents to report gains and losses on trading activities.

Apart from these three big players, the US government may involve the Financial Crimes Enforcement Network (FinCEN) in investigating money laundering cases.

Naturally, navigating the various regulations from each of these agencies can be overwhelming. Here are the key points you should know about crypto taxation in the US.

You must pay capital gains tax when selling cryptoYour losses can offset the gainsMining rewards are taxed as ordinary incomeThe IRS is watching

The tax rate depends on your tax bracket and how long you held the cryptocurrency before selling. Short-term gains (held for less than a year) are taxed at your ordinary income tax rate. Long-term gains typically are subject to lower tax rates.

Say you lost $8K during a bear market. You can use this loss to reduce your taxable capital gains from other investments. It’s worth noting that there’s a $3K capital loss cap for single tax filers.

Remember to report them on your tax return! What’s more, President Joe Biden recently proposed imposing a 30% electricity tax on mining. While the law is not yet in place, it highlights that crypto regulations in the US constantly evolve.

Just because crypto transactions are anonymous doesn’t mean that your activities are invisible. Centralized exchanges (CEXs) must comply with KYC procedures and report to the IRS.

While it may seem like the US government is only concerned with getting its cut, it also introduces investor protections:

- The SEC mandates transparent disclosures to reduce the risk of fraud. This includes details about the project, the team’s background, and the risks involved in investing.

- SEC offers educational resources to help investors understand crypto fundamentals, identify red flags, and make informed investment decisions.

- KYC rules help exchanges identify suspicious activities that may harm other users.

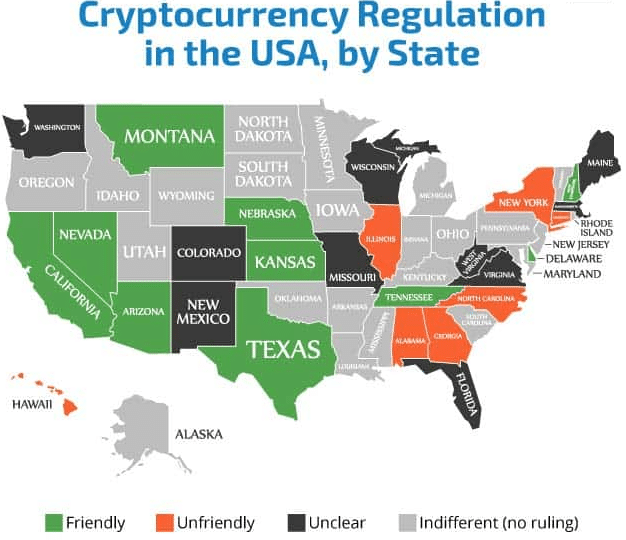

Also worth mentioning is that some states may have specific laws on crypto. For example, New York has a specific licensing regime called the ‘BitLicense’ for businesses dealing with virtual currencies.

Source: Finance Magnates

This license requires extensive background checks, compliance measures, and cybersecurity protocols. Likewise, California requires a Money Transmitter License for businesses that process over $10k in crypto within a year.

These are just a few examples, so always DYOR. You can find state-specific information on the North American Securities Administrators Association (NASAA) website.

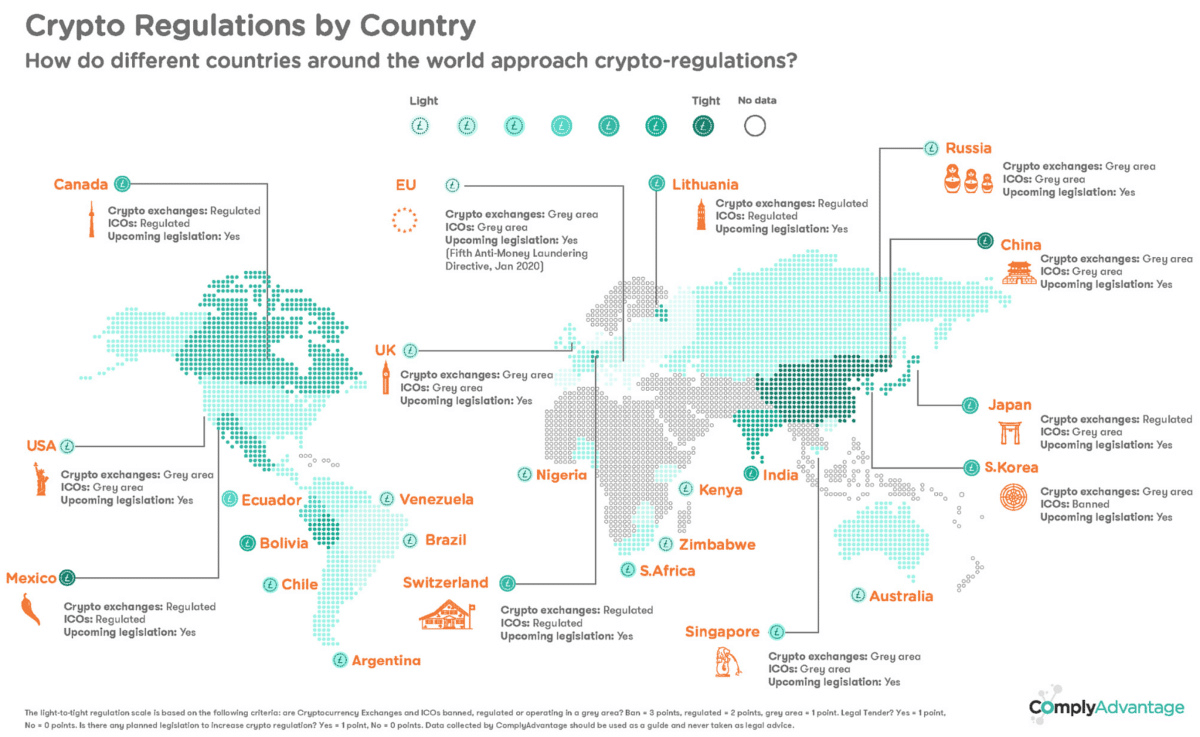

Rules and Regulations for Cryptocurrency Around the World

Crypto transcends borders, but regulations don’t. Read on to discover how the rules of the game differ across the world.

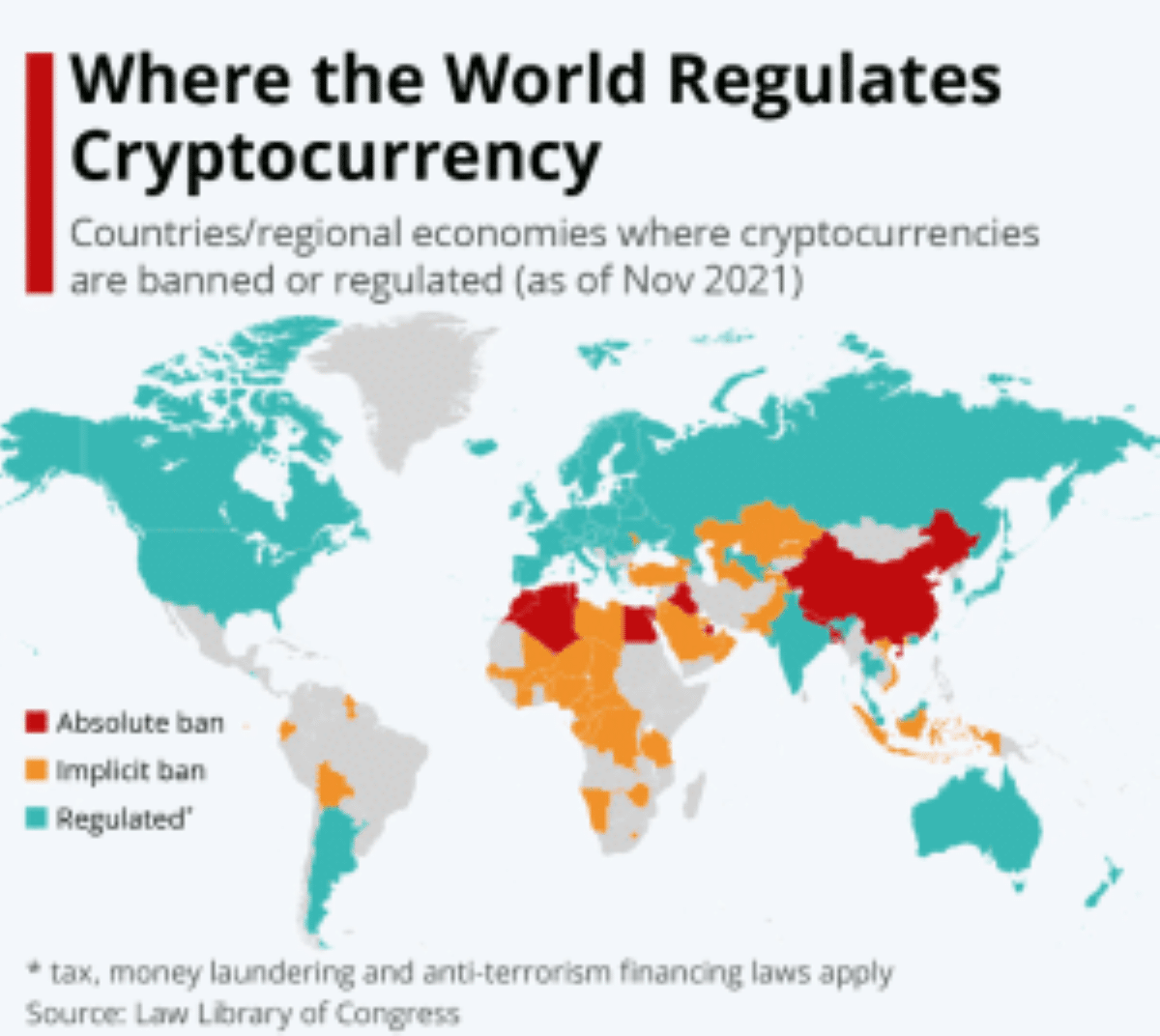

Source: Statista

China

- Legal status: Owning crypto is permitted; exchanges and ICOs are banned

- Tax rates: N/A

- Governing body: People’s Bank of China (PBOC)

China has a reputation for its strict laws, and crypto is no exception. However, contrary to common belief, there’s no outright ban on virtual currencies. Owning crypto isn’t illegal, but trading it on foreign exchanges or using it for payments? While no specific law prohibits these activities, the government makes them extremely difficult.

In 2013, the People’s Bank of China issued a Notice on Preventing Bitcoin Risks, clamping down heavily on crypto businesses, including exchanges, ICOs, new tokens, and other projects.

Furthermore, China sees crypto as a virtual commodity rather than a real currency.

So, while you won’t be prosecuted for owning crypto, there’s virtually no use for it in the region. China prioritizes control over its financial system and is concerned about digital currencies destabilizing it and enabling illicit activities.

Additionally, China is currently revising its AML laws to include virtual assets. This could potentially result in stricter regulations and penalties for using crypto.

Since China doesn’t recognize crypto, there are also no specific tax regulations. Instead of worrying about Bitcoin, China is busy developing its own central bank digital currency (CBDC), which will give the government greater control over citizens’ financial activities.

Think of it as the polar opposite of crypto – one’s all about decentralization, and the other’s about keeping a tight grip. It’s a safe bet that most would prefer the freedom of crypto, which is probably why the Chinese government is working overtime to tighten the reins.

Canada

- Legal status: Legal (treated as commodities)

- Tax rates: 15%–33% capital gains tax on profits

- Governing bodies: Financial Transactions and Reports Analysis Centre of Canada (FINTRAC), Canadian Securities Administrators (CSA)

Unlike many countries that have vague or non-existent crypto legislation, Canada has a proactive approach. It was the first country to approve a Bitcoin exchange-traded fund (ETF) on the Toronto Stock Exchange.

This move shows Canada’s openness to innovation. Overall, the country opts for regulations over restrictions to mitigate risks without hampering progress.

While Canada allows the holding and trading of crypto, virtual money is not legal tender like the Canadian dollar.

The Canada Revenue Agency (CRA) treats crypto trading as barter transactions, meaning you must report your gains on your tax return. The rate depends on your marginal tax bracket.

Furthermore, if you mine crypto, your profit is considered business income and is taxed accordingly. However, there is no tax on buying or holding crypto.

Crypto firms are classified as Money Service Businesses (MSBs), which brings them under the purview of the FINTRAC, Canada’s financial intelligence unit. FINTRAC employs AML laws like KYC and Suspicious Activity Reporting (SAR) procedures.

The Canadian Securities Administrators (CSA) is also actively involved in regulating crypto trading platforms. They determine if a crypto asset qualifies as a security and falls under respective laws.

United Kingdom

- Legal status: Legal (treated as unregulated financial instruments)

- Tax rates: 10%–20% capital gains tax on profits

- Governing body: Financial Conduct Authority (FCA)

Similarly to Canada, the UK takes a proactive and balanced outlook on virtual currency regulations. Crypto businesses must play by the book and comply with KYC and AML procedures.

Here’s where things get interesting. Recently, the Financial Services and Markets Act 2022 (FSMA 2022) brought certain crypto assets under the FCA’s regulatory umbrella.

This means crypto trading now faces similar rules as traditional investments. Crypto businesses need to get a proper FCA license and implement consumer protection measures to ensure everyone plays fairly.

The FSMA might also pave the way for further regulations. By mid-2024, the UK government plans to introduce secondary legislation that outlines specific rules for crypto activities under FCA’s purview.

Stablecoins (cryptos pegged to traditional currencies) have caught the attention of UK authorities. Their perceived stability could lead to wider adoption, potentially impacting traditional financial systems as people flock to digital money.

Despite the name, stablecoins aren’t risk-free. The mechanism that maintains their value is complex and vulnerable to disruptions.

If a stablecoin loses its peg or experiences a significant price drop, it could cause wider financial instability.

That’s why the Financial Services and Markets Bill (FSMB) has been fast-tracked through Parliament’s Upper House. It aims to keep stablecoins in check.

Meanwhile, UK citizens must pay capital gains tax on their investment profits. Short-term and long-term capital gains fall under the same umbrella and are taxed at 10%-20%, depending on your early earnings.

Japan

- Legal status: Legal (treated as legal property)

- Tax rates: 15%–55% income tax

- Governing body: Financial Services Agency (FSA)

Japan is known for its progressive stance on technological innovation, whether humanoid robots, renewable energy, or blockchain. That’s why Japan recognized crypto as legal property and developed appropriate laws relatively early, in 2017.

The FSA regulates crypto exchanges in Japan, requiring them to register and comply with AML rules. Money laundering appears to be the government’s primary concern, with new laws trying to close any loopholes that malicious actors could exploit.

For instance, Japan introduced the ‘Travel Rule,’ which mandates exchanges share customer information when transferring crypto to other platforms. This law was first issued in 1995 with fiat currency in mind but was amended for crypto in 2023.

Applying an old law to a new technology wasn’t seamless.

Banks dealing with fiat money had to include information like transfer references and the sender’s legal name.

Crypto transactions include no data beyond the transfer amount and wallet address, so regulations are still underwork.

Unlike many countries that treat crypto as capital gains for tax purposes, Japan classifies it as miscellaneous income. This means you must pay the same tax as you would from freelance work or side hustle.

Japan has a progressive tax system, so the rate you pay depends on your overall income. Generally, it ranges from 15% to 55%, significantly higher than the capital gains tax rate of 20%.

On a good note, you don’t have to report crypto gains if they don’t exceed $1,5k a year.

Australia

- Legal status: Legal (treated as virtual assets)

- Tax rates: 12%–35% capital gains tax on profits

- Governing bodies: Australian Securities and Investments Commission (ASIC), Australian Taxation Office (ATO)

Australia didn’t reinvent the wheel with its crypto taxation regulations. The government treats crypto as capital gains, so you must pay 12%–35% tax depending on your overall yearly income.

However, if you earn under $13,5K a year, you can enjoy your crypto profits tax-free.

Furthermore, holding your crypto for over 12 months before selling it gives you a 50% capital gains discount. It seems the Australian government is all in for HODLing.

Crypto exchanges operating in Australia must comply with regulations set by the Australian Transaction Reports and Analysis Centre (AUSTRAC). This includes KYC and AML procedures, which are the standard globally.

On the other hand, Australia threw a curveball with its ban on privacy coins. Tokens like Monero and Zcash make transactions difficult to trace, so the government is concerned about their use in money laundering. Most countries are still wrestling with how to handle privacy coins, and few have taken an equally bold step.

Singapore

- Legal status: Legal (treated as property)

- Tax rates: 0%–22% income tax

- Governing body: Monetary Authority of Singapore (MAS)

Like the UK, Singapore treats cryptocurrency as property, not legal tender, so it could be subject to capital gains tax. However, Singapore doesn’t tax income from the sale of assets, contributing to its image of a ‘safe haven’ for crypto investors.

Here’s the catch. Despite the lack of capital gains tax, you may have to pay income tax if authorities deem them part of your core business activities.

They consider the frequency of trading, your investment amount, and the use of special infrastructure. Still, the tax rate ranges from 0% to 22%, which isn’t that bad compared to Japan.

Singapore also has AML and KYC laws for crypto businesses, like most countries we discussed above. Exchanges, DeFi platforms, and other firms must report to MAS under the Payment Services Act (PSA).

In 2022, MAS advised crypto businesses to limit mass advertising. Such cautiousness indicates Singapore is rolling out the red carpet for seasoned crypto players, not those just dipping their toes in the water.

South Korea

- Legal status: Legal; privacy coins and ICOs are banned

- Tax rates: 5%–45% miscellaneous income tax

- Governing bodies: Korea Financial Intelligence Unit (KFIU), self-regulatory organizations (SROs)

Like most countries, South Korea requires all crypto businesses to register with the KFIU and comply with AML and KYC laws.

However, South Korean exchanges also have self-regulatory organizations (SROs) established by the crypto industry itself. These SROs operate under the KFIU’s provision but can set additional rules for token listings, trading practices, and investor protection.

South Korea takes a zero-tolerance approach to crypto shenanigans. For example, they’ve banned Initial Coin Offerings (ICOs) altogether due to the high risk of scams. Privacy coins also got the boot to combat money laundering and financial terrorism.

Profits from crypto trading are taxed at 5%–45% as miscellaneous income, depending on your total yearly earnings. But there’s more – authorities are discussing introducing a capital gains tax in addition to the income tax.

All in all, South Korea has some of the strictest crypto regulations worldwide, but it’s far from China’s or Egypt’s complete crackdown. The government is open to innovation in the space but adopts new trends with caution.

India

- Legal status: Unclear

- Tax rates: 30% miscellaneous income tax + 1% tax deducted at source (TDS)

- Governing body: Reserve Bank of India (RBI)

India’s crypto regulations are somewhat vague. Unlike some countries that have either embraced or outlawed digital currencies, India remains firmly on the fence.

Recently, the government proposed a bill banning unregulated virtual currencies. This could spell trouble for crypto investors, especially if India launches its own CDBC, a potential competitor to BTC and ETH.

Despite the unclear legal status, the Indian government isn’t shy about taking its cut.

They currently levy a hefty 30% tax on crypto profits, significantly higher than many other nations. To add insult to injury, they also impose a 1% TDS on crypto transactions over ₹50,000 (roughly $600).

With no clear-cut crypto laws, AML and KYC procedures also play a waiting game. It seems India’s current strategy is to keep an eye on the global crypto scene before making a decisive move.

Brazil

- Legal status: Legal payment method

- Tax rates: 5%–45% miscellaneous income tax

- Governing bodies: Securities and Exchange Commission of Brazil (CVM), Central Bank of Brazil (BACEN)

Contrary to India, Brazil is the frontrunner in crypto adoption. Cryptocurrencies are a legal payment method countrywide, so Brazilian businesses can accept BTC, ETH, and other approved tokens alongside cash and credit cards.

This is unsurprising given Brazil’s history of an inflationary rollercoaster that made its citizens wary of fiat currencies. Some Brazilians might see crypto as a more reliable way to store their hard-earned cash.

However, Brazil isn’t going all-in without any guardrails. The BCB requires all crypto service providers to register and comply with standard AML and KYC regulations.

Furthermore, depending on your total annual income, the tax on crypto trading profits can get hefty. There’s no capital gains tax, but you must pay a 5%–45% miscellaneous income tax rate.

El Salvador

- Legal status: Legal tender

- Tax rates: 0% capital gains tax on BTC

- Governing body: SSF

El Salvador made headlines when it became the first (and so far, only) country to make Bitcoin legal tender. Unlike Brazil, where businesses can choose to accept BTC or not, El Salvador flipped the switch to mandatory.

Following this bold move, the government distributed free crypto wallets to citizens through their state-sponsored app, Chivo (which, for all you Spanish enthusiasts, means ‘cool’). This decision aimed to get everyone on board the Bitcoin train.

What’s more, El Salvador offers tax benefits for foreigners investing in crypto. With exemptions from capital gains taxes, the country hopes to attract foreign cash and fuel economic growth.

However, there are still a few kinks to iron out. Regulations for crypto businesses are still underway. There are no specific AML or KYC requirements or consumer protections, which raises concerns about illegal crypto activities.

Another hurdle El Salvador faces is BTC’s inherent volatility, making it a gamble for everyday transactions. Finally, let’s not forget the digital divide.

Not everyone in El Salvador has access to smartphones or the internet, which are crucial for using the Chivo wallet. This creates a situation where some citizens are left out of the Bitcoin bonanza.

Switzerland

- Legal status: Legal (treated as movable assets)

- Tax rates: 0%–0.99% wealth tax, no capital gains tax

- Governing bodies: Swiss Federal Tax Administration (SFTA), Swiss Financial Market Supervisory Authority (FINMA)

Similar to El Salvador and Brazil, Switzerland is pioneering crypto adoption. In 2020, it introduced laws concerning the notion of distributed ledger technology (DLT) securities. In essence, Switzerland created a legal framework that welcomes innovation within the crypto industry.

But let’s talk specifics. How is crypto taxed in Switzerland? Well, it depends on your tax status and how you use your crypto. For individual investors, things can be quite budget-friendly.

Switzerland treats crypto as movable assets and applies wealth tax at the cantonal level (think state level). These rates are capped at a chill 0.99% of your total assets.

The SFTA maintains a list with tax values for common cryptos to simplify the process.

Here’s the real kicker: there’s no capital gains tax on your crypto profits.

However, the capital gains tax exception only applies to private investors, not professional traders or businesses.

Furthermore, Switzerland operates a tiered licensing system for crypto businesses. For lower-risk activities like custody (holding crypto for clients) or basic trading platforms, a simpler ‘Finma Innovation License’ may suffice.

However, if you’re running a full-fledged crypto exchange, you’ll need a more comprehensive license from FINMA.

Of course, AML and KYC regulations are very much in play for crypto businesses in Switzerland. The Swiss government also recognizes the importance of educating consumers – for example, FINMA has a dedicated blog.

European Union

- Legal status: Legal (may vary by country)

- Tax rates: Varies by country

- Governing body: European Parliament

The EU leaves much of the responsibility for crypto rules to individual member countries, so it feels like a regulatory patchwork.

Taxation is a prime example of this diversity. Portugal welcomes crypto gains with open arms, treating them like tax-free income (under certain conditions).

Head north to Denmark, however, and you might face a whopping tax rate that could make your eyes water (up to 52.07%).

Cyprus, Estonia, Malta, and Slovenia residents enjoy a 0% capital tax on their crypto investments, whereas Finland, Germany, and Sweden impose some of the highest taxes, over 30%. Most countries, however, charge up to 20% tax.

It’s not all doom and gloom for high-rolling crypto enthusiasts, though. Countries like Cyprus, Estonia, Malta, and Slovenia have a 0% capital gains tax.

This stands in stark contrast to Finland, Germany, and Sweden, where tax rates can climb past 30%. Most EU countries fall somewhere in the middle, levying a tax rate of up to 20% on crypto profits.

Despite the tax chaos, the EU is making strides towards a more unified approach to crypto regulation.

The Fifth and Sixth Anti-Money Laundering Directives (5AMLD and 6AMLD) are now in place across the bloc. They require cryptocurrency service providers to adhere to KYC and combating the financing of terrorism (CFT) regulations.

In April 2023, the European Parliament took another step towards harmonization. They now require crypto service providers, such as exchanges and custodians, to obtain an operational license.

If you live in the EU, it’s important to do your due diligence on your local tax, reporting, and registration implications before diving headfirst into trading.

What are the Downsides to Regulating Digital Assets

We’ve briefly touched on the benefits of crypto regulations. However, excessive government control also has downsides. Let’s discuss some of them.

Stifling innovation

Blockchain technology is still evolving, and strict laws could dampen innovation. Do we want a world where groundbreaking ideas are shelved because they don’t tick all the regulatory boxes?

Market entry hurdles

Regulations often throw up roadblocks like licensing requirements and mountains of paperwork. These barriers prevent new startups from entering the market, hindering healthy competition.

Individual investors may also suffer. For example, the US SEC is considering regulations limiting participation in certain ICOs to accredited investors. These are typically individuals with a high income or a net worth of over $1 million.

Excessive regulations can limit the investment opportunities available to the general public and potentially concentrate wealth in the hands of a select few.

Enforcement challenges

Crypto transactions are borderless. However, there’s no global consensus on how to regulate them, so it’s hard to understand which rules apply to specific cases. For instance, a crypto exchange operating in one country might be subject to stricter KYC procedures than in another.

Operational overheads

The crypto space might be virtual, but the bills are very real. Businesses might have to shell out for specialized software and compliance specialists, which translates into higher fees for customers.

Smaller crypto companies might get squeezed out entirely, unable to afford the ever-growing compliance burden.

Market volatility

Sudden changes in regulations can send the crypto market on a wild ride. To illustrate, if people are unsure how new rules will impact their investments, they might panic sell, leading to sudden price drops.

Investor outflow

Ultimately, any government’s primary goal is to balance restrictions with investor support. After all, they want to collect as much tax revenue as possible while fighting illegal activities and keeping an eye on citizens’ transactions.

If cryptocurrency regulations are too strict, investors might flee to a country with a more lenient approach. This may hinder the country’s technological development and leave it behind the global curve.

Final Thoughts

The spectrum of global crypto regulations is broad. While some governments fully legalize crypto and incentivize investors with low tax rates, like El Salvador, others remain wary or ban crypto altogether.

Remember, the regulations are a work in flux. Before you plunge into trading, it’s crucial to Do Your Own Research (DYOR) about your local laws.

FAQs

Is there any regulation on cryptocurrency?

Yes, but each country has its own crypto regulations. Some countries have strict KYC, AML, and consumer protection rules, while others have almost none. It’s important to research crypto payment regulations in your region before diving into crypto. Read more under ‘What Does Regulation for Cryptocurrency Mean?’.

What is the new regulation for crypto?

New crypto regulations appear all the time. For example, the UK government plans to introduce secondary legislation that outlines specific rules for crypto activities by mid-2024. Likewise, many other countries are working on legislation or updating existing frameworks to address cryptocurrencies.

Should the SEC regulate crypto?

The SEC focuses on securities rather than all cryptocurrencies. Securities are crypto investments made to raise capital. Usually, investors don’t actively manage the asset. Therefore, cryptocurrencies that function as a medium of exchange or utility tokens don’t count as securities. Read more under ‘How is Crypto Regulated in the United States?’.

What regulatory protections currently apply to crypto assets?

Regulatory protections vary by country. For example, many countries have AML and KYC procedures in place. Some mandate crypto project disclosures and provide educational resources to investors. Read more under ‘Rules and Regulations for Cryptocurrency Around the World.’

References

Our Editorial Process

Our Editorial Process

The Tech Report editorial policy is centered on providing helpful, accurate content that offers real value to our readers. We only work with experienced writers who have specific knowledge in the topics they cover, including latest developments in technology, online privacy, cryptocurrencies, software, and more. Our editorial policy ensures that each topic is researched and curated by our in-house editors. We maintain rigorous journalistic standards, and every article is 100% written by real authors.

Regulation

Crypto community gets involved in anti-government protests in Nigeria

Amid the #EndBadGovernanceInNigeria protests in Nigeria, a notable shift is occurring within the country’s cryptocurrency sector. As the general public demands sweeping governance reforms, crypto community leaders are seizing the opportunity to advocate for specific regulatory changes.

Rume Ophi, former secretary of the Blockchain Stakeholders Association of Nigeria (SiBAN), stressed the critical need to integrate crypto-focused demands into the broader agenda of the protests.

Ophi explained the dual benefit of such requirements, noting that proper regulation can spur substantial economic growth by attracting investors and creating job opportunities. Ophi noted, “Including calls for favorable crypto regulations is not just about the crypto community; it’s about leveraging these technologies to foster broader economic prosperity.”

Existing government efforts

In opposition to Ophi’s call for action, Chimezie Chuta, chair of the National Blockchain Policy Steering Committee, presents a different view. He pointed out The Nigerian government continued efforts to nurture the blockchain and cryptocurrency industries.

According to Chuta, the creation of a steering committee was essential to effectively address the needs of the crypto community.

Chuta also highlighted the creation of a subcommittee to harmonize regulations for virtual asset service providers (VASPs). With the aim of streamlining operations and providing clear regulatory direction, the initiative involves cooperation with major organizations including the Securities and Exchange Commission (SEC) and the Central Bank of Nigeria (CBN). “Our efforts should mitigate the need for protest as substantial progress is being made to address the needs of the crypto industry,” Chuta said.

A united call for support

The ongoing dialogue between the crypto community and government agencies reflects a complex landscape of negotiations and demands for progress.

While actors like Ophi are calling for more direct action and the inclusion of crypto demands in protest agendas, government figures like Chuta are advocating for recognition of the steps already taken.

As protests continue, the crypto community’s push for regulatory reform highlights a crucial aspect of Nigeria’s broader fight to improve governance and economic policies. Both sides agree that favorable regulations are critical to the successful adoption and implementation of blockchain technologies, signaling a potentially transformative era for Nigeria’s economic framework.

Read also : OKX Exchange Exits Nigerian Market Amid Regulatory Crackdown

Regulation

Cryptocurrency Regulations in Slovenia 2024

Slovenia, a small but highly developed European country with a population of 2.1 million, boasts a rich industrial history that has contributed greatly to its strong economy. As the most economically developed Slavic nation, Slovenia has grown steadily since adopting the euro in 2007. Its openness to innovation has been a key factor in its success in the industrial sector, making it a prime destination for cryptocurrency enthusiasts. Many believe that Slovenia is poised to become a powerful fintech hub in Europe. But does its current regulatory framework for cryptocurrencies support such aspirations?

Let’s explore Slovenia’s cryptocurrency regulations and see if they can propel the country to the forefront of the cryptocurrency landscape. My expectations are positive. What are yours? Before we answer, let’s dig a little deeper.

1. Cryptocurrency regulation in Slovenia: an overview

Slovenia is renowned for its innovation-friendly stance, providing a supportive environment for emerging technologies such as blockchain and cryptocurrencies. Under the Payment Services and Systems Act, cryptocurrencies are classified as virtual assets rather than financial or monetary instruments.

The regulation of the cryptocurrency sector in Slovenia is decentralized. Different authorities manage different aspects of the ecosystem. For example, the Bank of Slovenia and the Securities Market Agency oversee cryptocurrency transactions to ensure compliance with financial laws, including anti-money laundering (AML) and terrorist financing regulations. The Slovenian Act on the Prevention of Money Laundering and Terrorist Financing (ZPPDFT-2) incorporates the EU’s 5th Anti-Money Laundering Directive (5MLD) and aligns with the latest FATF recommendations. All virtual currency service providers must register with the Office of the Republic of Slovenia.

2. Cryptocurrency regulation in Slovenia: what’s new?

Several notable developments have taken place this year in the cryptocurrency sector in Slovenia:

July 25, 2024:Slovenia has issued a €30 million on-chain digital sovereign bond, the first of its kind in the EU, with a yield of 3.65%, maturing on 25 November 2024.

May 14, 2024:NiceHash has announced the first Slovenian Bitcoin-focused conference, NiceHashX, scheduled for November 8-9 in Maribor.

3. Explanation of the tax framework for cryptocurrencies in Slovenia

The Slovenian cryptocurrency tax framework provides clear guidelines for individuals and businesses. According to the Slovenian Financial Administration, the tax treatment depends on the status of the trader and the nature of the transaction.

- People:Income earned from cryptocurrencies through employment or ongoing business activities is subject to personal income tax. However, capital gains from transactions or market fluctuations are exempt from tax.

- Companies:Capital gains from cryptocurrency-related activities are subject to a 19% corporate tax. Value-added tax (VAT) generally applies at a rate of 22%, although cryptocurrency transactions that are considered as means of payment are exempt from VAT. Companies are not allowed to limit payment methods to cryptocurrencies alone. Tokens issued during ICOs must follow standard accounting rules and corporate tax law.

4. Cryptocurrency Mining in Slovenia: What You Need to Know

Cryptocurrency mining is not restricted in Slovenia, but income from mining is considered business income and is therefore taxable. This includes rewards from validating transactions and any additional income from mining operations. Both individuals and legal entities must comply with Slovenian tax regulations.

5. Timeline of the development of cryptocurrency regulation in Slovenia

Here is a timeline highlighting the evolution of cryptocurrency regulations in Slovenia:

- 2013:The Slovenian Financial Administration has issued guidelines stating that income from cryptocurrency transactions should be taxed.

- 2017:The Slovenian Financial Administration has provided more detailed guidelines on cryptocurrency taxation, depending on factors such as the status of the trader and the type of transaction.

- 2023:The EU adopted the Markets in Crypto-Assets (MiCA) Regulation, establishing a uniform regulatory framework for crypto-assets, their issuers and service providers across the EU.

Endnote

Slovenia’s approach to the cryptocurrency sector is commendable, reflecting its optimistic view of the future of cryptocurrencies. The country’s balanced regulatory framework supports cryptocurrency innovation while protecting users’ rights and preventing illegal activities. Recent developments demonstrate Slovenia’s commitment to continually improving its regulatory environment. Slovenia’s cryptocurrency regulatory framework sets a positive example for other nations navigating the evolving cryptocurrency landscape.

Read also : Hong Kong Cryptocurrency Regulations 2024

Regulation

A Blank Sheet for Cryptocurrencies: Kamala Harris’ Regulatory Opportunity

photo by Shubham Dhage on Unsplash

As the cryptocurrency landscape continues to evolve, the need for clear regulation has never been more pressing.

With Vice President Kamala Harris now leading the charge on digital asset regulation in the United States, this represents a unique opportunity to start fresh. This fresh start can foster innovation and protect consumers. It can also pave the way for widespread adoption across industries, including real estate agencies, healthcare providers, and online gaming platforms like these. online casinos ukAccording to experts at SafestCasinoSites, these platforms come with benefits such as bonus offers, a wide selection of games, and various payment methods. Ultimately, all this increase in adoption could propel the cryptocurrency market forward.

With this in mind, let’s look at the current state of cryptocurrency regulation in the United States, a complex and confusing landscape. Multiple agencies, including the Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), and the Financial Crimes Enforcement Network (FinCEN), have overlapping jurisdictions, creating a fragmented regulatory environment. This lack of clarity has stifled innovation as companies are reluctant to invest in the United States, fearing regulatory repercussions. A coherent and clear regulatory framework is urgently needed to realize the full potential of cryptocurrencies in the United States.

While the US struggles to find its footing, other countries, such as Singapore and the UK, are actively looking into the cryptocurrency sector by adopting clear and supportive regulatory frameworks. This has led to a brain drain, with companies choosing to locate in more conducive environments.

Vice President Kamala Harris has a unique opportunity to change that narrative and start over. Regulation of cryptocurrencies. By taking a comprehensive and inclusive approach, it can help create a framework that balances consumer protection with innovation and growth. The time has come for clear and effective regulation of cryptocurrencies in the United States.

Effective regulation of digital assets is essential to foster a safe and innovative environment. The key principles guiding this regulation are clarity, innovation, global cooperation, consumer protection, and flexibility. Clear definitions and guidelines eliminate ambiguity while encouraging experimentation and development to ensure progress. Collaboration with international partners establishes consistent standards, preventing regulatory arbitrage. Strong safeguards protect consumers from fraud and market abuse, and adaptability allows for evolution in response to emerging trends and technologies, striking a balance between innovation and protection.

The benefits of effective cryptocurrency regulation are multiple and far-reaching. By establishing clear guidelines, governments can attract investors and mainstream users, driving growth and adoption. This can, in turn, position countries like the United States as global leaders in fintech and innovation. Strong safeguards will also increase consumer confidence in digital assets and related products, increasing economic activity.

A thriving crypto industry can contribute significantly to GDP and job creation, which has a positive impact on the overall economy. Furthermore, effective regulation has paved the way for the growth of many businesses such as tech startups, online casinos, and pharmaceutical companies, demonstrating that clear guidelines can open up new opportunities without stifling innovation. This is a great example of how regulation can allay fears of regressive policies, even if Kamala Harris does not repeal the current progressive approach. By adopting effective regulation, governments can create fertile ground for the crypto industry to thrive, thereby promoting progress and prosperity.

Regulation

South Korea Imposes New ‘Monitoring’ Fees on Cryptocurrency Exchanges

Big news! The latest regulatory changes in South Korea are expected to impact major cryptocurrency exchanges like Upbit and Bithumb. Under the updated regulations, these platforms will now have to pay monitoring fees, which could cause problems for some exchanges.

Overview of new fees

In the latest move to regulate cryptocurrencies, the Financial Services Commission announced on July 1 the revised “Enforcement Order of the Act on the Establishment of the Financial Services Commission, etc.” update “Regulations on the collection of contributions from financial institutions, etc.” According to local legislation newsThe regulations require virtual asset operators to pay supervisory fees for inspections conducted by the Financial Supervisory Service starting next year. The total fees for the four major exchanges are estimated at around 300 million won, or about $220,000.

Apportionment of costs

Upbit, which holds a dominant market share, is expected to bear more than 90% of the total fee, or about 272 million won ($199,592) based on its operating revenue. Bithumb will pay about 21.14 million won ($155,157), while Coinone and GOPAX will contribute about 6.03 million won ($4,422) and 830,000 won ($608), respectively. Korbit is excluded from this fee due to its lower operating revenue.

Impact on the industry

The supervision fee will function similarly to a quasi-tax for financial institutions subject to inspections by the Financial Supervisory Service. The new law requires any company with a turnover of 3 billion won or more to pay the fee.

In the past, fees for electronic financial companies and P2P investment firms were phased in over three years. However, the taxation of virtual asset operators has been accelerated, reflecting the rapid growth of the cryptocurrency market and increasing regulatory scrutiny.

Industry reactions

The rapid introduction of the fee was unexpected by some industry players, who had expected a delay. Financial Supervisory Service officials justified the decision by citing the creation of the body concerned and the costs already incurred.

While larger exchanges like Upbit and Bithumb can afford the cost, smaller exchanges like Coinone and GOPAX, which are currently operating at a loss, could face an additional financial burden. This is part of a broader trend of declining trading volumes for South Korean exchanges, which have seen a 30% drop since the new law went into effect.

-

Regulation8 months ago

Regulation8 months agoNancy Pelosi Considers Supporting Republican Crypto Bill FIT21 – London Business News

-

Regulation10 months ago

Regulation10 months agoRipple CTO and Cardano founder clash over XRP’s regulatory challenges ⋆ ZyCrypto

-

Videos10 months ago

Videos10 months agoCryptocurrency News: Bitcoin, ETH ETF, AI Crypto Rally, AKT, TON & MORE!!

-

Regulation9 months ago

Regulation9 months agoBitcoin’s future is ‘bleak’ and ripe for regulation, says lead developer

-

News9 months ago

News9 months agoThe trader earned $46 million with PEPE after reaching a new ATH

-

News7 months ago

News7 months agoAave Price Increases Following Whales Accumulation and V3.1 Launch

-

Regulation7 months ago

Regulation7 months agoSouth Korea Imposes New ‘Monitoring’ Fees on Cryptocurrency Exchanges

-

Regulation7 months ago

Regulation7 months agoA Blank Sheet for Cryptocurrencies: Kamala Harris’ Regulatory Opportunity

-

Regulation7 months ago

Regulation7 months agoCryptocurrency Regulations in Slovenia 2024

-

Regulation9 months ago

Regulation9 months ago🔒 Crypto needs regulation to thrive: Tyler Cowen

-

Blockchain9 months ago

Blockchain9 months agoSolana ranks the fastest blockchain in the world, surpassing Ethereum, Polygon ⋆ ZyCrypto

-

Blockchain9 months ago

Blockchain9 months agoSolana Surpasses Ethereum and Polygon as the Fastest Blockchain ⋆ ZyCrypto