Bitcoin

Why These Bitcoin Miners Are Becoming Summer’s Hot AI Stocks

Crypto miners are harnessing their advanced equipment and low-cost energy for the burgeoning artificial intelligence sector. As the demand for computational power soars, these miners are uniquely positioned to profit from the AI boom.

By Nina Bambysheva, Forbes Staff

Energy has become the hot commodity in the artificial intelligence world. Take cloud computing provider CoreWeave, which earlier this month inked a $3.5 billion deal with Core Scientific. The agreement involves CoreWeave paying $290 million annually over 12 years for the Austin-based bitcoin miner’s data centers to host AI-related computing hardware. CoreWeave will also cover all capital expenditures.

The deal was so good that Core Scientific’s stock doubled to $10 in early June, leading some observers to view the company as the new “picks and shovels” play for AI. On June 26, CoreWeave announced a second contract, this one projected to bring Core Scientific $1.2 billion in revenue in the coming years. Core Scientific emerged from bankruptcy in January and is one of the largest bitcoin miners in North America.

The soaring demand for heavy-duty computer capacity, driven by AI applications such as ChatGPT—its queries require 10 times the electricity of traditional Google searches—is putting a premium on companies like Core Scientific that have access to cheap power in states such as Texas and North Dakota and agreements to tap more energy from elsewhere. Having sufficient power available now is vital when you consider that building high-performance computing (HPC) data centers from scratch typically takes 3-5 years, with current wait times for electrical-grid connections stretching up to six, according to the Lawrence Berkeley National Laboratory research center.

Adam Sullivan, CEO of Core Scientific

Courtesy of Core Scientific

“The demand is insatiable,” says Adam Sullivan, Core Scientific’s CEO. “If we just execute on what is within our current contracted power today, we’d be a top 10 data center company in the United States hosting a very significant portion of AI that’s done in the United States over the coming years. We’ve been working very closely with Nvidia and a number of different partners on the development and design of what’s required to operate these chips.”

Since Core Scientific’s announcement of the first CoreWeave contract on June 3, the aggregate market value of 14 U.S.-listed bitcoin miners surged by 22%, according to research by JPMorgan, a stark contrast to the 12% decline in bitcoin and a 4% rise in the S&P 500.

The 14 miners control about 5 gigawatts of power and can spare 3.6 gigawatts of that for HPC, a June 24 research report by JPMorgan indicates. They also have purchase agreements for an additional 4.5 gigawatts from new power plants in various stages of construction and permitting.

That new energy is enough to support about 3.4 million households for a year, and it could come in handy. Driven by the AI boom, data centers’ energy demand could surge to 9% of U.S. power generation by 2030, according to the Electric Power Research Institute. This projected increase is more than double the current usage.

But the miners cannot easily repurpose their excess electric capacity for AI. “Near term, power is extremely hard to find in large quantities, and that’s the big asset a lot of the U.S. bitcoin miners have right now, but those power contracts are valuable if they have the other pieces that go along with it, primarily fiber connectivity,” says Wes Cummins, CEO of data center developer Applied Digital. Fiber-optic cabling is crucial in high-performance computing because it is what enables high-speed data transfers.

Kevin Dede, an analyst at H.C. Wainwright, notes, “Bitcoin purists will push back and say, ‘No, you can’t host AI machines in a bitcoin mining data center.’ Okay, I get it, you can’t. You need cleaner air and better cooling.” But smaller AI players that may not have an appetite for quite the same computing and power provided by hyperscalers—companies with massive data centers and cloud infrastructure such as Amazon’s AWS, Microsoft Azure and Google Cloud—could better integrate with the level of service range bitcoin miners are accustomed to delivering, which may ultimately lead to a bitcoin mining/HPC data center hybrid, he adds.

There is evidence that investors agree.

“Listed bitcoin mining stocks have re-rated during the past three weeks as the value of the miners’ power assets has come to the fore,” wrote Mark Palmer, an analyst at investment banking firm Benchmark, in a June 21 research note. “The average enterprise value/revenue multiple of a selected group of listed miners, including IREN, TeraWulf and BitDigital, is now at 7.8x, up from 5.2x two months ago.”

This is timely given the latest halving of the reward for adding a block to the Bitcoin blockchain. The reduction of the payment to 3.125 bitcoin has resulted in mining earnings reaching historic lows. In addition, the 10 miners that we found to be considering AI projects were all unprofitable last year, with bitcoin slowly recovering from the effects of the 2022 crypto winter and trading below the cost of mining it.

While Core Scientific is in the spotlight, several other miners have also been adjusting their operations to capitalize on the AI wave:

IREN

Formerly known as Iris Energy, IREN was one of the earliest companies to recognize the opportunity. JPMorgan calculates it is best positioned to take advantage of the HPC/AI demand, based on its track record of building high-quality data centers on time. The company also recently purchased 816 Nvidia H100 GPUs— arguably the most powerful chips for AI. “Outside of Core Scientific, IREN and maybe Hut 8, we haven’t really seen that level of materialized revenue coming from the AI business,” says Mike Colonnese, another analyst at H.C. Wainwright.

HUT 8

The Miami-based bitcoin miner announced a $150 million investment from Coatue Management, which has also backed CoreWeave, to build AI-related infrastructure. Coatue will buy a five-year note, which the company can extend for up to three years. The debt will pay 8%, and Coatue can convert it into stock, initially at $16.395 a share. That was a 45% premium when the deal was announced, but Hut 8 is now trading at $14.99.

Asher Genoot, CEO of Hut 8

Courtesy of Hut 8

“We want to work with partners that have scale or will be there for a long period of time for us to grow and continue building with, well-known names within the broader ecosystem and the AI sector, and we are in conversations with many of these counterparties,” says Asher Genoot, CEO of Hut 8. The key part of the equation is not only which companies will get an opportunity to address this market, but which companies will have the ability to deliver, and Hut 8 is one of them, he claims.

“Hut 8 has demonstrated its ability to stand up greenfield sites for energy assets and data centers relatively quickly and inexpensively,” agrees Benchmark’s Palmer. He rates Hut’s stock a buy with a $17 price target.

APPLIED DIGITAL

One of the first miners to pivot to building HPC data centers, Applied Digital recently signed a letter of intent with an unnamed U.S. hyperscale computing provider for a lease of 400 megawatts. The company’s Jamestown, North Dakota, facility is an interesting example of an attempt to balance mining and HPC efforts, according to H.C. Wainwright’s Dede—what’s becoming known as a mullet data center. Similar to the hairstyle, this kind of facility combines high-performance computing operations up front and bitcoin mining operations when there’s excess power capacity.

“I think people are very focused on power right now, but there’s a lot of other pieces that are very important if you want to transition your business from bitcoin mining to HPC,” says CEO Cummins, pointing out at wait times for key electrical gear of up to more than 2.5 years and competition for employees that has experience with large-scale data centers. “We spent a lot of time on this already. We’ve worked through the supply chain issues, we’ve picked up the experts. We really see ourselves as an HPC infrastructure company in the future.”

John Todaro, an analyst at Needham, named Applied Digital its top pick for HPC/AI while also highlighting IREN, Core Scientific, TeraWulf, Bitdeer, Hut 8, Bit Digital and HIVE Digital Technologies.

Bitcoin Miners Go AI

For the more pure plays, like Riot, CleanSpark and Marathon Digital Holdings, the three largest U.S. bitcoin miners by market capitalization, traditional crypto motivations remain strong. Bitcoin is near all-time highs, and supports like rising macro and political uncertainty are unlikely to fade soon.

“I think the optimal use of our resources is to focus on bitcoin mining and helping share the positive relationship to energy. Not only does it help stabilize the power grid, but it’s the future of money and there is a finite amount that will ever be mined. Some of our data centers could support HPC but we believe we are making a more positive impact and achieving success under our current strategy,” said Zach Bradford, CEO of CleanSpark, in a statement to Forbes.

Marathon has actually expanded its mining activities by adding kaspa (KAS), a proof-of-work digital currency, to its portfolio. “By mining kaspa, we are able to create a stream of revenue that is diversified from bitcoin, and that is directly tied to our core competencies in digital asset compute,” said Adam Swick, Marathon’s chief growth officer, in a statement shared on the company’s website. In March Forbes included Kaspa in its list of zombie blockchains because of little discernable use.

CleanSpark earlier this month announced it had added five mining sites in Georgia, worth $25.8 million, and on June 27 said it agreed to buy peer Griid Infrastructure in an all-stock deal valued at $155 million. Riot, meanwhile, is trying to take over rival Bitfarms via a proxy battle.

Investors in pure play mining should be a little bit more cautious, warns the analyst known on X as pennyether. “They’re sort of already pricing in a rally in bitcoin, but if it doesn’t happen, say we held to $60,000 per bitcoin for another year, I have to imagine that a lot of the mining stocks are going to take a substantial haircut.”

Sure, it’s hard to break into a new, highly complex industry, writes Colin Harper, head of content and research at bitcoin mining services firm Luxor Technologies, and “it becomes even more difficult when you consider that miners will be competing with some of the largest, most heavily capitalized tech companies on the planet.”

It could cost upward of $10 million per megawatt to build out AI data center infrastructure, while bitcoin mining sites’ megawatt cost between $300,000 to $500,000, according to H.C. Wainwright’s Colonnese. “The market has typically responded well to anything with AI but these are very capex-intensive builds, and you have to get them right,” he says.

Still, a shift to AI operations for those with available infrastructure and energy capacity offers potentially compelling benefits. By replacing the volatility of bitcoin with more stable revenue from AI computing, miners can benefit from predictable budgets funded by established customers. This also helps miners boost income to be able to afford the high capital investment necessary to stay competitive with new mining equipment, concluded analysts at Morgan Stanley in an April report.

“The truth is that AI companies can pay more for that power because they don’t care. Their business model is stronger. With bitcoin mining, you have no idea what the price of bitcoin is going to be or how hard it’s going to be to mine one, so you’re taking a lot more risk,” says Dede.

Morgan Stanley’s report highlighted multiple miners’ sites suitable for conversion to data centers, including locations in Texas, Georgia, Canada, the United Arab Emirates and Bhutan. Most miners that are seeking to retrofit will be looking at capital expenditures north of $6 million per megawatt, according to Needham analysts.

For many mining companies, getting a piece of the high-performance pie is too lucrative an opportunity to pass up.

“It doesn’t mean miners will completely revamp their businesses,” says Phil Harvey, CEO of Sabre56, a hosting provider and digital-asset-mining consultancy. “They’ve already put a lot of money, time and effort into crypto and some of those sites are only going to be good for crypto.” But “it’s foolish not to be offering this up as a business,” he adds. “That opens up your investment universe a lot wider, private equity firms that are climbing over themselves to invest in HPC/AI because investors are saying ‘I want to be in this.’”

MORE FROM FORBES

ForbesA Noisy Office Is A Nuisance-And A Business OpportunityBy Jena McGregorForbesHackers Are Now Coming For Your Airline Miles And Hotel PointsBy Jeremy BogaiskyForbesHere Are Biden’s Top 10 Biggest Billionaire DonorsBy Leo KaminForbesHere Are Trump’s 10 Biggest Billionaire DonorsBy Leo KaminForbesHow AI Is Distorting The Returns Of Vanguard’s Largest ETFsBy Mitchell Martin

Bitcoin

‘This is huge’ — Billionaire Mark Cuban issues ‘incredible’ Bitcoin and crypto prediction amid price slump

Bitcoin has surged again this year under former President Donald Trump Cryptocurrency boosts US presidential election in November with ‘revolutionary’ plan.

The price of bitcoin has surged to more than its all-time high in recent months, surpassing $70,000 per bitcoin and triggering a wave of mega-optimistic predictions about the price of bitcoinalthough it fell again this week to below $65,000 after the Federal Reserve kept interest rates steady.

Now, as Elon Musk suddenly breaks his silence on bitcoin and cryptocurrenciesBillionaire investor Mark Cuban called a California plan to digitize 42 million car titles using blockchain an “incredible step forward” and “huge” for cryptocurrencies.

Sign up for free CryptoCodex now—A daily five-minute newsletter for traders, investors, and crypto curious people that will keep you up to date and ahead of the bitcoin and crypto bull market

Mark Cuban, famous Shark Tank investor and billionaire owner of the NBA team Dallas Mavericks, has… [+] called a cryptocurrency update “amazing” amid bitcoin’s price slump.

Getty Images

The California Department of Motor Vehicles (DMV) has digitized 42 million car titles using blockchain, it was reported by Reuters, through technology company Oxhead Alpha on the Avalanche blockchain and designed to detect fraud and facilitate the securities transfer process.

“This is an incredible development for crypto,” Cuban, best known as an investor on TV’s Shark Tank and owner of the Dallas Mavericks NBA team, posted on X, joking that U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler could sue the state as part of his hostility toward cryptocurrencies and blockchain technology.

“The reason this is huge for crypto is because people who hold the tokens will have an app with an Avalanche wallet,” Cuban said. “Tens of millions of Californians having and using a crypto wallet in the next five years, or however long it takes, normalizes the use of wallets and crypto.”

John Wu, president of Avalanche developer Ava Labs, told Reuters that California’s DMV is “creating a wallet that you can download on your phone.”

Sign up for CryptoCodex now—A free daily newsletter for the crypto-curious

Bitcoin’s price has rallied this year, triggering a wave of bullish bitcoin price predictions from… [+] people like billionaire Mark Cuban.

Forbes Digital Assets

Last month, Cuban predicted that if the US dollar falls as the global reserve currency, bitcoin could become “a global ‘safe haven’” and a “global currency.” potentially sending the price of bitcoin to a much higher level.

According to Cuban, bitcoin could become what its most ardent supporters “envision” — a means “of protecting our economies… This is already happening in countries facing hyperinflation.”

The price of bitcoin has skyrocketed over the past year, largely due to the world’s largest asset manager, BlackRock, leading a bitcoin attack on Wall Street.

Bitcoin

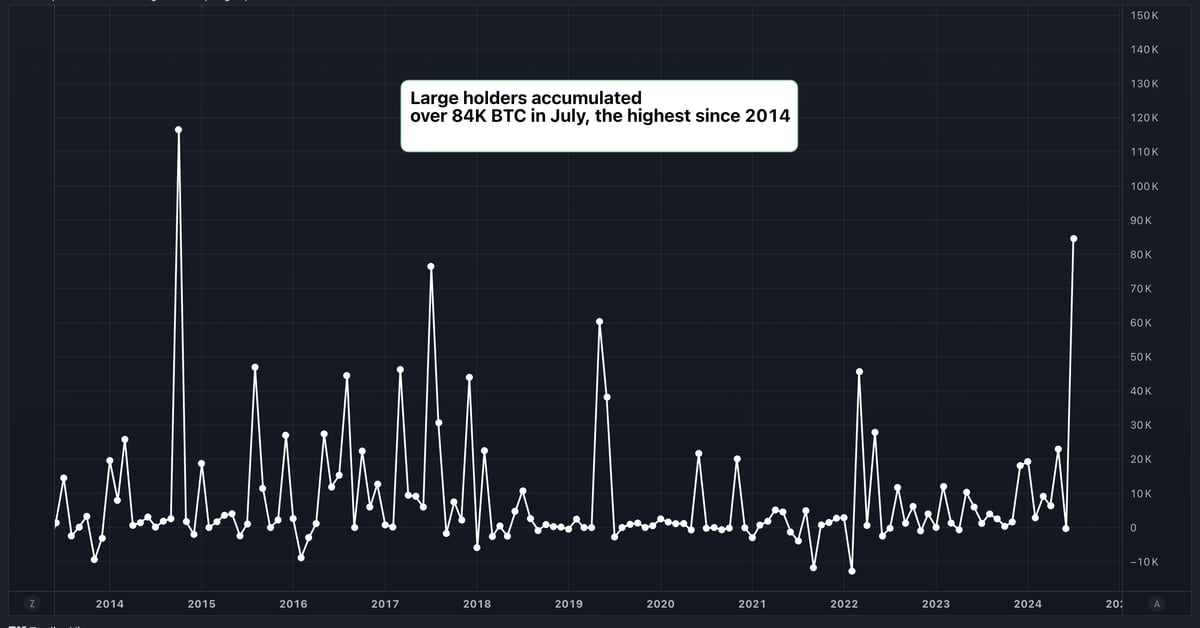

Large Bitcoin (BTC) Holders Added $5.4 Billion Worth of BTC in July, Data Shows

Please note that our Privacy Policy, terms of use, cookiesIt is do not sell my personal information Has been updated.

CoinDesk is a awarded media outlet that covers the cryptocurrency industry. Its journalists follow a strict set of editorial policies. In November 2023, CoinDesk has been acquired by the Bullish group, owner of Optimistica regulated digital asset exchange. The Bullish Group is majority owned by Block.one; both companies have interests CoinDesk has a portfolio of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as an independent subsidiary with an editorial board to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

Bitcoin

Peter Schiff criticizes Michael Saylor’s Bitcoin hype by U.Today

U.Today – Renowned economist and cryptocurrency critic Peter Schiff has criticized Michael Saylor’s recent hype about the growing adoption of cryptocurrencies as a strategic treasury asset by corporations.

Michael Saylor, a well-known Bitcoin advocate and president of MicroStrategy, recently shared his enthusiasm on X about the growing adoption of Bitcoin as a strategic treasury asset.

Citing a comment made by Bitcoin investor Bill Miller in a recent interview with CNBC, Saylor tweeted: “We now have more companies coming forward and saying we will put Bitcoin on our balance sheet as a strategic treasury asset.”

However, not everyone shares Saylor’s enthusiasm. Schiff, a vocal Bitcoin critic and gold bull, was quick to respond with his usual skepticism. In a pointed tweet, Schiff argued: “Bitcoin is neither strategic nor appropriate as a treasury asset. Companies should not risk shareholder funds. They should pay dividends and let shareholders risk their own money.”

Bitcoin enthusiasts are not intimidated

However, Schiff’s criticism shouldn’t deter Bitcoin enthusiasts, who often take Schiff’s words with a pinch of salt. To put things in context, Michael Saylor began buying Bitcoin in 2020 as an inflation hedge and alternative to money. Saylor’s company, MicroStrategy, is among the largest public holders of Bitcoin in the world. As of June 20, it held 226,331 BTC, purchased for around $8.33 billion at an average price of $36,798.

Over the weekend, Schiff was surprised when 87% of the more than 11,000 Bitcoin holders who responded to his X survey said they would not sell any of their Bitcoin even if the price dropped more than 99% to $120. They said not only would they not sell, but that they would continue to buy even when prices dropped.

Schiff unexpectedly revealed that “the main selling point for investors to buy Bitcoin is its excellent past performance record.”

At the time of writing, Bitcoin is trading at $66,067, having reached all-time highs of nearly $74,000 in mid-March.

Bitcoin

Bitcoin Falls as ETF Flows Reverse, Mt. Gox Moves Billions

In a week of drastic fluctuations, the price of Bitcoin (BTC) has retreated from its highs and is currently trading at US$66,250, down 0.9% in European trading.

This volatility comes on the heels of a significant surge above $70,000 earlier in the week, fueled by former President Donald Trump’s ambitious cryptocurrency plans announced in a Bitcoin Conference in Nashville.

Trump’s announcement to fire Securities and Exchange Commission Chairman Gary Gensler and establish a strategic Bitcoin reserve if elected president has temporarily sent the cryptocurrency market into a frenzy.

However, the excitement was short-lived as a series of events unfolded which caused investor sentiment to sour.

A significant sell-off of about 8% was triggered when the US Marshals Service moved $2 billion in Bitcoin for new wallets.

This move has reignited fears of a potential large-scale liquidation, compounded by lingering concerns over a possible Bitcoin liquidation from Mt. Gox. Early this morning, Mt. Gox administrator transferred US$2.2 billion value of your BTC assets in a new wallet.

Meanwhile, the US Bitcoin ETF spot market is showing signs of fluctuation, according to data from SoSo Value. On July 30, Bitcoin spot funds experienced their first net outflow in five days, totaling $18.3 million.

The Grayscale Bitcoin Trust (GBTC) saw outflows of $73.6 million, while the BlackRock iShares Bitcoin Trust (IBIT) attracted $74.9 million in inflows. But outflows from other funds left the category in the red at the end of Tuesday’s trading session. The total net asset value of spot Bitcoin ETFs currently stands at a substantial $58.5 billion.

In other crypto news, Ripple (XRP) is up 8.6% in the past 24 hours, hitting over 64 cents – its highest point since March 25, according to CoinGecko. data.

This rally comes amid a scheduled token unlock and growing optimism around a potential deal in the long-running SEC vs. Ripple lawsuit.

The crypto community is closely watching the SEC’s actions, particularly its intention to amend its complaint against Binance regarding “Third-Party Cryptocurrency Securities,” which some interpret as a positive sign for Ripple.

On a market analysis noteSingapore-based cryptocurrency trading desk QCP Capital wrote that while election headlines continue to dominate, several crucial macroeconomic events loom on the horizon.

“Election headlines will continue to be a key focus, but several key macroeconomic events are also on the horizon. Key events starting with the FOMC meeting on Wednesday, megacap tech earnings (Apple, Amazon, Meta) throughout the week, and unemployment data on Friday,” QCP Capital wrote.

Edited by Stacy Elliott.

-

Regulation11 months ago

Regulation11 months agoRipple CTO and Cardano founder clash over XRP’s regulatory challenges ⋆ ZyCrypto

-

Regulation10 months ago

Regulation10 months agoNancy Pelosi Considers Supporting Republican Crypto Bill FIT21 – London Business News

-

Videos11 months ago

Videos11 months agoCryptocurrency News: Bitcoin, ETH ETF, AI Crypto Rally, AKT, TON & MORE!!

-

Regulation11 months ago

Regulation11 months agoBitcoin’s future is ‘bleak’ and ripe for regulation, says lead developer

-

News8 months ago

News8 months agoAave Price Increases Following Whales Accumulation and V3.1 Launch

-

Regulation8 months ago

Regulation8 months agoSouth Korea Imposes New ‘Monitoring’ Fees on Cryptocurrency Exchanges

-

Regulation8 months ago

Regulation8 months agoA Blank Sheet for Cryptocurrencies: Kamala Harris’ Regulatory Opportunity

-

Regulation8 months ago

Regulation8 months agoCryptocurrency Regulations in Slovenia 2024

-

News11 months ago

News11 months agoThe trader earned $46 million with PEPE after reaching a new ATH

-

Regulation10 months ago

Regulation10 months agoCrypto needs regulation to thrive: Tyler Cowen

-

Blockchain11 months ago

Blockchain11 months agoSolana ranks the fastest blockchain in the world, surpassing Ethereum, Polygon ⋆ ZyCrypto

-

Blockchain10 months ago

Blockchain10 months agoSolana Surpasses Ethereum and Polygon as the Fastest Blockchain ⋆ ZyCrypto