Blockchain

After Bitcoin Halving, Is Ethereum a Sensible Buy?

If history is any guide, Ethereum could be on track to post stellar gains during Bitcoin’s current halving cycle.

THE Bitcoin (BTC 0.60%) on April 19 was one of the most anticipated events of the year for cryptocurrency investors. Three previous halving events in 2012, 2016, and 2020 led to spectacular gains for Bitcoin, and this year’s halving was expected to kick off another bull market cycle.

What many investors may not know, however, is that other cryptocurrencies can also see spectacular gains once Bitcoin Halving the cycle begins. One cryptocurrency on my radar right now is Ethereal (ETH 0.07%), which could be on track for rapid price appreciation over the next 12 months. Let’s take a closer look at why.

Bitcoin’s Impact on the Ethereum Ecosystem

Keep in mind that Ethereum is both a cryptocurrency and a blockchain ecosystem. This is important, because any new bullish sentiment around Bitcoin tends to benefit the components of these blockchain ecosystems, simply because of the increased interest investors have in everything cryptocurrency-related. This can include everything from non-fungible tokens (NFT) for decentralized finance (DeFi), all based on the Ethereum blockchain.

Image source: Getty Images.

In many ways, then, the Bitcoin halving is a rising tide that lifts all blockchain boats. This is exactly what happened during the previous Bitcoin halving cycle that began in May 2020. The growing excitement around the Bitcoin halving led investors to look for other cryptocurrencies that could benefit from it, and this naturally led them to Ethereum, which has the largest and most diverse blockchain ecosystem of any cryptocurrency.

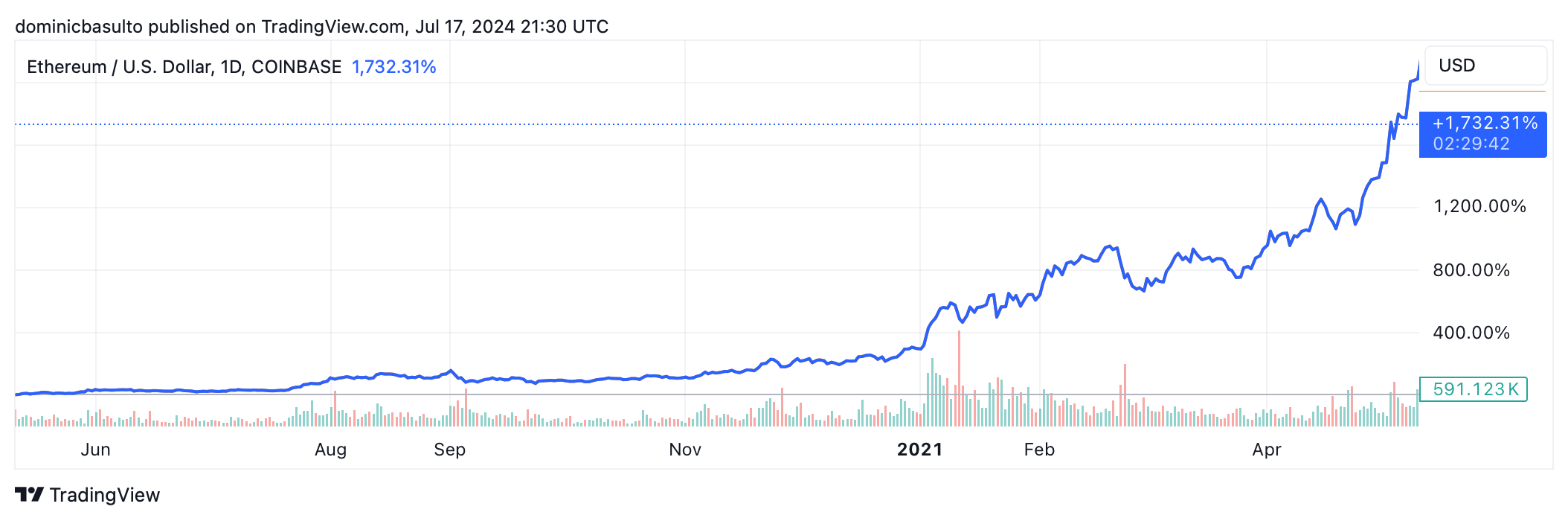

As a result of all the new money that has flowed into the Ethereum ecosystem from cryptocurrency investors, Ethereum’s value has started to skyrocket. In a 12-month period starting from the date of Bitcoin’s halving in May 2020, Ethereum has risen by over 1,732%.

Ether/US Dollar Chart by TradingView

Of course, there’s no guarantee that this same phenomenon will happen again for Ethereum in 2024. After all, past performance is no guarantee of future performance. But there are simply so many use cases for Ethereum that I’m increasingly confident that investors will find new sources of value within its sprawling blockchain ecosystem.

New Ethereum Spot ETFs Launch

The second reason why Ethereum could skyrocket in the post-halving cycle has to do with the impending launch of the new Ethereum ETF Spots. The Securities and Exchange Commission officially gave the green light to these new Ethereum ETFs at the end of May. Coincidentally, this coincided with the Bitcoin halving date in mid-April. So it’s only a matter of time before investor money starts flowing into these ETFs, helping to drive up the price of Ethereum.

It is true that there is not as much investor demand for spot Ethereum ETFs as there is for Bitcoin ETF SpotsBut as much as $3 billion could flow into these ETFs by the end of 2024. At a minimum, this new influx of money would help absorb any new selling pressure in the cryptocurrency market.

How High Can Ethereum Go?

The combination of these two factors could see Ethereum soar over the next 12 months. A growing number of analysts and investors now believe that Ethereum could regain its all-time high of $4,891 by the end of 2025. And from there, Ethereum could rise to $22,000 by 2030, according to investment firm VanEck.

Of course, a lot has to go right for Ethereum to skyrocket in value. So keep an eye on the changing sentiment around the Bitcoin halving and how it impacts investors’ perceptions of the value that can be unlocked within blockchain ecosystems. If history is any guide, Ethereum may end up being the most obvious buy of this Bitcoin halving cycle, just as it was in 2020.

Domenico Basulto has positions in Bitcoin and Ethereum. The Motley Fool has positions in and recommends Bitcoin and Ethereum. The Motley Fool has a disclosure policy.