Blockchain

Big Bitcoin (BTC) and Ether (ETH) Price Swings Following Ethereum Spot ETF Decision Trigger $350 Million Crypto Liquidations

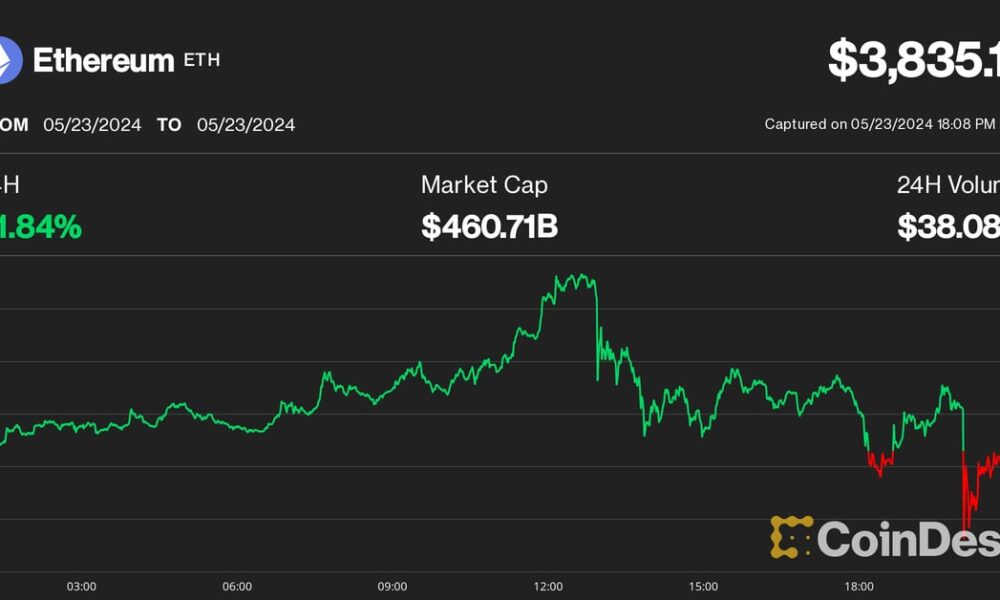

Cryptocurrency prices fluctuated wildly on Thursday as traders anxiously awaited a U.S. regulatory decision to list the spot ether exchange-traded funds.

In the nerve-wracking hour leading up to the eventual approval, ETH first plummeted to $3,500 around U.S. traditional market closing time, then surged to nearly $3,900 as the first unconfirmed reports of an approval appeared to settle above the $3,800 after confirmation.

Bitcoin (BTC) there was an equally frenetic episode that collapsed to $66,000, then rose back to $68,300 before reducing gains to below $68,000. However, ETH has performed better, advancing 1.5% in the past 24 hours, compared to BTC’s nearly 3% decline over the same period. The broad market CoinDesk 20 Index fell 1.6% on the day.

In this period of volatility, liquidations of all leveraged crypto derivatives positions rose to over $350 million during the day, the highest since May 1. CoinGlass data Shows.

Liquidations occur when an exchange closes a leveraged trading position due to a partial or total loss of the trader’s initial money or “margin” – if the trader fails to meet margin requirements or does not have sufficient funds to keep the negotiation open.

The lion’s share of the canceled positions were long bets on rising prices, worth about $250 million, suggesting that over-leveraged traders were caught by surprise by the sudden collapse in prices. ETH traders took the biggest hit, with $132 million in liquidations, followed by $70 million in BTC derivative liquidations.