Regulation

“Bitcoin and Ethereum are digital products”

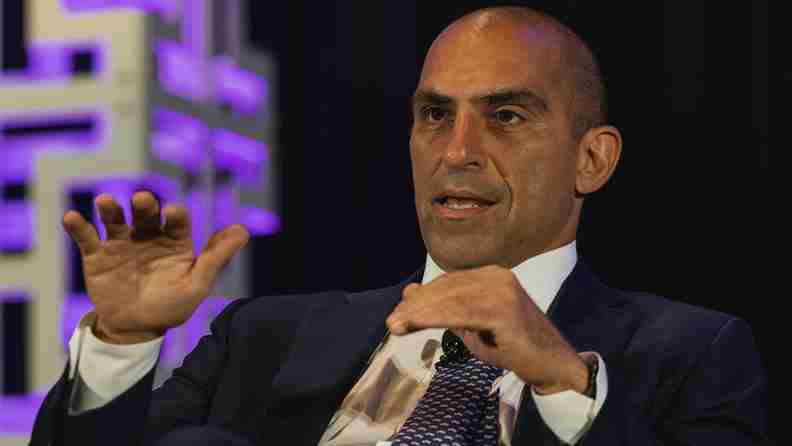

On July 10, 2024, the Chairman of the Commodity Futures Trading Commission (CFTC), Rostin Behnamannounced that an Illinois court had confirmed that Bitcoin And Ethereum must be considered digital products. This recognition is based on the interpretation of the Commodity Exchange Actthat 70-80% of the cryptocurrency market, including Bitcoin and Ethereum, falls into the non-securities category.

🚨CFTC Chairman Behnam says Illinois court upheld that $BTC And $ETH are digital commodities within the meaning of the Commodity Exchange Act.

— Eleanor Terrett (@EleanorTerrett) July 10, 2024

The difference between digital commodities and securities

Behnam’s assertion contrasts with the position of the Securities and Exchange Commission (SEC)), who has often argued that some cryptocurrencies, such as Ethereum, should be classified as securities and therefore regulated by the Commission. This distinction is crucial because basic products And securities are subject to different regulations and compliance requirements.

Lessons from Cryptocurrency Fraud Cases

Questioned by the senator Sherrod Brown What lessons have been learned from cryptocurrency fraud cases? Behnam responded by highlighting the uniqueness of the technology underlying digital assets. He stressed that this technology requires a different approach in terms of cyber security And operational resilience than traditional assets.

Concerns over cryptocurrency market regulation

Senator Cory Booker expressed concerns about regulatory responsibilities, which have so far been shared between the SEC and the CFTC, leaving the cryptocurrency market “subject to abuseBooker noted that nearly half of the cases the CFTC has decided role involve cryptocurrencies, calling it “extraordinary.” In response to Booker, Behnam acknowledged the challenge, describing it as a “shocking fact“for an agency that oversees markets worth trillions of dollars. He also pointed out that the agency lacks adequate jurisdiction and funding to regulate the cryptocurrency sector, putting both traditional and crypto markets at risk.

The jurisdictional conflict between the SEC and the CFTC

Senator Roger Marshall highlighted the ongoing jurisdictional conflict between the SEC and CFTC, with both agencies trying to determine which digital assets are securities and who are basic productsMarshall asked if it wouldn’t be simpler to give the CFTC full jurisdiction. Behnam replied: “I’m speaking for myself, but I’d be happy to do that. I think we have the experience and the capabilities.”

Future implications

Previously, former attorney for the Department of Justice Seth Goertz explained in an interview with Cryptonews.com how the SEC vs. Coinbase This case could redefine cryptocurrency regulation in the United States. The Illinois court’s decision marks an important step toward greater clarity in cryptocurrency regulation, but also underscores the need for a more coherent and better-defined regulatory structure.