Ethereum

Bitcoin Cash (BCH) Price Recovers $600 After Ethereum ETF Approval?

Bitcoin spot price rebounded 5% to reclaim $490 on May 24, with recent moves seen among BCH whales suggesting further upside could follow.

Ethereum ETF Sell-the-News Drives BCH Price Up 8%

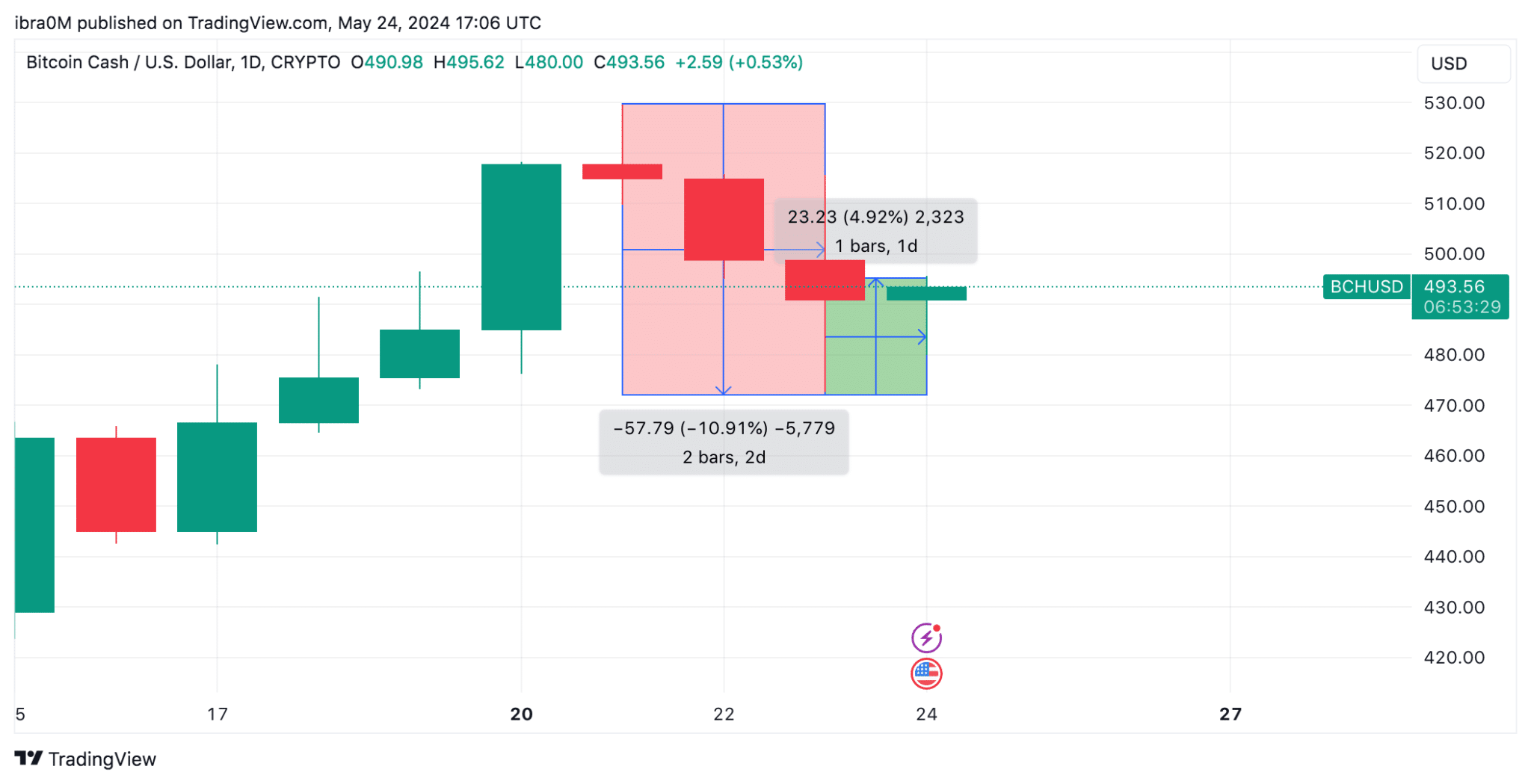

BCH price plummeted to an 11% freefall over the past 72 hours before rebounding 5% to regain $490 territory on Friday evening at 5 p.m. CET.

The Bitcoin Cash price volatility follows the SEC’s approval of the Ethereum ETF on May 23, which sent swing traders and paper investors into a “news selling” frenzy.

The concept of “selling the news” is a popular contrarian strategy in cryptocurrency trading, in which investors quickly sell their holdings just on the cusp of a major bullish news event, tying up prices. first profits before the euphoria wears off, then buying at a lower price. prices.

This narrative appears to have played out in the BCH markets over the past 24 hours. As shown in the graph above. After the official approval verdict of the Ethereum ETF on May 23, the price of BCH fell by 11%, falling to a weekly low of $472. But within a few hours, the price of BCH rebounded by 5% to reach the $490 level.

Whale investors reacted with the acquisition of 10,000 BCH

However, on-chain data shows that the wave of “news selling” was mainly limited to swing traders and retail investors, while Bitcoin Cash whale investors maintained a bullish stance.

The Santiment chart below tracks the number of coins held in whale wallets holding balances of at least 1,000 BCH (~$500,000).

– Advertisement –

The chart above shows that BCH whales held a total of 11.92 million BCH in their cumulative balances as of May 19. But since Bloomberg analysts broke the news of Ethereum ETF approved on May 20, whales quickly increased their buying pressure.

In nominal terms, since May 20, Bitcoin Cash whales have acquired 10,000 BCH, bringing their cumulative balances to 11.93 million.

Priced at the current price of around $493 per coin, Bitcoin Cash whales have effectively invested around $5.2 million.

Typically, when whales start purchasing such large volumes of coins in a short period of time, it puts intense upward pressure on the price of the underlying asset for two main reasons.

First, significant demand from whales reduces the supply available in the market, driving up prices due to increased scarcity. Second, whale accumulation often demonstrates confidence in the asset’s future performance, encouraging other investors to follow suit, further amplifying the price rise.

This dynamic partly explains the rapid 5% rebound in BCH prices observed on May 24. If whales maintain the buying trend, BCH price could surge towards the elusive $600 target in the coming days.

BCH Price Prediction: $530 Resistance Looms

After the 5% rebound recorded following the approval of the Ethereum ETF, the price of Bitcoin Cash now appears poised to rise further towards $600. Based on recent on-chain moves, the continuation of the whales’ $5.2 million buying trend will likely crowd out paper swing traders who are selling in market euphoria.

The Parabolic Stop and Reverse (SAR) technical indicator also confirms this bullish BCH price prediction. Currently, Parabolic SAR points are pointing towards the $454 level, which is well below the current BCH price at $493.

This alignment occurs when markets are in a strong uptrend, providing a strong support level that could prevent a significant downside move.

On the other hand, the previous market high at $530 could provide a key resistance level in the near term. If BCH manages to break through this resistance, it will likely attract additional buying interest, likely propelling the price towards the $600 target.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinions of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. Crypto Basic is not responsible for any financial losses.

-Advertisement-