Bitcoin

Bitcoin eclipsed by Ether and Solana in crypto bets riding on ETF hype

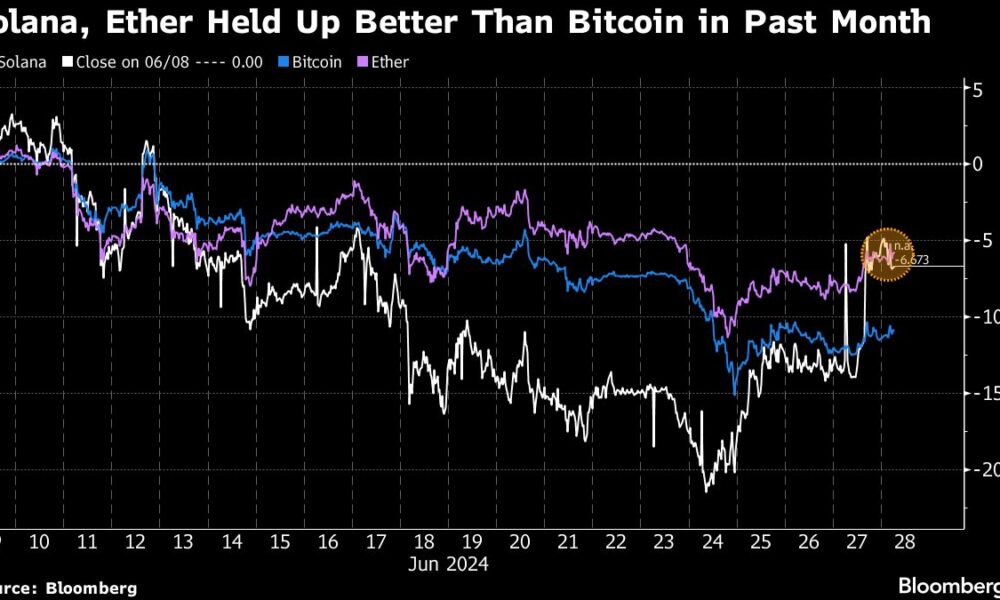

(Bloomberg) — Bitcoin’s performance is starting to be overshadowed by tokens Ether and Solana as enthusiasm around U.S. cryptocurrency exchange-traded funds shifts toward the two smaller digital assets.

Bloomberg’s Most Read

Solana saw its biggest surge in over a month on Thursday after fund manager VanEck filed to launch an ETF for the token. Ether has outpaced Bitcoin this year as final approvals for funds focused on the coin near.

In contrast, Bitcoin rose to prominence in early 2024 when the first US spot ETFs for the largest digital asset were launched. Products from companies such as BlackRock Inc. and Fidelity Investments attracted large inflows, sending Bitcoin to a record high of $73,798 in March, but demand and the price have since cooled.

The U.S. Securities and Exchange Commission last month approved exchange proposals to list spot-Ether ETFs. Some reports said final approvals for listings could come as early as next week.

Ether ETFs Outlook

Analysts have begun to dismiss tempered expectations about demand for ETFs holding the second token Ether, which is less well-known than Bitcoin. US vehicles could attract $5 billion in net inflows in the first five months, according to Galaxy Digital Holdings LP and Fundstrat Global Advisors LLC.

“Sentiment surrounding the launch of the Ether ETF is very bearish,” Fundstrat head of digital asset strategy Sean Farrell wrote in a note. He predicts ETFs will get a boost from hedge funds pursuing so-called basis trading, which seeks to exploit discrepancies between the spot market and the futures market.

Ether is up 49% since the turn of the year, outpacing Bitcoin’s 45% advance. Solana — also known as SOL — had already surged 754% in 12 months prior to Thursday’s gains and is ranked as the No. 5 digital asset.

U.S. Bitcoin ETFs have garnered $14.5 billion in net inflows since listing in January. JPMorgan Chase & Co. strategists estimated that future Ether portfolios will attract a “modest” $1 billion to $3 billion in net inflows over the rest of 2024.

SEC Position

The SEC surprisingly moved to approve Ether ETFs in the offing after reluctantly allowing Bitcoin funds following a court reversal in 2023.

While Bitcoin is viewed as a commodity, the agency led by Chairman Gary Gensler argues that most other tokens are unregistered securities that should be subject to its oversight. Gensler has been ambiguous about whether Ether is a security.

The story continues

But Solana is one of more than a dozen coins that the SEC has highlighted in various filings as unregistered securities. This raises questions about whether the regulator would allow Solana ETFs. A filing like VanEck’s does not mean the SEC will give the product approval for launch.

Bitcoin fell about 1% to trade around $60,850 at 11:27 a.m. Friday in New York. Ether dropped to $3,400 and Solana fell 5% to $142.

–With the help of Suvashree Ghosh.

Most Read from Bloomberg Businessweek

©2024 Bloomberg LP