Blockchain

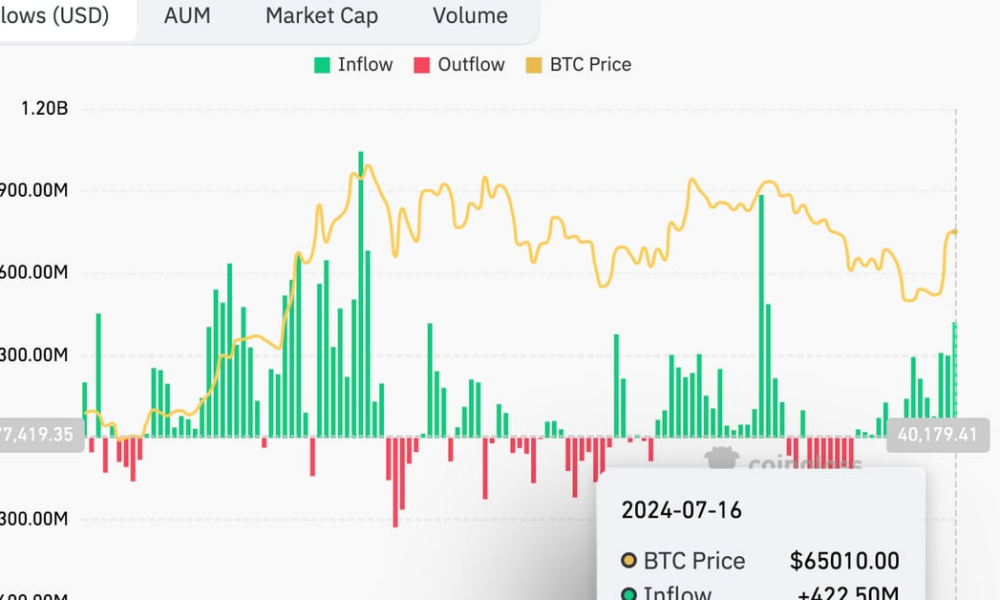

Bitcoin ETF Inflows Hit Six-Week High of $422.5M

U.S.-listed exchange-traded funds that closely track bitcoin (BTC) spot prices are again in demand and how.

On Tuesday, the 11 funds posted cumulative net inflows of $422.5 million, the highest daily tally since June 5, extending a seven-day winning streak, according to data tracked by Farside Investors AND Coin glass.

BlackRock’s IBIT raked in over $260 million on Tuesday, accounting for a huge share of cumulative inflows. FBTC attracted $61.1 million, while others, except GBTC, DEFI, and BTCW, each took in less than $30 million.

These funds have collectively raised more than $1 billion in the last three days alone, underscoring investor confidence in bitcoin’s price outlook.

BTC has risen 23% to $65,800 since hitting a low near $53,500 on July 5, Data from CoinDeskIn addition to ETF inflows, the price recovery could be linked to the exhaustion of selling pressure from the German state of Saxony, dramatic improvement of probability of pro-crypto Republican candidate Donald Trump who won the US presidential election on November 4 and Trump decision to appoint Ohio Republican Senator and BTC holder James David Vance is Vice President.

Vance has been advocating for BTC and digital assets since 2021, and last month began circulating draft cryptocurrency legislation.

“It is notable that Vance advanced cryptocurrency legislation at a time when he knew he was being considered by Trump for vice president. This highlights the new political salience of cryptocurrencies, but also the extent to which digital asset policy has become part of the Republican vision for the U.S. economy,” FRNT Financial said in Tuesday’s newsletter.

“Furthermore, given that Trump can only serve another four years if elected, the vice president’s decision was also seen as a choice about political succession. It is also encouraging for the crypto community that Trump’s presumed political successor is a BTC holder and has prioritized crypto-friendly legislation,” FRNT added.

It is also likely that, with the oversupply from Saxony behind us, the cryptocurrency market will recover the sustained rally in tech stocks on Wall Street. Such is the optimism that Tuesday’s reports of new repayments to creditors by the defunct Mt. Gox exchange failed to keep BTC prices under pressure for long.