Bitcoin

Bitcoin Falls Out of Step With US Stocks, What This Could Mean for Crypto Market

Recent data shows that Bitcoin has completely shut down US Stocks. This is significant considering how the leading cryptocurrency and these stocks have had a positive correlation before, which has undoubtedly positively impacted Bitcoin and the broader cryptocurrency market.

Bitcoin has no correlation with US stocks

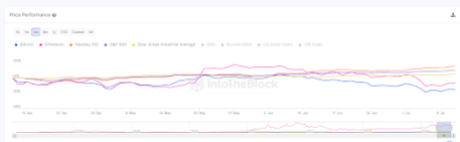

Data in IntoTheBlock market intelligence platform shows that Bitcoin’s correlation with the Nasdaq 100 and S&P 500 has dropped to -0.78 and -0.83, respectively. This means that Bitcoin and these assets have a strong negative correlation, with their prices tending to move in opposite directions.

In fact, this has been the case for quite some time now, as the flagship cryptocurrency has been in a major downtrend for quite some time now. On the other hand, the Nasdaq 100 and S&P 500 have continued to enjoy considerable rallies. Data from IntoTheBlock shows that the Nasdaq 100 and S&P 500 are up over 7% and 4% in the last monthwhile Bitcoin fell more than 15%.

A Bloomberg report also highlighted the “collapse” correlation between Bitcoin and US stocks and attributed this decline to the massive selling pressure that the leading cryptocurrency is facing. Joshua Lim, co-founder of trading firm Arbelos Markets, told Bloomberg that this selling pressure caused by companies like German government “put a cap” on Bitcoin’s appreciation while these US stocks are trading at all-time highs.

Data from IntoTheBlock shows that it is indeed this selling pressure that has caused Bitcoin to outperform these US stocks. At the beginning of June, Bitcoin’s correlation with the Nasdaq 100 and the S&P 500 stood at 0.86 and 0.73, respectively. However, this strong positive correlation began to decline once Bitcoin miners began unloading a significant amount of their holdings. Bitcoinist reported that these miners sold more than 30,000 BTC in June.

Bitcoin also witnessed an increase in selling pressure in late June, thanks to the German governmentwhich began offloading some of the seized bitcoins from the pirated film Movie2k. This selling pressure did not let up as the German government continued its sales spree this month.

Moment of Truth for BTC and the Stock Market

Bitcoin and US stocks will be tested again when the US Consumer Price Index (CPI) inflation data is released on July 11. The long-awaited report is expected to show that inflation in the country is cooling down, further strengthening the case for interest rate cuts. Such a development is undoubtedly bullish for these assets, especially Bitcoin and the broader crypto market.

In the short term, positive inflation data is expected to trigger a recovery in the price of Bitcoin, which is currently trying to recover $60,000 as support. Cryptocurrency analyst Justin Bennett warned that Bitcoin needs to stay above $57,800 or risk falling to as low as $50,000.

Featured image created with Dall.E, chart from Tradingview.com