Bitcoin

Bitcoin Falls to Lowest Level Since February on Fears of Persistent Selloff

(Bloomberg) — Bitcoin fell for a fourth straight trading session, hitting its lowest level since February on concerns about potential selloffs by governments, creditors of a failed exchange and struggling cryptocurrency miners.

Most read on Bloomberg

The original digital asset fell as much as 8% to $53,602 before halving the decline. Most cryptocurrencies fell broadly even as equity markets rallied, highlighting the range of challenges facing the industry.

Bitcoin is now down about 25% from its March record high as buzz around U.S. exchange-traded funds investing directly in the token gives way to fears of higher interest rates for longer and political uncertainty.

Additionally, administrators of bankrupt exchange Mt. Gox are returning an $8 billion stash of Bitcoin to creditors in stages. Uncertainty over how much of it will eventually be sold has weighed on markets. A wallet linked to Mt. Gox moved $2.7 billion worth of the token on Friday, according to Arkham Intelligence.

There are also signs that German authorities are preparing to sell some of the 50,000 Bitcoins they previously seized from online criminals. Bitcoin miners, meanwhile, are under pressure to offload tokens to cope with evaporating profitability.

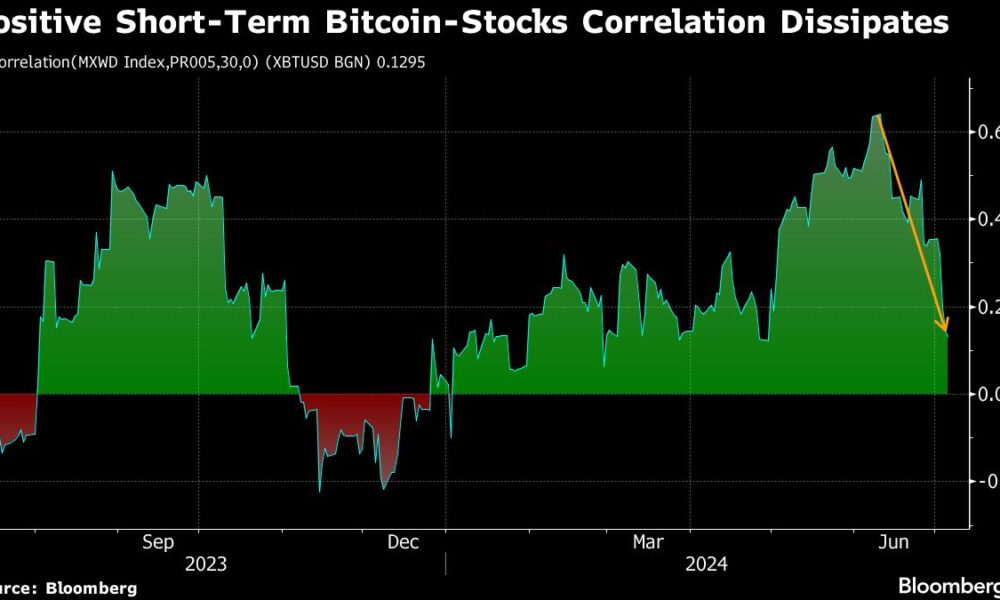

Meanwhile, MSCI Inc.’s global equity gauge is hovering near a record high and a short-term, 30-day correlation between Bitcoin and the index is plummeting. The question is whether the risk aversion in crypto is isolated or portends a circumspect quarter for traditional investments as well after a strong first half for stocks.

“There’s just a general lack of buzz in the crypto markets right now,” said Stefan von Haenisch, head of trading at OSL SG Pte. “Most of the news that’s being spread these days, for example the Mt. Gox selloff, is more bearish in nature.”

Von Haenisch said that the cryptocurrency needs a more dovish note on monetary policy from the Federal Reserve, adding that “a rate cut or two, coupled with an expansion of the Fed’s balance sheet, are two key ingredients that the cryptocurrency is really waiting for.”

Willy Chuang, chief operating officer of cryptocurrency exchange WOO X, said that selling pressure will be mainly concentrated in the short term.

“It is worth noting that despite these concerns, the long-term impact may be less severe as the market gradually absorbs the selling pressure,” Chuang said. “Short-term market fear is to be expected, but in the long term, these negative factors may gradually dissipate.”

The story continues

A report on Friday showed U.S. hiring moderated in June and previous months were revised lower, bolstering prospects that the Federal Reserve will start cutting interest rates in the coming months.

Bitcoin hit an all-time high of $73,798 in March, driven by unexpectedly strong demand for the token’s inaugural U.S. ETFs. Inflows have since slowed, dragging Bitcoin lower and casting a shadow over the rest of the digital asset market.

Approvals for the debut U.S. ETFs for the second-ranked Ether token are pending, but interest in the products could be mixed if the cryptocurrency sell-off continues.

Liquidations

More than $536 million worth of bullish cryptocurrency positions have been liquidated in the past 24 hours, data from Coinglass shows. The liquidations over the past three days are among the largest since April.

“Weak weekend liquidity will exacerbate any moves triggered by liquidations, even small ones,” said Caroline Mauron, co-founder of digital asset derivatives liquidity provider Orbit Markets. Meanwhile, the return of U.S. investors from the July 4 holiday should help bring some stability, she added.

The operators of the energy-hungry computers that underpin the Bitcoin blockchain continue to absorb the financial impact of April’s so-called halving, which restricted the new tokens they receive for their work. One response from these Bitcoin miners is to sell off some of their token inventory.

Miners’ daily revenue has fallen 75% to $26.5 million since the April halving, data from CryptoQuant shows. Transaction fees earned by miners have fallen to 3.7% of total revenue after jumping to a high of 75% earlier that month.

“The $51,000 to $52,000 range is crucial as many Bitcoin miners are reaching their breakeven point for profitable mining,” said Le Shi, head of trading at market making and algorithmic trading firm Auros.

–With the help of Muyao Shen.

Most Read from Bloomberg Businessweek

©2024 Bloomberg LP