Ethereum

Bitcoin Price Drop From $300 Billion Below $60,000 Suddenly Accelerates As Ethereum, XRP, Crypto Prepare for Shock Reversal

Updated 05/01 below. This article was originally published on April 30

Bitcoin and cryptocurrencies, including major coins Ethereum and XRP, jumped ahead of the Federal Reserve’s interest rate decision this week (even though some think the Fed could be blown out of the water).

The price of bitcoin has fallen back to around $60,000 per bitcoin, dragging down the price of Ethereum, XRP and the broader crypto market, wiping out some $500 billion since reaching a recent peak of $2.9 trillion despite Leak Revealing New Bitcoin Exchange Traded Fund (ETF) Earthquake May Be Imminent.

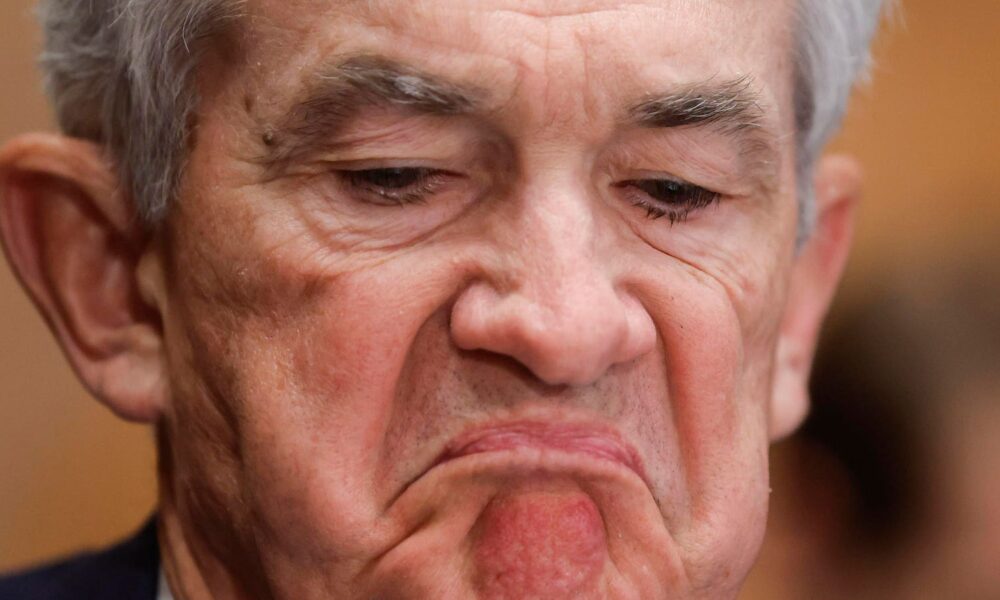

NOW, as an executive from Elon Musk’s X reveals the platform’s ‘end goal’. A “perfect storm of negatives” sent Bitcoin price tumbling ahead of Fed Chairman Jerome Powell’s interest rate decision announcement.

Sign up now for the free CryptoCodex—A five-minute daily newsletter for traders, investors and the crypto-curious that will keep you informed and ahead of the bitcoin and crypto market bull run.

US Federal Reserve Chairman Jerome Powell will reveal the Fed’s latest interest rate decision on… [+] On Monday, this could potentially wreak havoc with the price of Bitcoin, Ethereum, XRP and the broader crypto market.

Getty Images

“The last few weeks have been a perfect storm of negatives for digital assets,” Geoff Kendrick, head of FX and crypto research at Standard Chartered, wrote in an emailed note. “Bitcoin ETF inflows have stalled, and Ethereum ETFs are now unlikely to be approved in May as planned.”

Kendrick highlighted the growing likelihood that the Fed’s interest rate cuts will be “pushed back,” while “risky assets” like Bitcoin, Ethereum and XRP “have been dragged down by the escalation conflict in the Middle East.

Updated 01/05: Bitcoin’s price fall has suddenly accelerated, with $300 billion wiped from the combined Ethereum, XRP and crypto market in less than a week. The price of Ethereum is down 10% since yesterday, as is Bitcoin, while main rival Solana is down 12%. Ripple’s XRP is down 5% while Binance’s BNB is down 9%.

“Bitcoin’s closing price on Tuesday became the lowest since the end of February, confirming the downtrend and falling below the support of March and April and the psychologically important level,” said Alex Kuptsikevich, senior market analyst at FxPro , in comments sent by email.

“Bitcoin ended April down 15.5% at $59,000, following six months of gains out of the last seven (January bitcoin ended virtually unchanged). Technical downside targets appear now be $55,700 per bitcoin, a 61.8% Fibonacci retracement of the rise since October, and the area of $51,000 to $52,000, the consolidation zone of late January However, the FOMC announcements more. late in the day and Friday’s monthly jobs data has enough potential to accelerate or reverse the downtrend.

The Fed’s Federal Open Market Committee (FOMC) is expected to leave rates unchanged in a range of 5.25% to 5.5% on Wednesday, although traders will closely watch Chairman Powell’s press conference at 2 p.m. 30 p.m. ET to watch for signs that the Fed may signal a rate change. its series of interest rate cuts planned this year.

“Even though the Fed is expected to maintain the status quo on interest rates, comments on its current thinking on the path of rates for the rest of the year will likely have a significant impact on markets,” said Russ Mould, investment director at AJ Bell. said in emailed comments.

Sign up now for CryptoCodex—A free daily newsletter for the crypto-curious

The price of bitcoin has fallen back from its recent high of around $73,000 per bitcoin, dragging down… [+] Ethereum, XRP and the broader crypto market.

Forbes Digital Assets

“The worst case scenario for tomorrow would be that the Fed reveals that it is talking about rate hikes again,” wrote Noelle Acheson, market analyst and author of the Crypto Is Macro Now newsletter. “Analysts are talking about it, but such an abrupt change from the Fed’s ‘cuts are imminent’ stance just a few months ago would send the alarming message that things are really bad and could get worse.”

Meanwhile, US Treasury Secretary Janet Yellen, former chair of the Federal Reserve, is also expected to announce the Treasury General Account refinancing decision on Wednesday…something that legendary crypto trader and founder of the Maelstrom investment fund, Arthur Hayes, considers more important than the Fed.

Despite the current “perfect storm,” Kendrick said Standard Chartered still believes bitcoin’s price will hit $150,000 this year, while Ethereum’s price is expected to more than double to $8,000.

“We believe that the bad news is already priced in for Bitcoin and Ethereum, and that the positive structural factors will take over as the negative factors fade,” Kendrick added.