Bitcoin

Bitcoin Price Prediction | Could it reach US$150 thousand?

With Bitcoin rising to $66,700, could a new all-time high be on the horizon, fueled by reduced US inflation and rumors of Fed rate cuts?

Bitcoin (Bitcoin) has recently emerged in price, reaching $66,700 on May 16, with the current price at $65,800 levels.

This increase follows the publication of the US economic data. US inflation eased slightly last month, with the consumer price index (CPI) rising at an annual rate of 3.4% in April, down from 3.5% the previous month.

CPI data suggests a potential downward trend in the cost of living, sparking speculation of a Fed rate cut.

Other central banks, such as the Bank of England (BOE) and the European Central Bank (ECB), are also expected reduce rates in June, indicating greater market liquidity for risky assets, including cryptocurrencies.

BTC, like other risk assets, is influenced by changes in the monetary policies of major central banks. When the cost of borrowing fiat currency is expected to decrease, BTC tends to rise.

Meanwhile, Salim Ramji, a former Blackrock executive, has been named Vanguard’s new CEO. His appointment raised industry speculation about whether Vanguard will launch spot Bitcoin ETFs under his leadership, given his pro-Bitcoin and blockchain technology outlook.

However, Ramji stated which aims to maintain consistency with Vanguard’s investment philosophy and product offerings.

What does all this mean for BTC and its price action in the coming days? Let’s find out.

Public reaction and speculation

In response to the recent rise in Bitcoin’s value, public sentiment has been generally positive.

Andrew Tate, known for his controversial statements, has expressed a strong desire to move away from traditional fiat currencies and fully embrace Bitcoin.

I know I shouldn’t do this in chaotic times, but I’m about to leave the decree completely and invest over 100 million in BTC.

And I’ll even prove that I did it.

I’m done with the banks.

I ended up with their money.

Put an end to fraud.

Then I’m going for a boat ride.

– Andrew Tate (@Cobratate) May 15, 2024

He tweeted about moving over 100 million into BTC, citing a loss of faith in traditional banking systems and seeing Bitcoin as a more secure and reliable store of value.

On the institutional side, there has been growing interest and participation in Bitcoin.

ETF analyst Eric Balchunas, known for his insights on Bloomberg, mentioned the diversity of institutional investors participating in the Bitcoin IBIT spot ETF.

$IBIT finished with 414 reported starters in their first 13F season, which is mind-boggling and record-breaking. Even having 20 starters as a newborn is very rare. Here’s a look at how BTC ETFs compare to other ETFs launched in January (aka the Class of 2024) on this metric. pic.twitter.com/ngicEdbaTq

-Éric Balchunas (@EricBalchunas) May 16, 2024

In its first 13F filing season, IBIT reported 414 holders, a number typically reached years after a product launch.

It’s amazing how many different types of institutions were represented in the first 13Fs. Here it is $IBIT division by type. Only inst type missing is Endowment, I think. Typically you don’t see such a long list of holder types until years after launch and mega liquidity (which IBIT already has) pic.twitter.com/5BY1aSbYAq

-Éric Balchunas (@EricBalchunas) May 15, 2024

To put it simply, a 13F filing is a report that institutional investment managers must file with the Securities and Exchange Commission (SEC). It discloses its holdings in public companies and provides information about its investment strategies.

The fact that IBIT has attracted so many institutional investors since its inception is a strong indicator of the growing institutional interest in Bitcoin.

Meanwhile, Anthony Scaramucci, founder of SkyBridge Capital, notes that skeptics are now embracing Bitcoin long-term after conducting thorough research, suggesting a cycle of increasing acceptance among mainstream investors.

JUST IN:🇺🇸 Anthony Scaramucci, founder of SkyBridge Capital talks about how to do your homework in #Bitcoin and how skeptics are now embracing #BTC for the long term 👀

“Do your homework #Bitcoin, because when you do your homework on bitcoin, you go towards bitcoin. I know VERY FEW… pic.twitter.com/76NJtarFgf

– Simply Bitcoin (@SimplyBitcoinTV) May 16, 2024

Some community members are even predicting that the third and fourth quarters of 2024 will be particularly fruitful for Bitcoin in terms of price gains.

Q3 Q4 2024 is where the gains will be made.#btc

– WIZZ🥷 (beware of scammers) (@CryptoWizardd) May 16, 2024

This optimism is fueled by expectations of continued institutional adoption, regulatory clarity, and increased awareness and acceptance of Bitcoin as a legitimate asset class.

BTC Price Prediction

Bitcoin is once again showing signs of strength, with the recent breach of the $65,000 resistance level suggesting a potential move towards a new all-time high.

TradingShot, a prominent crypto trading expert, has established a ambitious target $150,000 for BTC by August 2024.

TradingShot’s forecast is supported by Bitcoin’s current behavior, as evidenced by its recent 25% correction and subsequent recovery, which TradingShot considers a normal occurrence within bull cycles.

BTC price chart | Source: TradingView

The analyst also noted that Bitcoin closed above the 50-day moving average (MA50) after facing two rejections, signaling promising upward growth.

Meanwhile, renowned analyst Michaël van de Poppe noted that BTC maintained strong support at $60.5K and predicts a period of calm, upward movement for BTC.

Clearly, #Bitcoin kept the low range strongly at US$60.5 thousand.

An upward breakout has occurred, during which a calm, upward period appears inevitable.

This period is where I think #Altcoins will begin to accelerate as confidence returns to the markets. pic.twitter.com/t3qeJ905W3

-Michaël van de Poppe (@CryptoMichNL) May 16, 2024

Van de Poppe suggests that this period of stability could lead to increased confidence in the market, potentially benefiting altcoins as well.

Similarly, another well-known analyst, Titan of Crypto, made a conservative prediction for the top of the BTC price cycle, suggesting it could reach $108,000 based on Fibonacci circles.

#Bitcoin Top of the cycle forecast! ⛰️💥

Assuming that returns tend to decline as the market matures, Fibonacci circles could give us a hint as to what #BTC the top of the price cycle could be:

➡️ $108,000.

It is a conservative price prediction. I think you’ll get over it.

What’s your opinion? pic.twitter.com/TS1KRMsXa3

— Crypto Titan (@Washigorira) May 9, 2024

However, Titan of Crypto believes that BTC price could exceed this prediction, indicating an optimistic outlook for BTC.

Peter Brandt, a respected trader and analyst, also expressed optimism about the future price movement of BTC.

Brandt shared a chart that suggests a positive roadmap for BTC, indicating that his preferred interpretation of the data is in line with a bullish outlook for the cryptocurrency.

However, as with any investment, it is important to carry out your own research and consider your risk tolerance before making any decisions. Always remember that predictions can go wrong, so you should never invest more than you can afford to lose.

Bitcoin

‘This is huge’ — Billionaire Mark Cuban issues ‘incredible’ Bitcoin and crypto prediction amid price slump

Bitcoin has surged again this year under former President Donald Trump Cryptocurrency boosts US presidential election in November with ‘revolutionary’ plan.

The price of bitcoin has surged to more than its all-time high in recent months, surpassing $70,000 per bitcoin and triggering a wave of mega-optimistic predictions about the price of bitcoinalthough it fell again this week to below $65,000 after the Federal Reserve kept interest rates steady.

Now, as Elon Musk suddenly breaks his silence on bitcoin and cryptocurrenciesBillionaire investor Mark Cuban called a California plan to digitize 42 million car titles using blockchain an “incredible step forward” and “huge” for cryptocurrencies.

Sign up for free CryptoCodex now—A daily five-minute newsletter for traders, investors, and crypto curious people that will keep you up to date and ahead of the bitcoin and crypto bull market

Mark Cuban, famous Shark Tank investor and billionaire owner of the NBA team Dallas Mavericks, has… [+] called a cryptocurrency update “amazing” amid bitcoin’s price slump.

Getty Images

The California Department of Motor Vehicles (DMV) has digitized 42 million car titles using blockchain, it was reported by Reuters, through technology company Oxhead Alpha on the Avalanche blockchain and designed to detect fraud and facilitate the securities transfer process.

“This is an incredible development for crypto,” Cuban, best known as an investor on TV’s Shark Tank and owner of the Dallas Mavericks NBA team, posted on X, joking that U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler could sue the state as part of his hostility toward cryptocurrencies and blockchain technology.

“The reason this is huge for crypto is because people who hold the tokens will have an app with an Avalanche wallet,” Cuban said. “Tens of millions of Californians having and using a crypto wallet in the next five years, or however long it takes, normalizes the use of wallets and crypto.”

John Wu, president of Avalanche developer Ava Labs, told Reuters that California’s DMV is “creating a wallet that you can download on your phone.”

Sign up for CryptoCodex now—A free daily newsletter for the crypto-curious

Bitcoin’s price has rallied this year, triggering a wave of bullish bitcoin price predictions from… [+] people like billionaire Mark Cuban.

Forbes Digital Assets

Last month, Cuban predicted that if the US dollar falls as the global reserve currency, bitcoin could become “a global ‘safe haven’” and a “global currency.” potentially sending the price of bitcoin to a much higher level.

According to Cuban, bitcoin could become what its most ardent supporters “envision” — a means “of protecting our economies… This is already happening in countries facing hyperinflation.”

The price of bitcoin has skyrocketed over the past year, largely due to the world’s largest asset manager, BlackRock, leading a bitcoin attack on Wall Street.

Bitcoin

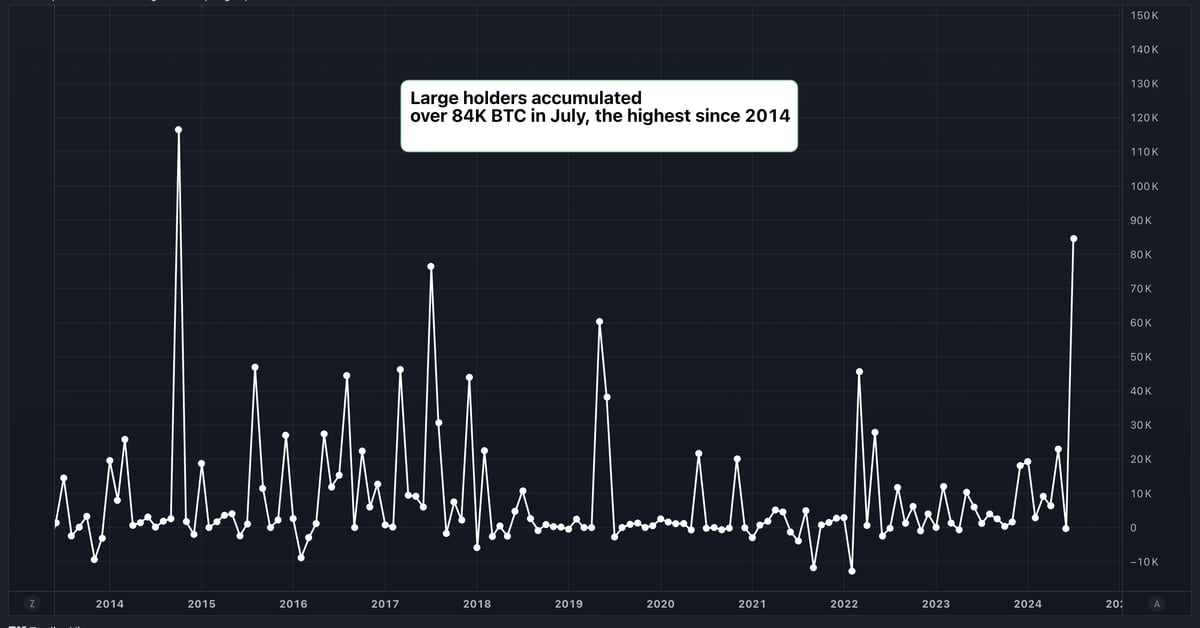

Large Bitcoin (BTC) Holders Added $5.4 Billion Worth of BTC in July, Data Shows

Please note that our Privacy Policy, terms of use, cookiesIt is do not sell my personal information Has been updated.

CoinDesk is a awarded media outlet that covers the cryptocurrency industry. Its journalists follow a strict set of editorial policies. In November 2023, CoinDesk has been acquired by the Bullish group, owner of Optimistica regulated digital asset exchange. The Bullish Group is majority owned by Block.one; both companies have interests CoinDesk has a portfolio of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as an independent subsidiary with an editorial board to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

Bitcoin

Peter Schiff criticizes Michael Saylor’s Bitcoin hype by U.Today

U.Today – Renowned economist and cryptocurrency critic Peter Schiff has criticized Michael Saylor’s recent hype about the growing adoption of cryptocurrencies as a strategic treasury asset by corporations.

Michael Saylor, a well-known Bitcoin advocate and president of MicroStrategy, recently shared his enthusiasm on X about the growing adoption of Bitcoin as a strategic treasury asset.

Citing a comment made by Bitcoin investor Bill Miller in a recent interview with CNBC, Saylor tweeted: “We now have more companies coming forward and saying we will put Bitcoin on our balance sheet as a strategic treasury asset.”

However, not everyone shares Saylor’s enthusiasm. Schiff, a vocal Bitcoin critic and gold bull, was quick to respond with his usual skepticism. In a pointed tweet, Schiff argued: “Bitcoin is neither strategic nor appropriate as a treasury asset. Companies should not risk shareholder funds. They should pay dividends and let shareholders risk their own money.”

Bitcoin enthusiasts are not intimidated

However, Schiff’s criticism shouldn’t deter Bitcoin enthusiasts, who often take Schiff’s words with a pinch of salt. To put things in context, Michael Saylor began buying Bitcoin in 2020 as an inflation hedge and alternative to money. Saylor’s company, MicroStrategy, is among the largest public holders of Bitcoin in the world. As of June 20, it held 226,331 BTC, purchased for around $8.33 billion at an average price of $36,798.

Over the weekend, Schiff was surprised when 87% of the more than 11,000 Bitcoin holders who responded to his X survey said they would not sell any of their Bitcoin even if the price dropped more than 99% to $120. They said not only would they not sell, but that they would continue to buy even when prices dropped.

Schiff unexpectedly revealed that “the main selling point for investors to buy Bitcoin is its excellent past performance record.”

At the time of writing, Bitcoin is trading at $66,067, having reached all-time highs of nearly $74,000 in mid-March.

Bitcoin

Bitcoin Falls as ETF Flows Reverse, Mt. Gox Moves Billions

In a week of drastic fluctuations, the price of Bitcoin (BTC) has retreated from its highs and is currently trading at US$66,250, down 0.9% in European trading.

This volatility comes on the heels of a significant surge above $70,000 earlier in the week, fueled by former President Donald Trump’s ambitious cryptocurrency plans announced in a Bitcoin Conference in Nashville.

Trump’s announcement to fire Securities and Exchange Commission Chairman Gary Gensler and establish a strategic Bitcoin reserve if elected president has temporarily sent the cryptocurrency market into a frenzy.

However, the excitement was short-lived as a series of events unfolded which caused investor sentiment to sour.

A significant sell-off of about 8% was triggered when the US Marshals Service moved $2 billion in Bitcoin for new wallets.

This move has reignited fears of a potential large-scale liquidation, compounded by lingering concerns over a possible Bitcoin liquidation from Mt. Gox. Early this morning, Mt. Gox administrator transferred US$2.2 billion value of your BTC assets in a new wallet.

Meanwhile, the US Bitcoin ETF spot market is showing signs of fluctuation, according to data from SoSo Value. On July 30, Bitcoin spot funds experienced their first net outflow in five days, totaling $18.3 million.

The Grayscale Bitcoin Trust (GBTC) saw outflows of $73.6 million, while the BlackRock iShares Bitcoin Trust (IBIT) attracted $74.9 million in inflows. But outflows from other funds left the category in the red at the end of Tuesday’s trading session. The total net asset value of spot Bitcoin ETFs currently stands at a substantial $58.5 billion.

In other crypto news, Ripple (XRP) is up 8.6% in the past 24 hours, hitting over 64 cents – its highest point since March 25, according to CoinGecko. data.

This rally comes amid a scheduled token unlock and growing optimism around a potential deal in the long-running SEC vs. Ripple lawsuit.

The crypto community is closely watching the SEC’s actions, particularly its intention to amend its complaint against Binance regarding “Third-Party Cryptocurrency Securities,” which some interpret as a positive sign for Ripple.

On a market analysis noteSingapore-based cryptocurrency trading desk QCP Capital wrote that while election headlines continue to dominate, several crucial macroeconomic events loom on the horizon.

“Election headlines will continue to be a key focus, but several key macroeconomic events are also on the horizon. Key events starting with the FOMC meeting on Wednesday, megacap tech earnings (Apple, Amazon, Meta) throughout the week, and unemployment data on Friday,” QCP Capital wrote.

Edited by Stacy Elliott.

-

Regulation7 months ago

Regulation7 months agoRipple CTO and Cardano founder clash over XRP’s regulatory challenges ⋆ ZyCrypto

-

Regulation5 months ago

Regulation5 months agoNancy Pelosi Considers Supporting Republican Crypto Bill FIT21 – London Business News

-

Videos6 months ago

Videos6 months agoCryptocurrency News: Bitcoin, ETH ETF, AI Crypto Rally, AKT, TON & MORE!!

-

Regulation6 months ago

Regulation6 months agoBitcoin’s future is ‘bleak’ and ripe for regulation, says lead developer

-

News6 months ago

News6 months agoThe trader earned $46 million with PEPE after reaching a new ATH

-

Blockchain6 months ago

Blockchain6 months agoSolana ranks the fastest blockchain in the world, surpassing Ethereum, Polygon ⋆ ZyCrypto

-

Blockchain6 months ago

Blockchain6 months agoSolana Surpasses Ethereum and Polygon as the Fastest Blockchain ⋆ ZyCrypto

-

Regulation6 months ago

Regulation6 months ago🔒 Crypto needs regulation to thrive: Tyler Cowen

-

Videos6 months ago

Videos6 months agoWho Really CONTROLS THE MARKETS!! Her plans REVEALED!!

-

Videos7 months ago

Videos7 months agoKucoin safe?? Exchange REVIEW and beginner’s guide!!

-

Blockchain6 months ago

Blockchain6 months ago“Liquid vesting” is an oxymoronic feature of blockchain that allows early investors to sell without waiting

-

Videos6 months ago

Videos6 months agoInstitutions purchasing MEMECOINS?! Everything you need to know!