Bitcoin

Bitcoin Price Tied to Binance Vs Coinbase Battle, Quant Reveals – TradingView News

A quant explained how there appears to be a relationship between Coinbase’s spot volume dominance versus Binance’s and the price of Bitcoin.

Bitcoin has reacted to Binance/Coinbase volume changes

In a CryptoQuant Quicktake post, an analyst discussed the cryptocurrency market dynamics arising from the ongoing battle between Binance and Coinbase for spot volume dominance.

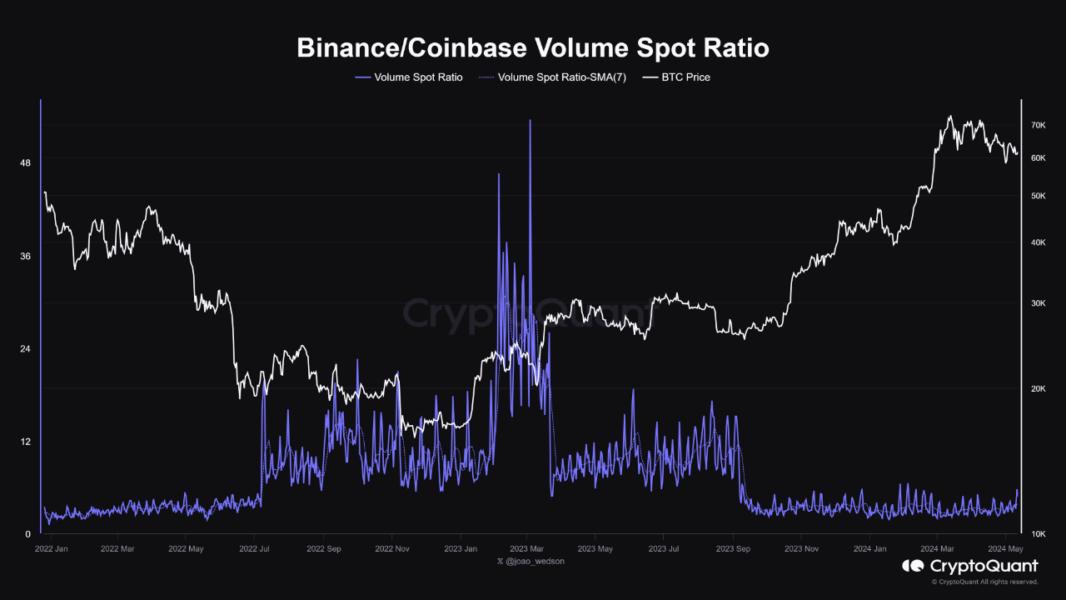

The quant shared a chart below that shows how this war for dominance has played out over the past decade.

NewsBTC

As the chart shows, Binance has been the more dominant of the two platforms when considering spot volume. The exchange hosts five times more volume than Coinbase.

The analyst notes that the difference between the two would be even greater when considering the BTC-FDUSD pair, which is not included in the data in the chart above.

Despite much lower spot volume, Coinbase has not yet become irrelevant in the market. For example, the platform is the custodian of spot Bitcoin exchange-traded funds (ETFs) such as BlackRock’s IBIT and Grayscale’s GBTC.

There also appears to be an interesting pattern between the dominance of the American stock market and the spot price of Bitcoin. The quant highlighted this trend on the chart.

There have been some cases where an increase in Coinbase’s spot trading volume relative to Binance has preceded increases in the cryptocurrency’s value. Likewise, drops in platform dominance have apparently led to drops in Bitcoin’s price.

The analyst also discussed the volume trend of the two exchanges more closely using the spot volume relationship for them, as shown below.

The chart shows that the spot volume relationship between Binance and Coinbase has reached very high levels in 2023, with the former’s volume being 53 times greater than that of the latter. The reason behind this was the zero-fee scheme that Binance introduced for Bitcoin trading pairs.

However, Coinbase volume has increased recently, although the ratio remains notably in Binance’s favor. This shift in the market came as news related to the Bitcoin spot ETF began to intensify.

How much concludes:

The dynamics between these exchanges are complex, but the graphs show that the dominance of each exchange at specific times has a direct impact on the price of Bitcoin. It is a real battle between the biggest players in the market, where competition is constant and the result is reflected in the movements of cryptocurrencies.

BTC Price

At the time of writing, Bitcoin is trading around $61,800, down 3% over the past week.