Bitcoin

Bitcoin Rises Above $60K After US Job Market Report

Bitcoin price consolidated above $60,000 following today’s US labor market report.

The rise of Bitcoin (Bitcoin) happened shortly after the publication of the US employment report, which changed expectations regarding the Federal Reserve’s key rate cut from November to September.

Bitcoin gained more than 4% after the statistics were released and continues to grow, heading towards US$62,000, according to CoinMarketCap data.

Source: CoinMarketCap

CryptoQuant CEO Ki Young Ju said that Bitcoin whales accumulated 47,000 BTC in anticipation of the Fed report.

Macroeconomic data has caused expectations regarding the path of the Fed’s key rate in 2024 to be revised — instead of one, the market is now factoring in two cuts of 0.25% each, with the first expected in September, and not in November, before the release of Statistics.

Bloomberg analysts he said The main report for investors will now be the report on consumer price dynamics on May 15.

“Overall, the job market still remains strong and they will need to see more evidence of a slowdown, or a surprisingly sharp drop in employment, to be concerned about their employment mandate after such a strong series of job gains. . Ultimately, the FOMC will remain on hold until there is clarity on inflation.”

Ali Jaffery, capital markets specialist at CIBC

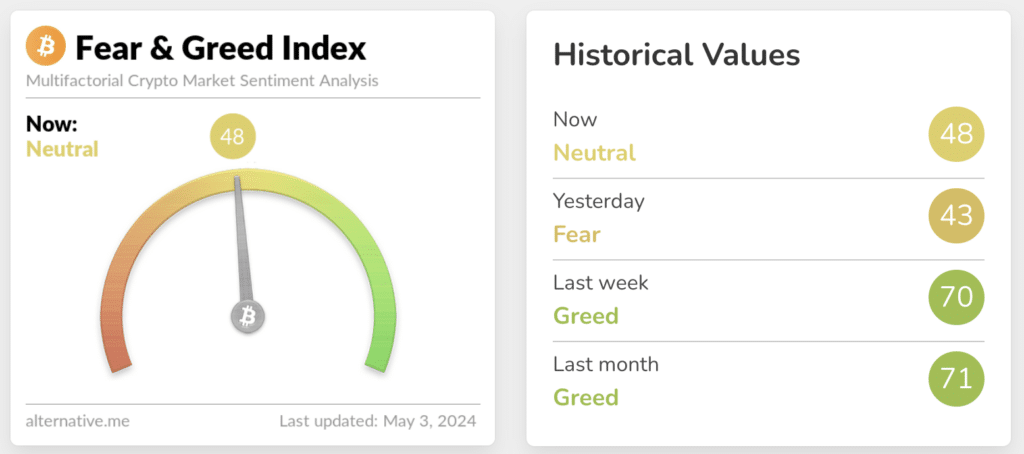

After the release of the US labor market report, risk appetite increased in global markets. The S&P 500 stock index opened up 1.2%, and the cryptocurrency fear and greed index rose five points on the day, moving from the fear zone to the neutral zone.

Source:

Recently, the price of BTC fell below the $60,000 threshold. Against the backdrop of Bitcoin’s fall, analysts at Santiment said the data released in the United States caused an increase in discussions around the hashtag #buythedip and mentions of BTC.

According to analysts, this increase in sentiment indicates a renewed polarization among traders. Some are in favor of a buying opportunity, while others remain cautious.