Bitcoin

Bitcoin’s correlation with tech drops amid ‘glut’ in supply

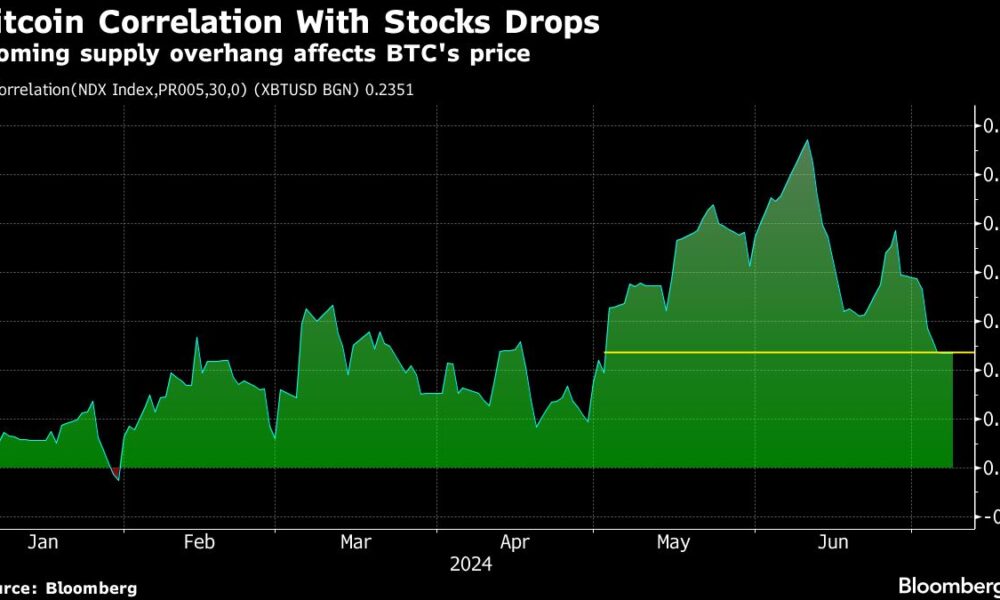

(Bloomberg) — After trading nearly in tandem for the past few months, Bitcoin’s correlation with rising U.S. stocks is collapsing under the weight of too much supply and too little demand for the cryptocurrency.

Most read on Bloomberg

The 90-day correlation coefficient of Bitcoin and the tech-dominant Nasdaq 100 index fell to 0.21 on Tuesday, the lowest level since early May. It has fallen more than 50% in the two months. A coefficient of 1 means the assets are moving in sync, while minus 1 would show they are moving in opposite directions.

“Bitcoin is experiencing an excess of idiosyncratic supply events — including spot sales of seized coins held by the German and U.S. governments and distributions from the Mt. Gox estate,” said Joshua Lim, co-founder of trading firm Arbelos Markets. “This has put a cap on the upside even as other risk assets trade at all-time highs.”

Bitcoin’s decline from its March high accelerated last week after Mt. Gox administrators began the process of returning about $8 billion worth of tokens to creditors. At the same time, German police began selling off some of the 50,000 Bitcoins they had previously seized from a piracy website.

“Token oversupply is expected to hit centralized exchanges in the coming days, likely putting downward pressure on prices,” said Manuel Villegas, Next Generation research analyst at Julius Baer. “The looming oversupply has been the main factor weighing on sentiment.”

Meanwhile, Bitcoin miners are under pressure to dump tokens to cope with falling profitability.

The operators of the energy-hungry computers that underpin the Bitcoin blockchain continue to absorb the financial impact of April’s so-called halving, which restricted the new tokens they receive for their work. One response from these Bitcoin miners is to sell off some of their token inventory.

“Bitcoin miners have a problem when prices fall because their cost base is fiat-based; the average total production cost for Bitcoin miners, according to our estimates, is close to $54,500,” Villegas said. “When prices fall significantly below this threshold, miners may need to liquidate some of their token holdings to cover their fiat-based costs.”

Bitcoin was little changed on Tuesday at around $57,070, down about 22% from its all-time high of $73,798 reached in March.

The story continues

Most Read from Bloomberg Businessweek

©2024 Bloomberg LP