Blockchain

Bitcoin’s Mt. Gox Swings Add to Signs of a Rocky Crypto Bounce

(Bloomberg) — Bitcoin fell again on concerns about possible token sell-offs by creditors of the failed Mt. Gox exchange, fueling doubts about the remaining momentum in the cryptocurrency bull run that began last year.

Bloomberg’s Most Read

The largest digital asset slipped as much as 5.2% on Monday to $54,313, about $19,000 below its all-time high in March. Smaller tokens like Solana and Cardano traded higher.

Tokyo-based Mt. Gox, which went bust a decade ago after being hacked, is returning about $8 billion worth of bitcoin to creditors in phases, highlighting the potential for a wall of supply to enter the market. Some industry participants have argued that cryptocurrency market makers are failing to minimize wide price swings.

“Momentum traders have taken over the market and market makers are not stepping in to balance the flows,” said Jeff Dorman, chief investment officer at Arca. “That’s why we’re seeing violent moves in both directions right now.”

Sentiment has also been hampered by signs the German government is selling off seized Bitcoin, as well as declining inflows into dedicated exchange-traded funds in the U.S. Skepticism is growing over predictions from digital asset faithful that the original cryptocurrency is still on track to hit $100,000.

The charts below analyze the outlook for Bitcoin after the token has dropped more than 20% from its all-time high in the first quarter.

Technical test

Speculators are scouring the charts for patterns that could signal the end of Bitcoin’s slide. Tony Sycamore, a market analyst at IG Australia Pty, pointed to the 200-day moving average. A sustained rise above that level would be an indication that Friday’s intraday low around $53,600 was a “capitulation,” he wrote in the note.

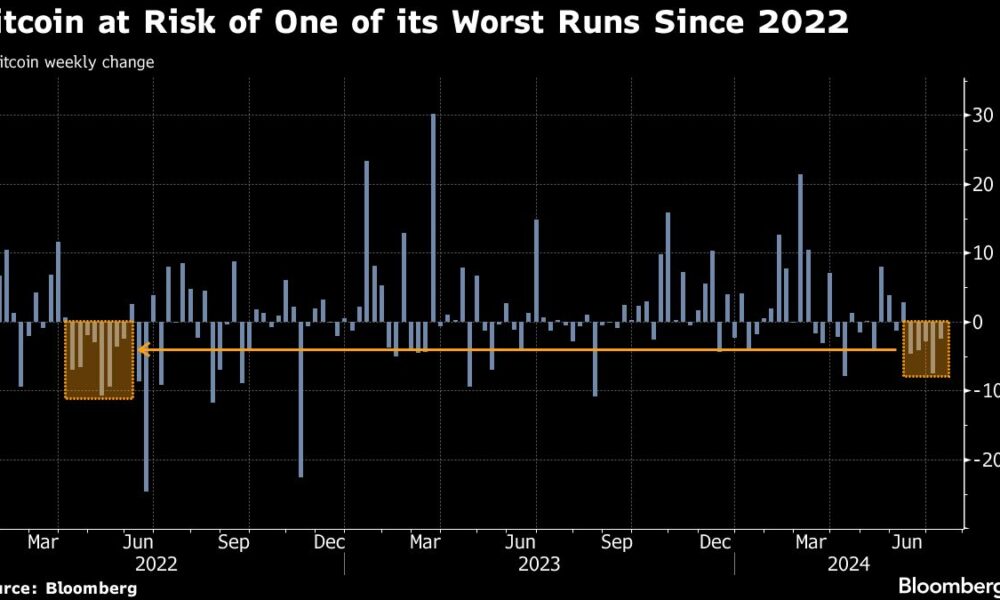

Prolonged losses

Bitcoin stumbled on Monday with an ominous slide. If the pullback lasts through Sunday, the token would have posted five straight weeks of declines, the longest losing streak since the 2022 digital asset bear market. There is a risk of a “downward grind” in prices until the Federal Reserve begins to ease monetary policy, said Stefan von Haenisch, head of trading at OSL SG Pte.

Not so great

As of early 2024, Bitcoin’s annual gains have approached 70%, well ahead of traditional assets like stocks. Now, the tech-heavy Nasdaq 100 index is closer to matching the token. Selloffs typically punctuate Bitcoin bull markets, and the long-term outlook remains positive, said Khushboo Khullar, a venture partner at Lightning Ventures, which invests in Bitcoin-related companies.

The story continues

Spot-ETF flows

Surprisingly strong demand for the first U.S. Bitcoin ETFs fueled the digital asset’s record-breaking rally earlier this year. Inflows have since moderated, and one question is whether the recent weakness will spook ETF investors. But on Friday, at least, they appeared to be buying the dip, posting their strongest net inflows in about a month.

The Mt. Gox sell-off is unlikely to lead to mass selling by creditors, but the longer Bitcoin stays below $60,000, the greater the chances of a further price correction, said Hayden Hughes, head of cryptocurrency investments at Singapore-based family office Evergreen Growth.

Option Betting

The options market suggests that some investors see Bitcoin’s decline as temporary: The highest concentration of bullish bets is around a $100,000 strike price, according to Deribit data. That could reflect expectations of more dovish monetary settings from the Fed in the coming months and the momentum behind Donald Trump, a cryptocurrency advocate, to become U.S. president again.

Caroline Mauron, co-founder of digital asset derivatives liquidity provider Orbit Markets, expects cryptocurrencies to take a cue from global markets ahead of Fed Chair Jerome Powell’s testimony and U.S. inflation data, which are due this week and could impact monetary policy projections.

–With the collaboration of Olga Kharif.

(Updates with commentary in the fourth paragraph.)

Bloomberg Businessweek’s Most Read

©2024 Bloomberg L.P.