News

BlackRock CEO Issues ‘Huge’ Warning After Crypto Flip Fuels Price Boom in Bitcoin, Ethereum, XRP

Update 7/16 below. This post was originally published on July 14

US Treasury Secretary Janet Yellen has warned that countries around the world are moving away from the US dollar—as the spiraling $34 trillion US debt pile fuels fears of collapse—while bitcoin and cryptocurrencies are slowly eroding the dollar’s dominance.

The price of bitcoin has skyrocketed in the last year, rising despite a ‘critical’ warning from the Federal Reserveand helped by the bettors who are increasingly convinced that former US President Donald Trump will retake the White House in November.

Now, as Project 2025’s radical policy plan puts bitcoin on a collision course with goldYellen said she fears that U.S. financial sanctions could reduce the dollar’s role in the world as Russia encourages the use of bitcoin and cryptocurrencies.

Register now for free CryptoCodex—A five-minute daily newsletter for traders, investors and cryptocurrency curious that will keep you updated and abreast of the bull run in the bitcoin and cryptocurrency market

US Treasury Secretary Janet Yellen has warned that the US dollar’s dominance will continue to decline as… [+] Russia Turns Toward Bitcoin and Cryptocurrencies Despite Price Fluctuations

AFP via Getty Images

“We have very powerful sanctions that are available because of the important role of the dollar in international transactions,” Yellen said. said U.S. lawmakers this week at the House Financial Services Committee.

“The more we used sanctions, the more countries looked for ways to conduct financial transactions that did not involve the dollar.”

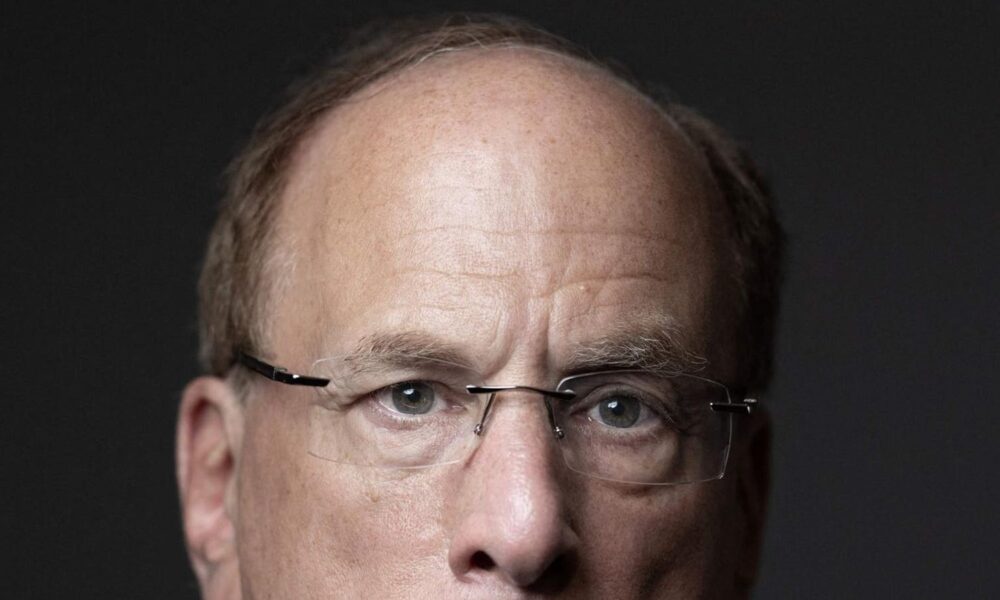

Update 7/16: BlackRock Chief Executive Larry Fink, whose cryptocurrency conversion last year spearheaded a successful campaign to bring spot bitcoin exchange-traded funds (ETFs) to Wall Street, has sounded the alarm about the pace at which U.S. debt is growing.

“We are putting a real burden on our children with this huge expense that we cannot afford,” Fink said. said CNBC, calling on the U.S. and countries around the world to focus on economic growth. “The U.S. deficit is the largest in the world, growing at the fastest rate in the world, and we need to find ways to minimize the deficit’s impact on the economy. Government deficits are growing too fast as a percentage of GDP.”

Earlier this year, Bank of America analysts warned that the U.S. debt load is on track to add $1 trillion every 100 days—fueling a surge in the price of bitcoin.

“The U.S. national debt is increasing by $1 trillion every 100 days,” Michael Hartnett, chief strategist at Bank of America, wrote in a note to clients, adding that “it’s no wonder ‘debt write-downs’ are being traded [are] approaching all-time highs.”

Last month, analysts at BlackRock, the world’s largest asset manager, warned that an “unprecedented” scenario is unfolding that could hit the price of bitcoin and the cryptocurrency market as the Federal Reserve and central banks “are forced to keep interest rates higher than pre-pandemic to counter persistent inflationary pressures.”

Fink also admitted he was wrong about bitcoin and called it a “legitimate” financial instrument, after calling it “an indicator of money laundering” in 2017.

“It’s a legitimate financial instrument that allows you to have maybe some kind of uncorrelated return,” Fink told CNBC. “I think it’s a tool you invest in when you’re most scared, though. It’s a tool when you think countries are devaluing their currency with excessive deficits, and some countries are.”

BlackRock’s adoption of Bitcoin is widely credited with driving the recovery in the price of Bitcoin and the cryptocurrency market over the past year, with a series of spot Bitcoin ETFs exploding on Wall Street in January, led by BlackRock’s Bitcoin IBIT fund.

In recent years, the United States has targeted Russia and Iran with severe financial sanctions, with it being accused of using the dollar as a weapon and alienating the so-called BRICS group of emerging countries from the Western financial system.

The BRICS, initially composed of Brazil, Russia, India and China, were later joined by South Africa and then Egypt, Ethiopia, Iran, Saudi Arabia and the United Arab Emirates (UAE)

iShares MSCI UAE Capped ETF

), are important developing countries that have formed an alliance to increase their power and influence on the world stage.

Western financial sanctions led by the United States “will have a certain impact on the international status of the U.S. dollar,” said Zhao Qingming, a Beijing-based financial expert. said China’s Global Times newspaper. “In the short term, the US dollar’s position is expected to remain stable, but over time, its position may weaken.”

Earlier this month, Russia’s central bank encouraged the use of bitcoin and cryptocurrencies to counter Western sanctions imposed over the conflict in Ukraine.

Sign up to CryptoCodex now—A free daily newsletter for cryptocurrency lovers

ForbesProject 2025 Has Set Up Bitcoin for a $16 Trillion Showdown with Gold

The price of bitcoin has fluctuated wildly in recent years, recovering as fears grew over the future of the… [+] US Dollar.

Forbes Digital Assets

“New financial technology creates opportunities for schemes that did not exist before. That is why we have softened our position on the use of cryptocurrencies in international payments, allowing the use of digital assets in such payments,” said Elvira Nabiullina, Governor of the Central Bank of Russia, as they say he said at a financial conference in St. Petersburg.

Fresh fears of a U.S. dollar crash come as some bitcoin and cryptocurrency traders are betting that the price of bitcoin will skyrocket to an all-time high ahead of the U.S. election in November.

In a note dated July 2 view According to The Block, Geoffrey Kendrick, head of forex and cryptocurrency research at Standard Chartered, “bitcoin is likely to hit a new all-time high in August, followed by $100,000 by US Election Day,” adding: “The logic here is that both regulation and mining would be viewed more favorably under Trump.”

Kendrick said he expects the price of bitcoin to reach $150,000 by the end of 2024 and $200,000 before the end of 2025, which would give bitcoin a market cap of about $4 trillion.

Trump has emerged as the bitcoin and cryptocurrency community’s favorite candidate, promising to protect people’s right to own bitcoin and being announced as the keynote speaker at the Bitcoin 2024 conference later this month, putting him in stark contrast to the Biden administration’s anti-cryptocurrency stance.