News

BlackRock’s $20 billion ETF is now the largest Bitcoin fund in the world

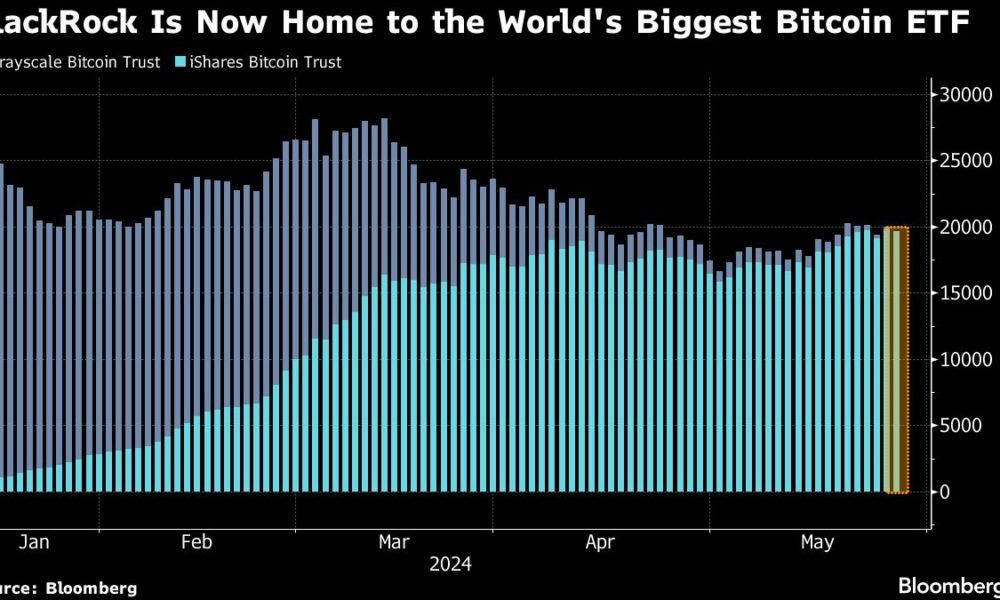

(Bloomberg) — BlackRock Inc.’s iShares Bitcoin Trust has become the world’s largest fund for the original cryptocurrency, amassing nearly $20 billion in total assets since it listed in the U.S. earlier this year.

Most read by Bloomberg

The exchange traded fund held $19.68 billion of the token on Tuesday, dethroning the $19.65 billion Grayscale Bitcoin Trust, data compiled by Bloomberg showed. The third largest is Fidelity Investments’ $11.1 billion offering.

The BlackRock and Fidelity Bitcoin ETFs were among nine that debuted on Jan. 11, the same day the more than decade-old Grayscale vehicle converted to an ETF. The launches were a watershed moment for cryptocurrencies, making Bitcoin more accessible to investors and spurring a rally in the token to a record $73,798 by March.

The iShares Bitcoin Trust has attracted the largest inflow since it launched, $16.5 billion, while investors have withdrawn $17.7 billion from the Grayscale fund in the same period. The latter’s higher commissions and referees’ exits were cited as possible outflow factors.

Neither BlackRock nor Grayscale Investments LLC immediately responded to requests for comment outside normal U.S. business hours. Grayscale plans to launch a clone of its main fund, according to a March regulatory filing, and fees are expected to be lower, a person familiar with the matter said at the time.

The Securities and Exchange Commission reluctantly gave the green light to the first spot Bitcoin ETFs in the United States in January, following a 2023 court dismissal in a lawsuit brought by Grayscale.

The company created the Grayscale Bitcoin Trust in 2013 and it has become known as the largest vehicle of its kind. But shares of the closed-end product sometimes traded at substantial premiums or discounts to net asset value, prompting Grayscale to push for a conversion to an ETF to ensure trading at par.

SEC pivot

Last week, the SEC surprisingly moved toward allowing ETFs for Ether, a token that is second only to Bitcoin in terms of market value. The agency chaired by Gary Gensler is skeptical of the cryptocurrency industry in general following a series of scandals.

The Bitcoin fund group, with $58.5 billion in assets to date, has been hailed as one of the most successful new ETF categories. But critics argue that volatile digital assets are not suited to widespread adoption, even within ETFs.

The story continues

Some nations, such as Singapore and China, curb or ban investor access. In the United States, a spokesperson for Vanguard Group said in January that the company has no plans to offer cryptocurrency-related products. BlackRock and Vanguard are the two largest asset managers in the world.

Bitcoin has quadrupled since the start of last year, helped by ETFs, in a powerful recovery from a bear market in 2022. The token was up about 1% at $68,797 as of 12.48pm on Wednesday in Singapore.

Most read by Bloomberg Businessweek

©2024 Bloomberg LP