Ethereum

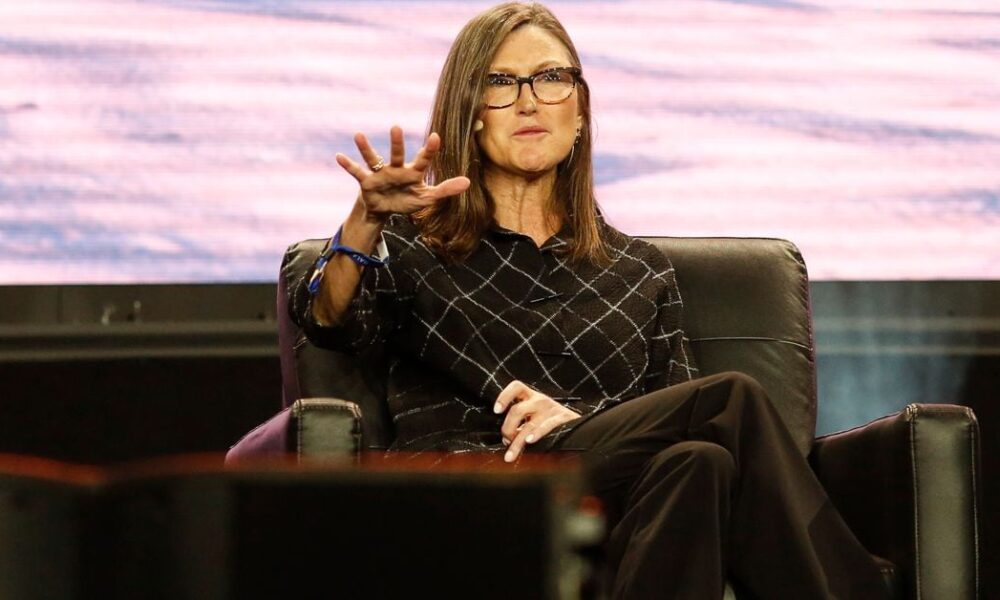

Cathie Wood’s Ark Pulls Out of Ethereum ETF (ETH), Likely Due to Fee War

Cathie Wood’s Ark has been a staunch advocate of cryptocurrencies for years and is one of the companies that already offers a spot Bitcoin ETF.

It joined other companies applying to offer ether ETFs in the United States. But last week she withdrew without explaining why.

According to experts, it is an intense battle to attract customers with low fees for crypto ETFs.

During a fireside chat at CoinDesk’s Consensus conference in Austin, Texas, last week, Wood said ARK’s bitcoin spot ETF, launched earlier this year, did not bring money to the company because it charges investors very low fees: 0.21%. While this is comparable to what other Bitcoin ETF issuers charge, it is significantly lower than what non-crypto ETFs typically charge.

“This may just be a business decision,” said Nate Geraci, president of ETF Store. “If the Ark 21Shares Bitcoin ETF (ARKB) can eclipse $3.5 billion in less than five months and Ark can’t make money, that’s obviously a problem.”

ETF issuers charge investors a fee to compensate for managing the fund. Many investors seek to minimize these fees because they reduce returns.

In the race to launch a spot Bitcoin ETF, Grayscale has set its fees significantly higher than its competitors, at 1.5%, which appears to be one of the main reasons why investors have withdrawn billions dollars of the fund and the fund. lost its early lead, in terms of assets, over BlackRock.

“I don’t think anyone really expected the fee war to become this aggressive before we even saw launches,” said James Seyffart, ETF analyst at Bloomberg Intelligence.

Seyffart also believes Ark made the decision based on low fees. “It’s possible that the partnership makes a lot of sense, especially given the demand for Bitcoin ETFs,” he said. “But after fees got so low from the start, there simply may not be enough money from fees for both companies, especially on an Ethereum ETF if they expect to less demand compared to Bitcoin ETFs.”

Only one budding issuer, Franklin Templeton, has revealed its fund’s fees so far, which it has set at 0.19%. according to a filethe same amount it charges for the Franklin Bitcoin ETF.

Despite the ETFs’ low fee structure, Ark’s departure from the race came as a shock, given the asset manager’s strong footing in the industry and its offering of several other ether-linked funds.

“It’s a surprising decision from my point of view,” Geraci said. “From a longer-term brand perspective, I’m surprised Ark doesn’t see value in getting involved in the spot ether ETF category. Ark has been much more forward-thinking when it comes to crypto than many of its competitors, so it’s strange to see them staying away.

No Ark Invest representative could be reached for comment.

CORRECTION (June 6, 2024, 3:48 p.m. UTC): Fixes to remove reference to Ark being the first to request an ether ETF.