Regulation

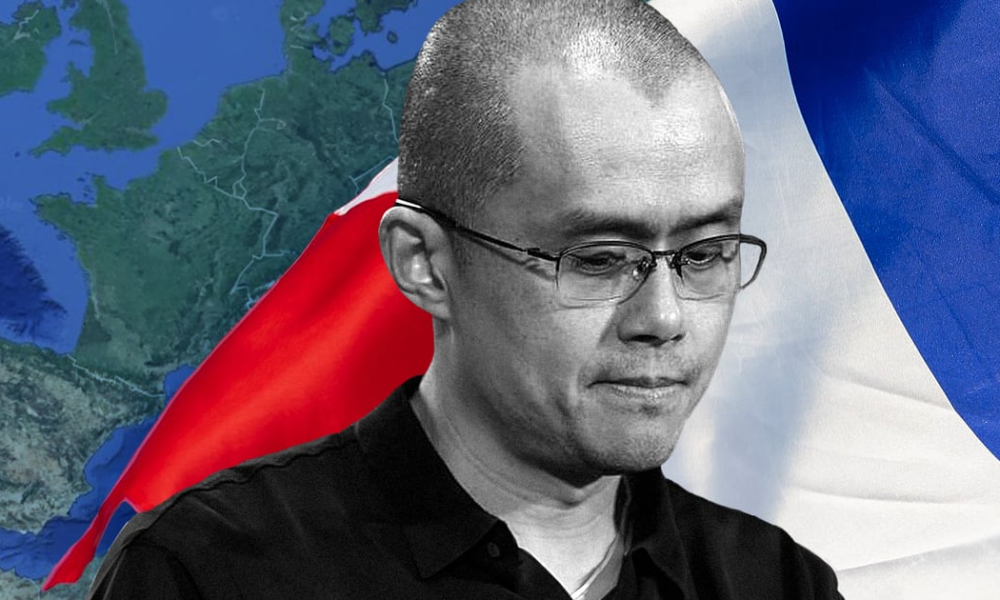

Convicted CZ owns 100% of Binance France. Now all access to the EU is under threat – DL News

- Legal issues facing Binance in France could block its access to the EU as new crypto laws come into force.

- If French regulators reject Binance, other EU states could follow suit.

- Regulators may deregister Binance because convicted former CEO Changpeng Zhao is the French unit’s sole shareholder.

Binance faces legal hurdles in Europe that threaten the exchange giant’s access to the EU market.

Europe’s crypto regulation, known as Markets in Crypto-Asset Regulation, or MiCA, will force regulators to consider whether legally entangled Binance has a place on the block.

Binance has achieved market dominance in the crypto industry, aided by its major hub in France. Its subsidiary, Binance France, is registered with the Autorité des Marchés Financiers, or AMF.

But a convicted criminal as a sole shareholder will make French regulators think twice about the MiCA license Binance needs to operate in Europe.

“It’s a matter of life and death for Binance,” William O’Rorke, an attorney and partner at crypto law firm ORWL, told DL News. “MiCA should apply equally everywhere. If a company is refused in France, it must not be authorized elsewhere in Europe.

If French regulators do not consider Binance suitable for MiCA, the rest of European countries would also be ready to refuse it.

Changpeng Zhao – Binance founder, former CEO and convicted felon in the United States – will face his verdict Tuesday in a Seattle court. Zhao pleaded guilty to money laundering charges in November.

New CEO Richard Teng is tasked with cleaning house – and has attempted to polish his tarnished reputation as a fraudster during his seven years in business.

Join the community to receive our latest stories and updates

Sole shareholder

Zhao remains a 100% shareholder of Binance France.

“If you have a criminal conviction, there is a high risk of having your approval withdrawn,” O’Rorke said. “This is the basic French regulation.”

The AMF did not immediately respond to a request for comment.

Zhao may not be able to remain a significant shareholder if Binance is to survive in France as a regulated body.

“Sooner or later the AMF will have to come up with a solution, perhaps change the percentage held by Zhao,” he said. “As a regulatory lawyer, I wonder how they’re going to handle this.”

Binance has been registered with the AMF as a digital asset service provider since 2022.

This registration, based on compliance with anti-money laundering rules, will allow Binance to serve users in France until the end of the transitional period that French regulators have extended until December 2025.

After that, Binance will need to obtain a MiCA license in an EU member state, which it can then use to access all 27 countries.

MiCA establishes additional rules for crypto exchanges to prevent market abuse, strengthen security policy, marketing rules and publication of information on listed assets.

Binance in France

France is an “important jurisdiction” for Binance in Europe, O’Rorke said.

Zhao maintained close relationships with officials and rented French President Emmanuel Macron for his innovation-focused policy.

Binace too spent 100 million euros for blockchain research and development in France in 2021.

But in June, following allegations from American authorities, the Paris prosecutor open an investigation into Binance for suspicion of money laundering.

In December 2022, a group of investors for follow-up Binance for 2.4 million euros of illegal marketing to French consumers.

These two investigations constitute another potential blockage between Binance and its MiCA license.

If any of them succeed, it will threaten Binance’s ability to operate in Europe, O’Rorke said.

Raising standards

The Justice Department’s accusations against Binance, combined with Teng’s commitment to structural changes, “can also be seen as good news,” O’Rorke said.

That means U.S. regulators, the most powerful and well-resourced, are doing the heavy lifting to force the company to change.

“US regulators can now ensure that Binance complies with high global anti-money laundering oversight standards, in a way that French regulators could not have done.”

For example, part of the Binance agreement with the DOJ consists of a monitoring with an independent auditing firm that will oversee the operations and records of the exchange for five years.

Binance’s severe cleanup in the United States could spill over to its subsidiaries in Europe.

Registrations

Binance in Europe has been going through a tough time.

It withdrew its license application in Germany and deregistered itself from Cyprus and the Netherlands. Belgian authorities ordered its operations to cease, but later offered services through its Polish entity.

But Binance has registered subsidiaries in Italy, Sweden, Lithuania, Spain and Poland.

“They have a lot of internal work to do,” O’Rorke said.

“The DOJ’s prosecution could either be the beginning of the end for Binance or, conversely, the beginning of a new regulated Binance.”

Inbar Preiss is a regulation correspondent based in Brussels. Contact her at inbar@dlnews.com.