Regulation

Crypto “an outsized element of scams and problems” in the markets: Gary Gensler – Coinbase Glb (NASDAQ: COIN)

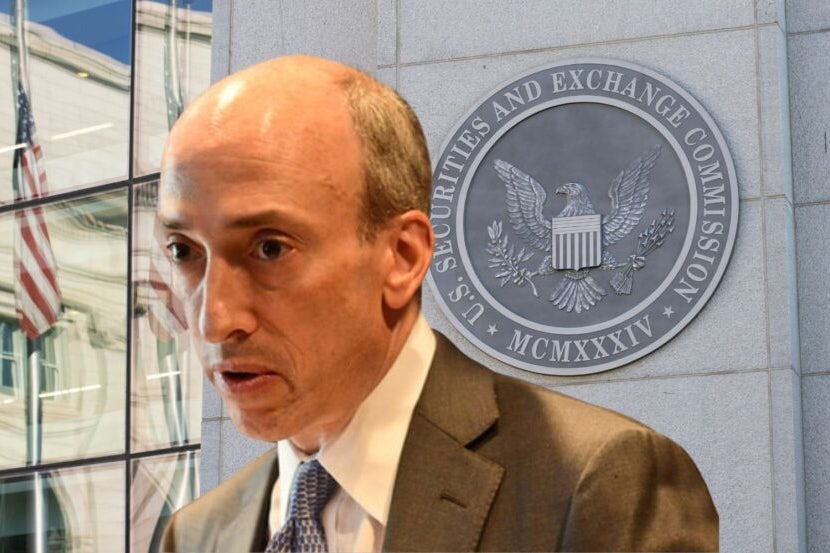

Highlighting the disproportionate number of frauds and scams within the relatively small crypto sector compared to its size in the broader market, SEC Chairman Gary Gensler highlighted the agency’s attention on Tuesday amid the rapid market expansion.

What happened: “We are seeing a $10 trillion capital market,” Gensler noted, clarifying that “crypto is a small part of our markets, but it is an outsized part of the scams, frauds and problems of our markets.

In an interview with CNBC, he stressed that without adequate regulatory frameworks, these problems are likely to persist, emphasizing the need for robust oversight.

Gensler’s remarks reflect ongoing concerns about the compliance of various crypto tokens with existing securities laws. He noted, “Much of this area does not comply with the protections of our securities laws,” which contributes to a higher ratio of emissions relative to market size.

During the interview, Gensler discussed recent actions taken by the SEC, including live litigation against Coinbase COIN, which he referred to to illustrate the SEC’s role as “cop on the ground.”

He said: “We have a very important responsibility… to ensure that people who ask you to invest your money in buying or selling securities follow the law. »

The discussion also touched on the broader implications of these regulatory measures for ordinary investors, particularly those using platforms like Robin Hood HOOD.

Read also: $130 billion asset manager Hightower makes a splash with one-time $68 million Bitcoin ETF purchase

Gensler advised caution, reminding viewers that many crypto tokens could be considered securities under laws as interpreted by the United States Supreme Court, thus requiring proper disclosures that are currently lacking.

One of the central points of the crypto discussion was whether Ethereum could be classified as a commodity or security, which would significantly impact the potential of a Ethereum ETF based on ETH/USD.

Gensler did not provide a definitive answer but reiterated his commitment to investor protection: “The fundamental question is how do we ensure that the American investor is protected?

And after: This continued regulatory attention is timely as the financial community eagerly awaits Benzinga’s decision. The future of digital assets event on November 19.

The event is expected to delve into these same questions, exploring the impact of regulatory decisions on the future digital asset landscape.

Insights from leaders like Gensler will be crucial for participants seeking to understand the complexities of investing in cryptocurrencies amid evolving regulatory frameworks.

Read next: Bitcoin Spot ETFs See Net Inflows of $217 Million on Monday

Image: Shutterstock