News

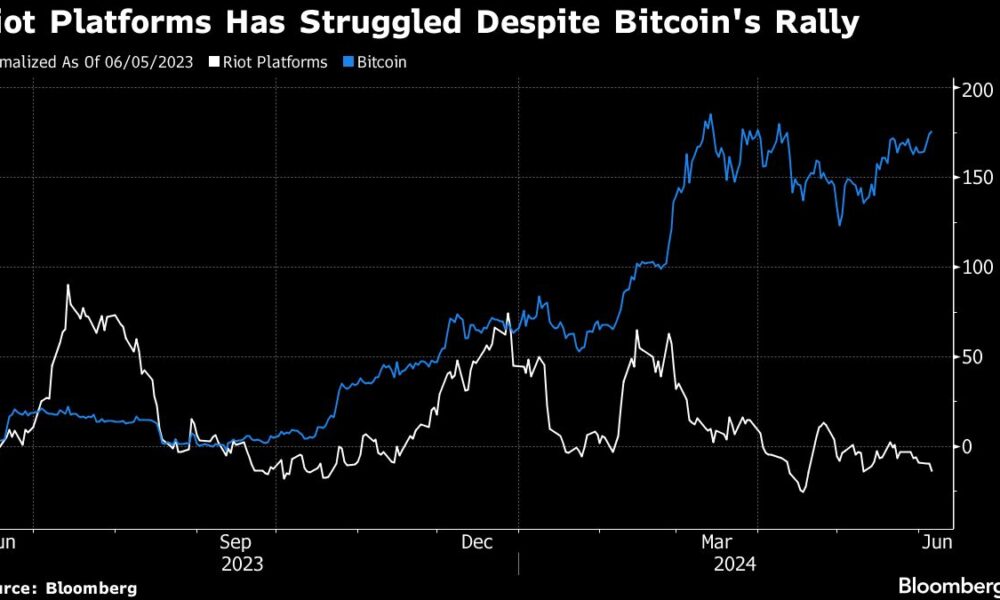

Crypto Miners’ Revolt Targeted by Short Seller Kerrisdale for ‘Flawed’ Business Model.

(Bloomberg) — Mining Bitcoin is a difficult business. This means cryptocurrency enthusiasts should buy tokens instead of mining stocks, according to Kerrisdale Capital Management LLC.

Most read by Bloomberg

The strategy is part of bets the short seller has made across the sector with his latest short position targeting Riot Platforms Inc. The thesis is that investing in a business built to reap unpredictable revenue in a fiercely competitive environment is flawed when Cryptocurrency believers can purchase Bitcoin outright instead.

Shares of the Castle Rock, Colorado-based company fell as much as 8.9% on Wednesday after Kerrisdale founder Sahm Adrangi’s report highlighted Riot’s shareholder dilution through stock sales while Adrangi he wrote letters to Texas government officials. The focus of those missives was on Texas energy laws that he said pay Riot to reduce energy use when prices rise.

A representative for Riot did not immediately respond to an email from Bloomberg News and did not call seeking comment.

“All Bitcoin miners are short, the whole business model, especially at current valuations, makes no sense,” Adrangi said by phone. Cryptocurrency mining is a commodity business and “the barriers to entry are almost zero if you have access to a computer and electricity.”

U.S. miners are exposed to global competition as new mining projects pop up around the world and “will only continue to intensify,” the report says. The ability for investors to purchase exchange-traded funds and exchange-traded products at low cost has also made the need to look for a Bitcoin proxy irrelevant, the report claims.

This isn’t the first time a cryptocurrency-exposed company has come under Kerrisdale’s radar. In March, the firm took a short trade on Michael Saylor’s MicroStrategy Inc. while taking a long position on Bitcoin.

“None of the reasons commonly given for MicroStrategy’s relative attractiveness justify paying well more than double for the same money,” Adrangi wrote at the time.

This was a winning bet for the company, before factoring in any costs of taking on the position. MicroStrategy shares have fallen about 13% since the report was released, while Bitcoin has risen more than 2%.

There are, however, risks that Bitcoin miners may change their business models and attract strategic investors and buyers.

The story continues

Core Scientific Inc., which emerged from bankruptcy earlier this year, rose 40% on Tuesday after announcing it had signed a series of 12-year contracts with CoreWeave Inc. Cloud computing provider CoreWeave, closely held, offered to buy Core Scientific for about $1 billion, Bloomberg News reported, citing a person familiar with the matter.

–With assistance from Carmen Reinicke.

Most read by Bloomberg Businessweek

©2024 Bloomberg LP