Regulation

Cryptocurrency Industry Wants Trump to Win and Overturn the SEC – BNN Bloomberg

(Bloomberg) — The cryptocurrency industry is hoping the upcoming U.S. presidential election will put someone in the White House who takes a softer approach to law enforcement, ending protracted battles with Wall Street’s top cop.

Former President Donald Trump recently cozyed up to the $2.5 trillion cryptocurrency industry, even inviting his supporters to a Bitcoin-focused fundraiser on July 27. While the Republican candidate was critical of cryptocurrencies during his time in office, his recent comments have been more favorable — and advocates expect that if he wins, the U.S. Securities and Exchange Commission will stop pursuing the digital asset space so aggressively.

“A Trump administration would likely seek to reset and rethink the SEC’s regulatory policy on cryptocurrencies,” said Michael Selig, a partner at Willkie Farr & Gallagher LLP. “Such a reset would naturally involve resolving ongoing enforcement actions and investigations from the previous administration.”

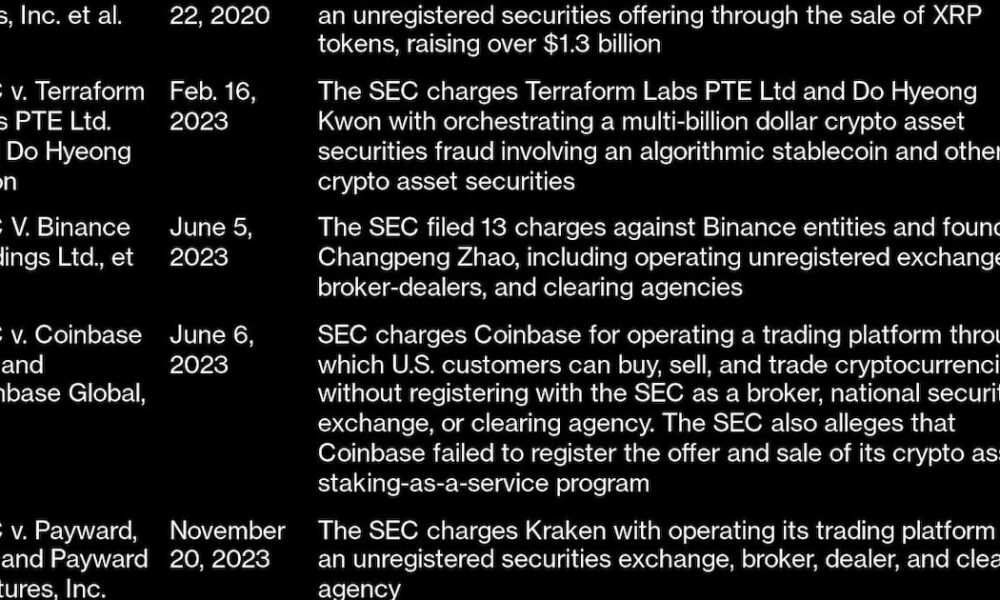

Under President Joe Biden, the SEC has stepped up its efforts to police the industry, particularly after the collapse of cryptocurrency exchange FTX in 2022. The regulator has filed dozens of lawsuits, often accusing exchanges and brokers of failing to properly register under securities laws.

SEC Chairman Gary Gensler maintains that most cryptocurrencies are securities and should therefore register with the agency. Many cryptocurrency companies argue that their tokens are not securities or that the registration requirements are unclear.

The SEC has settled some issues, but litigation involving companies like Kraken, Coinbase, and Binance remains pending in court. The SEC has also closed some of its investigations, including one into Ethereum and another into BUSD, a Binance-branded cryptocurrency issued by New York-based Paxos.

The mixed results have left open the question of whether tokens are securities. The SEC’s lawsuit against Ripple Labs Inc. and its executives could help put that matter to rest.

The SEC alleged that Ripple conducted an unregistered securities offering through the sale of XRP tokens, raising more than $1.3 billion. In what many saw as a setback for the SEC, a federal judge ruled last July that sales of XRP to retail investors on exchanges did not constitute investment contracts.

Ripple CEO Brad Garlinghouse predicted a resolution “very soon” in an interview with Bloomberg Television on Wednesday.

The SEC filed the complaint in 2020 while Trump was still in office, and he hasn’t provided specific details about his views on cryptocurrency regulation. But several lawyers and industry executives have said they expect less enforcement activity if he’s reelected.

“Remember, if Trump is elected, Republicans can immediately change the president,” said Austin Campbell, a blockchain consultant and adjunct professor at Columbia Business School. “What that means is that many of these cases — which have been settled to very varying degrees of quality and have resulted in very varying decisions that add to the confusion — could all be settled instead of having to go to trial.”

Of course, there is no guarantee that Trump will win the election, or what his actual political standing will be. He is leading in recent polls, while there is speculation that Biden might step aside and let another Democrat replace him on the ballot. It is unclear whether this will happen, who that candidate will be, or how another candidate would fare against Trump.

And some experts don’t predict that the SEC will drop or settle the pending litigation, even if Trump were to win.

Securities enforcement cases are typically “apolitical” and there is little turnover in staff resulting from political changes, said Emily Meyers, general counsel at venture capital firm Electric Capital.

“It’s unlikely that any pending cases will be dropped, especially those that are already being litigated in federal court,” Meyers said. “It’s more likely that a new administration, or even a second Biden administration, will bring fewer or different types of new cryptocurrency cases.”

Ji Kim, legal and policy director at the advocacy group Crypto Council for Innovation, took a similar view.

“If President Trump were re-elected and Chairman Gensler were to resign, we could see the current standard of regulation by enforcement change,” he said. “However, that would depend on the leadership and composition of the commissioners – nothing is guaranteed.”

©2024 Bloomberg LP