Ethereum

ETH Bulls Aim for $5,000 Rally in June

Ethereum price saw a meteoric rise of 4% over the weekend, hitting a daily high of $3,839 on June 3, as bears face increased liquidation risk amid a dwindling price. ETH supply.

Ethereum kicks off June 2024 with a 4% rise

Following the 30% price rally that greeted the approval of Ethereum ETFs, many ETH holders went into a profit-taking frenzy during the last week of May, reducing monthly gains to 24%. .

However, as the wave of news selling subsided, ETH markets began to see buying momentum in June.

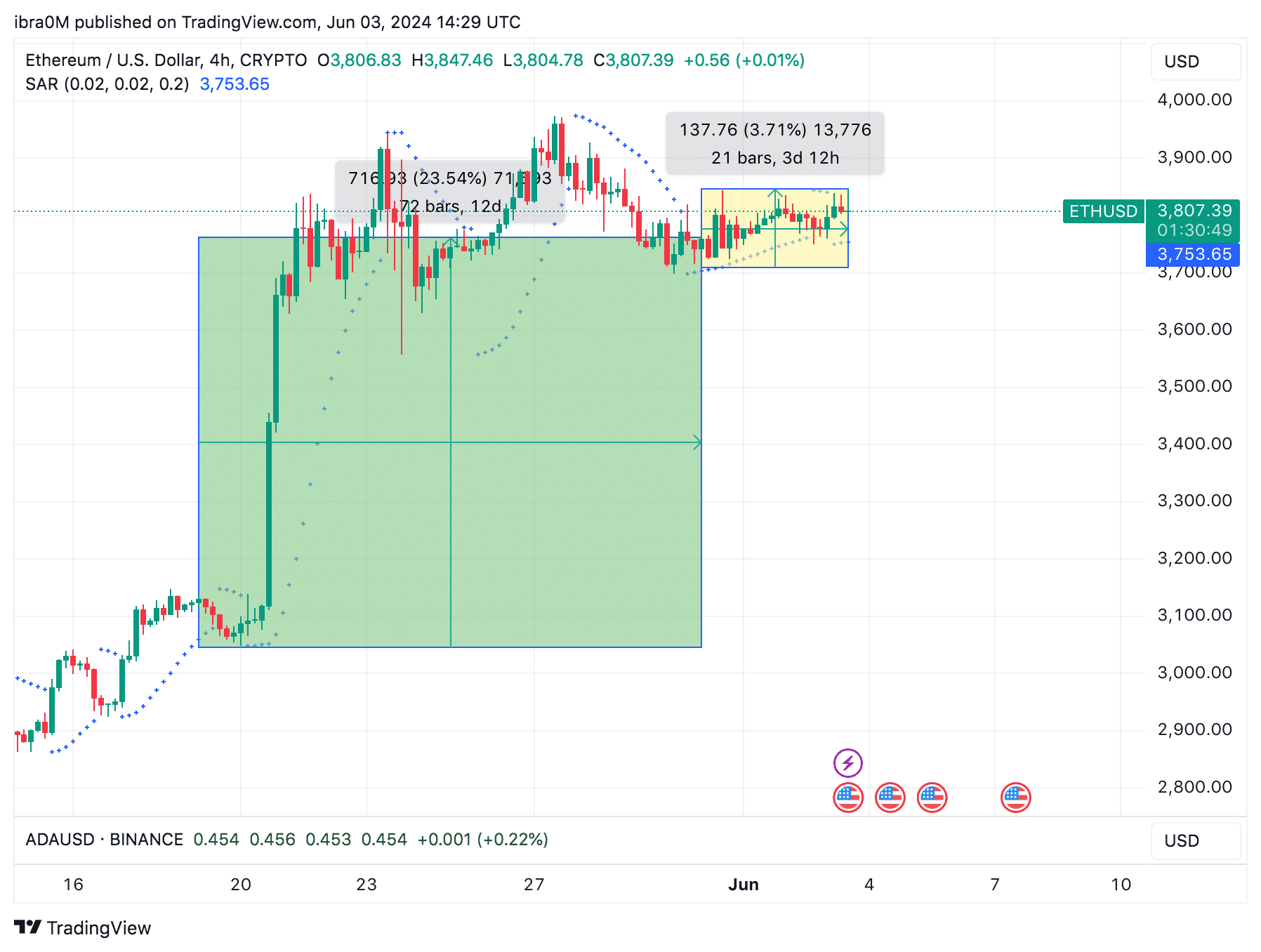

As shown in the yellow shaded area in the chart above, the price of ETH increased by 3.7% in the first three days of June. A decision that could set the tone for the rest of the month.

While the official launch of Ethereum ETFs is still in play, Ethereum continues to struggle to find the next surge in demand. However, on-chain data shows that the decreasing supply of ETH coins on exchanges has put the bulls back in charge.

Ethereum exchange supply in rapid decline

Crypto investors await the official launch of the recently approved Ethereum ETFs. Institutional investors across the United States, including pension funds, investment companies, hedge funds, and more, are expected to add billions of ETH to their portfolios in the coming weeks.

Recent on-chain movements of ETH coins on exchanges suggest that existing ETH holders have started taking bullish actions to anticipate the positive impact of ETF inflows.

– Advertisement –

A vital indication of this exchange reserves chart from Cryptoquant, which shows real-time changes in ETH balances held on exchange-hosted wallets and trading platforms.

There has been a considerable drop in the supply of ETH deposits on exchanges since May 21. The chart above shows that investors held 13.9 million ETH on exchanges as of May 21. But as of this writing on June 3, Ethereum’s exchange supply has now fallen to 13.1 million ETH.

This implies that Ethereum holders transferred over 800,000 ETH from the exchange supply to long-term storage options and staking contracts during the 14 trading days between May 21 and June 3 2024.

When there is a dramatic decline in foreign exchange supply, it creates a bullish buzz around the underlying asset for two main reasons. First, it means that existing investors are looking for long-term gains rather than exploiting short-term trading opportunities on exchanges.

More importantly, these exchange outflows of 800,000 ETH mean that over $3 billion worth of ETH has been removed from short-term market supply in the last two weeks alone.

This puts Ethereum price in a prime position to stage a parabolic breakout above $4,200 during the next wave of higher demand.

Besides ETF inflows, another key market event that could impact Ethereum’s June price action is the upcoming U.S. Nonfarm Payrolls report, scheduled for June 7. 2024.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinions of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. Crypto Basic is not responsible for any financial losses.

-Advertisement-