News

Ether and meme coins lead recovery while Bitcoin remains subdued

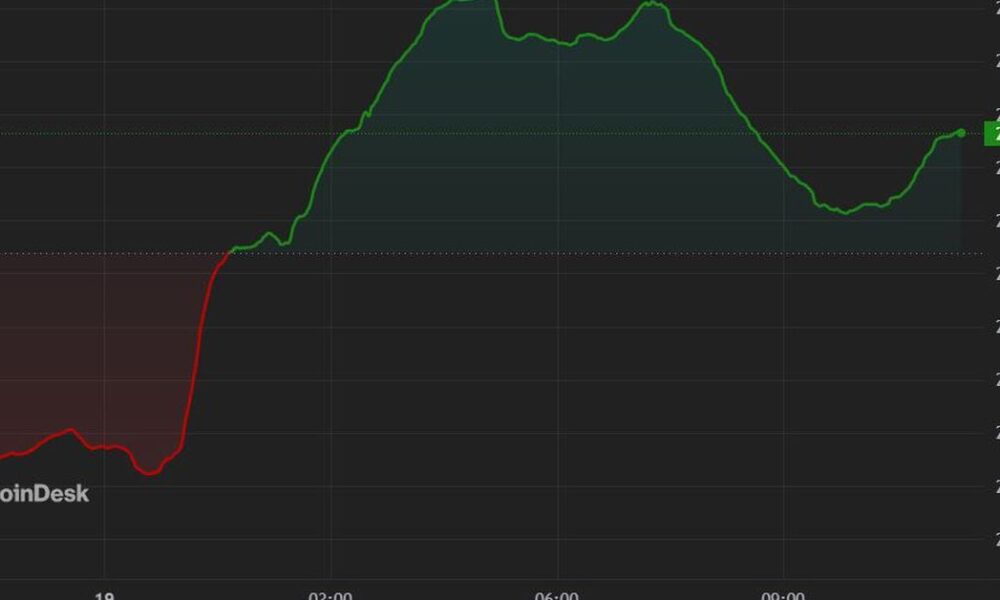

The digital asset market marked an increase during the European morning with Ether recovering $3,500. ETH is up more than 4% in the past 24 hours, trading at $3,540 as of this writing. The CoinDesk 20 Index (CD20) gained about 1.6%. DOGE is up nearly 3.5% after Tuesday’s plunge, while meme coin SHIB is also up more than 3%. Bitcoin remains subdued, trading around $65,400, up 0.2% compared to 24 hours ago. U.S. spot bitcoin ETFs saw additional outflows of $152.4 million on Tuesday.

Wallets tracked by the CryptoQuant show Whales have sold over $1.2 billion worth of BTC over the past two weeks. These long-term bitcoin holders show few signs of renewed demand, indicating a continued lack of upside for the world’s largest cryptocurrency. “Traders are not yet increasing their bitcoin holdings and demand growth from large holders still lacks strength,” the analysts wrote. Market watchers say cryptocurrency miners may increasingly look to the booming artificial intelligence sector rather than bitcoin to ply their trade, prompting them to sell their bitcoin rewards instead of holding onto them. Both industries rely heavily on powerful computing chips to generate and store data.

Bitcoin and cryptocurrency-related stocks are undervalued and ripe for institutional adoption, according to broker Bernstein. While BTC and bitcoin ETFs may have shown promise before disappointing in recent months, Bernstein expects ETFs to be approved by major brokerages and large private banking platforms in the second half of the year. Bitcoin ETF inflows are expected to accelerate in the third and fourth quarters, the report says, and the next phase of adoption will be driven by large advisors approving ETFs and allocating margins from existing portfolios. Bernstein topped valuations for bitcoin-adjacent publicly traded companies such as MicroStrategy, Robinhood and miners Riot Platforms and CleanSpark.