Ethereum

Ethereum begins to recover after Bitcoin halving: Key insights

- ETH is up 6% since the halving day.

- The total number of accounts wanting ETH on Binance has increased since the halving.

Bitcoin [BTC] the halving appears to have put significant upward pressure on Ethereum [ETH].

The second-largest cryptocurrency is up 6% since the halving day, trading at $3,250 at the time of writing, according to data from CoinMarketCap watch.

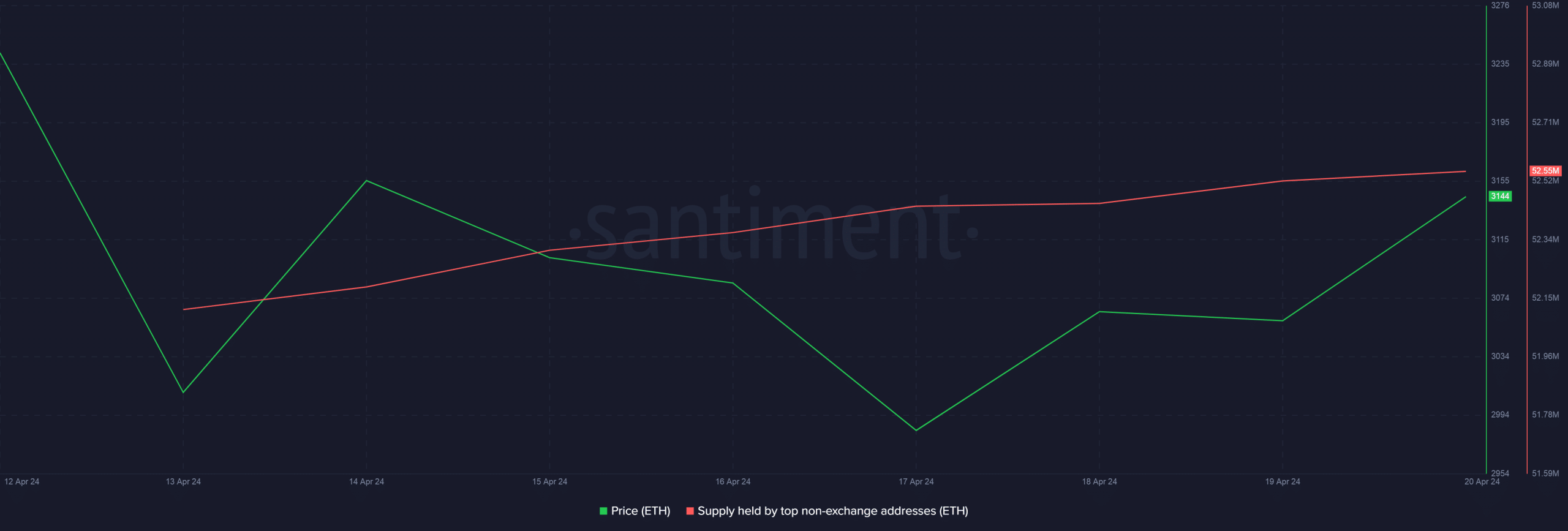

Using Santiment, AMBCrypto noted a slight increase in the total balance of top non-exchange addresses since the halving. This suggests that accumulation by influential investors supported the price rise.

Source: Santiment

Will the momentum continue?

According to a prominent crypto market analyst Ali Martinez, $3,170 to $3,270 provided strong resistance for ETH, with up to 1.63 million addresses acquiring 4.45 million coins in this range.

Although ETH has clearly broken the first barrier, a break above $3,270 would support the idea of a rally up to $3,650, Martinez predicted.

Futures traders bet on ETH rising

The price rise has also galvanized the ETH futures market. Since April 20, the total number of accounts wanting ETH on Binance has increased steadily, AMBCrypto noted using data from Hyblock Capital.

Additionally, the percentage of whale accounts accepting bullish bets on ETH has increased from 71% to 74% since the halving. This in some way justifies the theory of accumulation explained previously.

Source: Hyblock Capital

Market sentiment has also shifted towards greed, which could increase buying pressure in the coming days.

What do technical indicators say?

AMBCrypto examined the ETH daily chart and its key technical indicators to assess the next moves.

The Relative Strength Index (RSI) has reached the neutral level 50 at the time of writing, indicating a pivot to the bullish side. Typically, the 40-50 zone provides good support during a bull market.

Therefore, a sharp move above this zone could support a sustained rally.

Is your wallet green? Check ETH Profit Calculator

The Moving Average Convergence Divergence (MACD) has crossed above the signal line, indicating the possibility of a price increase.

However, to reinforce the bullish narrative, the MACD is expected to move above 0 in the coming days.

Source: Commercial View