Ethereum

Ethereum Price Rebounds 6% Ahead of Trump’s Bitcoin Conference Speech

Ethereum price hit $67,432 in July, up 6% on the day, as bullish traders placed a $1.38 billion bet ahead of Trump’s speech at the Bitcoin conference this weekend. ETH price looks set to post another rally amid ongoing market turmoil.

Ethereum Price Surges 6% on Trump Speech Speculation

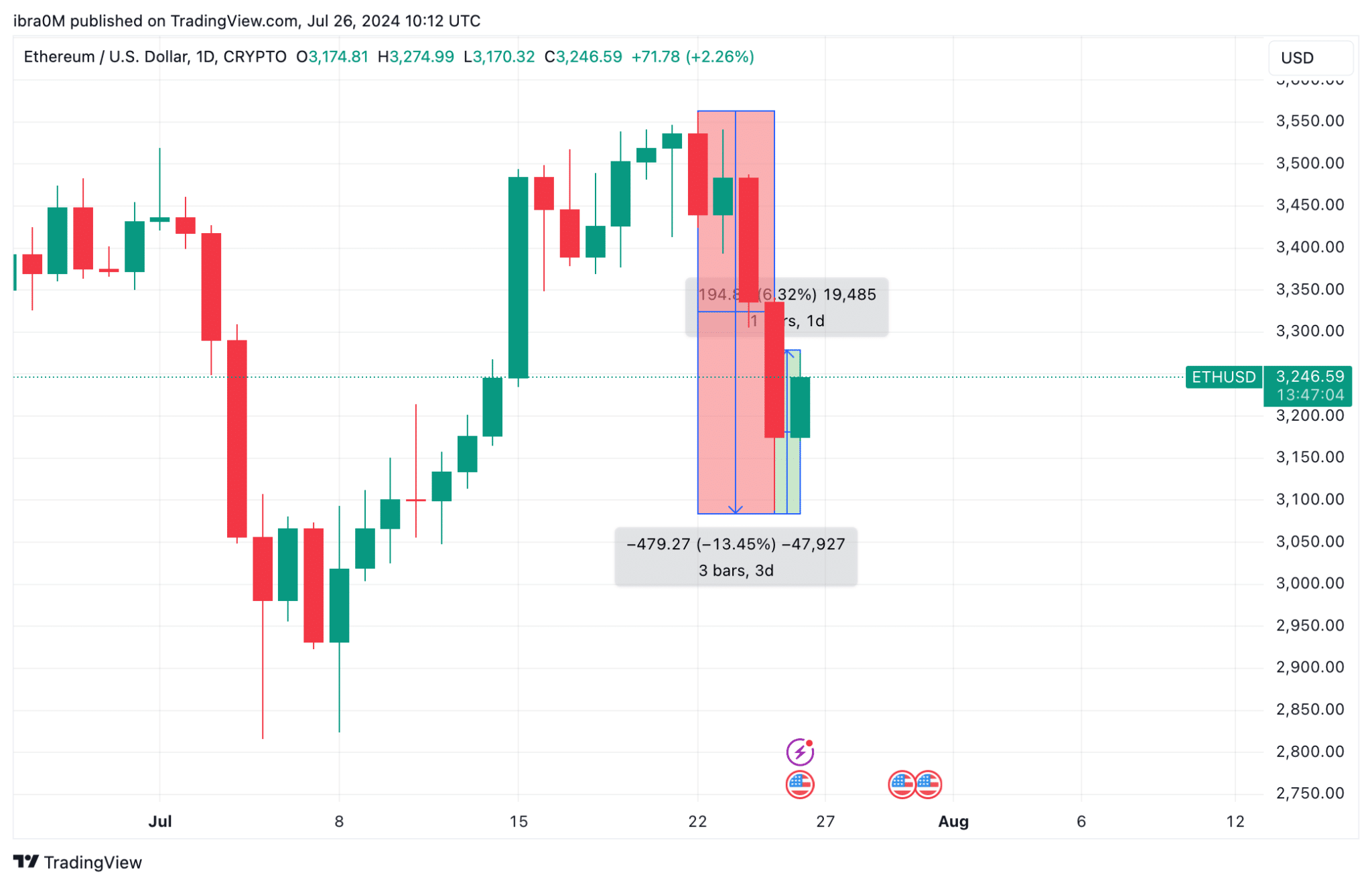

ETH price entered a worrying 13.45% downtrend midweek, amid a wave of selling that greeted the launch of Ethereum spot ETFs on Tuesday, June 23. However, industry sentiment turned bullish on Friday, July 26, as markets began to react Donald Trump’s presence confirmed at an upcoming Bitcoin conference in the United States.

On July 25, 2024, the “Bitcoin 2024” conference kicked off in Nashville. This annual Ethereum event has been held since 2013 and has generated global buzz over the years.

This year, high-profile speakers confirmed to participate in the event include Republican presidential candidate Donald Trump, MicroStrategy’s Michael Saylor, Ark Invest’s Cathie Wood, Robert F. Kennedy Jr., Russell Brand, Edward Snowden and many more.

Policy discussions such as taxation, regulation, and the adoption of cryptocurrency products across the United States dominated the discourse at this year’s edition.

Republican candidate Donald Trump is expected to speak at the event. Despite repeatedly claiming to be a crypto-friendly president, many crypto enthusiasts are speculating that Trump could announce a decision to support adding Bitcoin to the U.S. Treasury’s official strategic reserve.

This would see the US government invest directly in Bitcoin and hold BTC on its balance sheet in perpetuity, as currently seen in countries like El Salvador and the Central African Republic (CAR).

Ethereum Traders Build LONG Positions Ahead of Bitcoin Conference

In an effort to get ahead of the gains from this bullish speculation, ETH futures traders have built up an unusually large volume of LONG positions.

The Coinglass chart below shows the total value of ETH LONG contracts versus active SHORT positions listed around the 20% boundaries of current prices. This gives a clear insight into short-term investor sentiment.

Higher LONG positions often mean that investors are confident in an imminent price rise and are deploying more leverage to maximize profits on these potential gains.

In total, Ethereum derivatives traders currently have about $2 billion locked in speculative perpetual futures contracts within the price range of $2,918 to $3,570.

Clearly, these contracts are strongly oriented to the upside, with $1.38 billion of LONG contracts set up against $600 million of SHORT positions.

Donald Trump is scheduled to speak at the Bitcoin Nashville conference in less than 24 hours from the time of this article’s publication. These heavily skewed futures contracts clearly indicate that traders are anticipating a major breakout in Ethereum’s price following the conference.

The media buzz generated by the announcement of the bitcoin release over the past 24 hours has already propelled ETH to a 6% rally towards $3,245 at the time of writing. Many expect that a major statement from Donald Trump, such as the speculated addition of BTC to the US Treasury, could trigger a major buying frenzy.

Given the level of leverage currently being applied, it is possible that such a significant statement could propel ETH to new all-time highs above $5,000 if the bullish scenario plays out.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-