Regulation

Europe harmonises its rules with MiCA

8:30 p.m. ▪ 3 min read ▪ by Mikaia A.

Europe is clearly demonstrating its seriousness in regulating cryptocurrencies with the announcement of new guidelines under the MiCA regulation. On July 12, European banking and financial authorities published these guidelines aimed at standardizing the classification of crypto-assets. Today, we look at these new regulations and their potential impact on the cryptocurrency market.

A new era for crypto-assets

Europe is making great strides in regulating cryptocurrencies, especially stable coinsOn 12 July, the European Banking Authority (EBA), the European Insurance and Occupational Pensions Authority (EIOPA) and the European Securities and Markets Authority (ESMA) unveiled a series of guidelines for the classification of crypto-assets under the MiCA Regulation.

The aim is to establish a common and standardized approach to categorize the different forms of crypto.

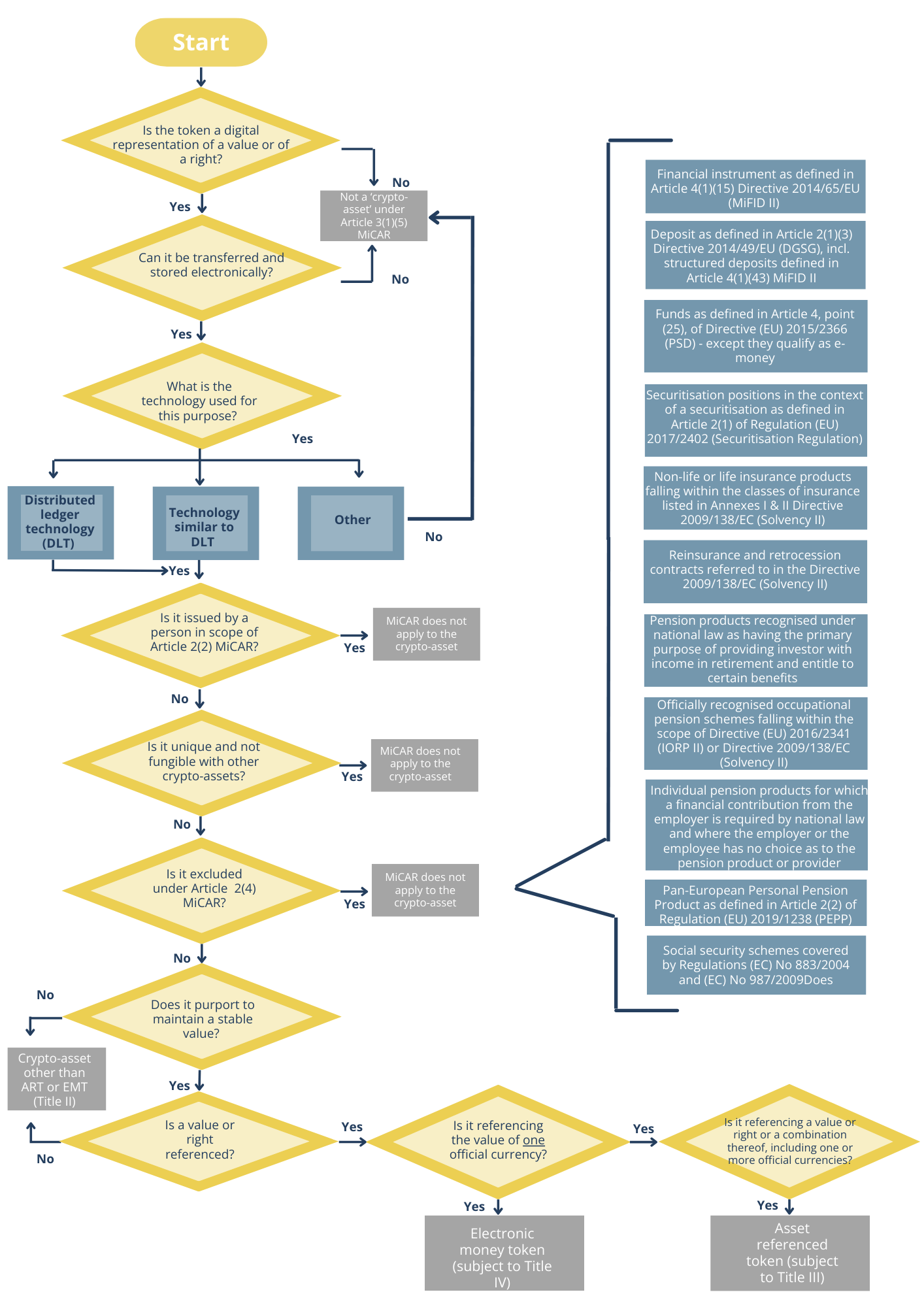

These new rules include a series of questions to determine whether a token should be classified under MiCA or falls into another category, such as electronic money tokens (EMTs) or asset-referenced tokens (ARTs).

Issuers must now provide detailed legal advice to clarify the classification of their tokens.

It is essential to note that these guidelines also include explanatory models and standardised tests, designed to help market participants and supervisors adopt a uniform approach.

“We are aiming for a harmonised classification of crypto-assets, which will provide more clarity and legal certainty to investors,” according to an ESMA official.

The MiCA regulatory roadmap

The implementation of the First MiCA regulations on stablecoins took place on June 30, and additional regulations are expected by December 2024.

Circle, the issuer of the USDC and EURC stablecoins, has already compliant with MiCA standardsillustrating the speed at which the market adapts.

The new guidelines also include a public consultation open until mid-October and a virtual hearing is scheduled for September 23.

Key points of the new regulations:

- Introduction of a series of questions to classify the tokens;

- Explanatory models and legal notices required for each token;

- Public consultation and virtual hearing to discuss the guidelines.

These measures show that the European Union is determined to harmonise cryptography rules, with the aim of creating a stable and transparent environment. The expected standardisation should provide better protection for investors and encourage innovation in the field of cryptocurrencies.

The MiCA regulation is a decisive step forwardproviding essential guarantees to investors and strengthening transparency in the crypto-asset market in Europe.

Optimize your Cointribune experience with our “Read to Earn” program! Earn points for each article read and access exclusive rewards. Sign up now and start earning benefits.

Click here to join “Read to Earn” and turn your passion for crypto into rewards!

Mikaïa A.

The blockchain and crypto revolution is underway! And the day the impacts will be felt on the most vulnerable economy in this World, against all hope, I will say that I had something to do with it

DISCLAIMER

The views, thoughts and opinions expressed in this article are solely those of the author and should not be considered investment advice. Do your own research before making any investment decision.