Ethereum

Excited Investors Will Plow $500 Million Into Ethereum ETFs During Opening Week, Says OKX – DL News

- The crypto industry expects Ethereum ETFs to be approved on Thursday.

- Investors are expecting a rally like the one that followed the rollout of Bitcoin ETFs.

- Ethereum ETFs pose new challenges for crypto exchanges.

Institutional investors are set to invest $500 million in Ethereum ETFs over the next week if they are approved on Thursday, according to analysis from OKX, the crypto exchange.

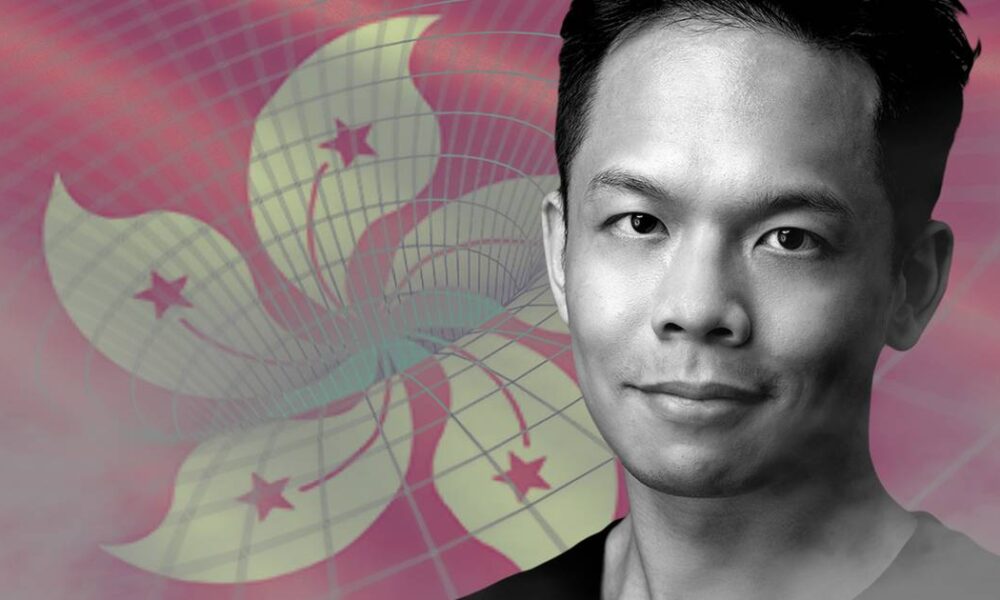

“This is probably as, if not more, important than the approval of the Bitcoin ETF.” Lennix Laithe global commercial director of OKX, said DL News.

“The potential approval of Ethereum to be traded as a proxy in a traditional setting could spark the next wave of institutional demand,” Lai said.

Overexcitement

Anticipation is reaching fever pitch after the U.S. Securities and Exchange Commission this week appeared to abandon its long-standing resistance to approving a spot exchange-traded fund for Ethereum.

Ethereum has rose 24% since Monday and has boosted the proof-of-stake sector – Lido Staked Ether, for example, is up 27% over the past seven days, according to CoinGecko.

Several candidates, such as BlackRock, Invesco Galaxy, Fidelity and Franklin Templeton, are eagerly awaiting the SEC’s decision.

Asset manager VanEck, however, is the first to obtain approval or refusal from the regulator.

While Van Eck’s head of digital asset research said Wednesday that it expects the SEC to honor the queue, any approval will likely be extended to other applicants to avoid the agency being seen as kingmaker.

Join the community to receive our latest stories and updates

Investors expect Ethereum ETFs to follow a similar path to the rollout of Bitcoin funds in January.

Ten of these products have been trading at volumes exceeding $1.5 billion since January.

Record rally

The advent of Bitcoin ETFs and Wall Street’s embrace of the asset class has sparked a record rally in crypto. This year, the sector’s market value soared 50% to $2.7 trillion.

An Ethereum counterpart could excite animal spirits even more. Bernstein analysts predicted this week, this Ether will reach $6,600 if funds are approved.

“Ethereum could potentially surpass its all-time high soon after the potential approval of the ETH ETF,” Lai said.

An Ethereum ETF will make it easier and cheaper for retail investors to purchase exposure to the second most valuable cryptocurrency.

“Like the Bitcoin ETF before it, an Ethereum ETF will be an important milestone for the industry,” Jean-Baptiste Graftieaux, CEO of Bitstamp, told DL News.

Cost of trade

Still, crypto exchanges like Coinbase and Kraken can come at a cost.

ETFs allow traders to access the asset class without using digital wallets or industry-native exchanges. In other words, mainstreaming has many effects.

Still, Lai downplayed the long-term risk for exchanges and said ETFs would provide a gateway for newcomers to the crypto space.

“It could actually increase the overall size of the market, including volume and participants, meaning it’s complementary rather than cannibalistic,” he said.

Crypto market players

- Bitcoin is down 1% over the past 24 hours to $69,550.

- Ethereum is up 2.5% at $3,830.

What we read

Eric Johansson is the editor-in-chief of DL News. Do you have any advice? Email the eric@dlnews.com.