Blockchain

Fear returns for the first time since October as cryptocurrency greed takes a backseat

The shine seems to have faded from Bitcoin’s crown. After a stellar run that culminated in a record price at the end of March, the world’s leading cryptocurrency underwent a sharp correction, plunging investor sentiment into the abyss. This sudden shift can be attributed to a confluence of factors, with the “fear and greed index” playing a fascinating role in this rollercoaster ride, along with a record exodus from a key investment vehicle.

Bitcoin and the Fear Meter: A Delicate Dance

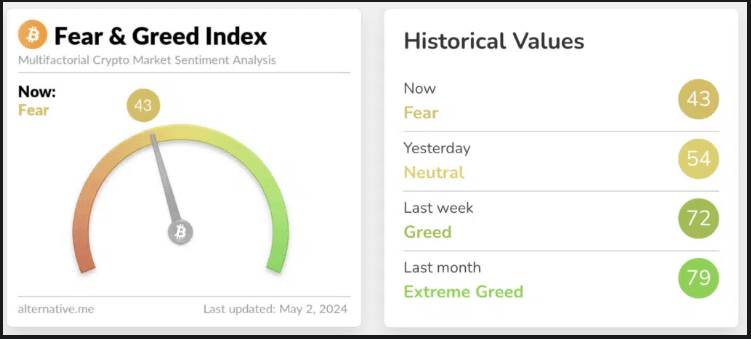

The Crypto Fear and Greed Index is a sentiment analysis tool that attempts to capture the overall emotional temperature of the cryptocurrency market. It works on a scale of 0 to 100, where 0 represents “extreme fear” and 100 represents “extreme greed.” This psychological barometer plays a surprisingly significant role in Bitcoin’s price movements.

Source: Alternative.me

During Bitcoin’s rise to its peak, the Fear and Greed Index hovered comfortably in the “Greed” zone. This has instilled a sense of euphoria among investors, encouraging “buy the sauce” mentality. Every drop in prices was seen as a buying opportunity, further fueling the upward momentum.

However, the recent price collapse has triggered a dramatic shift in sentiment. The index collapsed to a value of 43, firmly entering the “Fear” zone. This sudden turn towards pessimism triggered a wave of panic selling, as investors fearful of further losses rushed to sell their holdings.

BTCUSD trading at $59,352 on the 24-hour chart: TradingView.com

A self-fulfilling prophecy? The cryptocurrency fear index and market psychology

The Fear and Greed Index, while a valuable tool, can become a self-fulfilling prophecy in volatile markets like those Bitcoin. When fear dominates market sentiment, it can trigger a domino effect. When investors see the index drop, their anxieties increase, leading them to sell their Bitcoin holdings.

This selling pressure pushes the price further down, reinforcing the initial fear and causing further selling. This cyclical pattern can exacerbate price corrections, creating a negative feedback loop.

BTC seven-day price action. Source: Coingecko

Beyond fear: market fundamentals and long-term prospects

While the near-term picture for Bitcoin appears bleak, some analysts believe this is a necessary correction following the rapid run-up that preceded the halving event. The halving, which reduces the number of new Bitcoins entering circulation with each block, has fueled speculation and a buying frenzy. However, with the event now behind us, the market is adapting to the new reality.

Adding Fuel to the Fire: Record Outflows from Spot Bitcoin ETFs

Further exacerbating Bitcoin’s problems is a record exodus from spot Bitcoin exchange-traded funds (ETFs). On May 1, an incredible $560 million in net outflows were recorded from these investment vehicles.

Spot Bitcoin ETF allow investors to gain exposure to the price of Bitcoin without directly owning the cryptocurrency. This record outflow means a significant loss of confidence among some institutional investors, potentially spooking retail investors as well.

Despite the current turbulence, long-term believers in Bitcoin remain optimistic. They point to cryptocurrency’s underlying fundamentals, such as its decentralized nature and limited supply, as reasons for its long-term potential. However, the road to recovery may be bumpy and investors should be prepared for further volatility in the near future.

Featured image by Psychology Today, chart by TradingView