Bitcoin

Forecasts point to a monumental price increase in 18 months

Bitcoin (BTC), the largest cryptocurrency on the market, recently reached the crucial $70,000 level, proving to be a significant obstacle to its price consolidation in recent months.

Despite surpassing the previous maximum and reaching a record all time high (ATH) of $73,700 in March, BTC experienced a 20% price correction to around $56,500 in early May. However, this correction marked the start of new bullish momentum, with BTC currently trading at approximately $69,300.

Although the price of Bitcoin has experienced some volatility and a lack of sustained bullish action, venture capitalist and market expert Chamath Palihapitiya has provided optimistic predictions for the future of the cryptocurrency.

Bitcoin Price and Halving Analysis

In a recent episode from All In Podcast, Palihapitiya analyzed BTC’s historical patterns regarding the Halving event, which occurs approximately every four years and reduces the block reward given to miners.

The venture capitalist noted that after a Reduce by half, investors typically spend the first three months reevaluating the price and the general market situation. However, historically, significant price appreciation has occurred within six to 18 months.

To support his analysis, Palihapitiya referred to previous halving events. For better context, the first Halving took place on November 28, 2012, reducing the block reward from 50 BTC to 25 BTC. At the time of Halving, Bitcoin cost US$13 and within a year it reached a peak of US$1,152.

The second Halving occurred on July 16, 2016, reducing the block reward to 12.5 BTC. The price of Bitcoin at that time was $664, and within a year it reached a peak of $17,760.

The most recent halving took place on May 11, 2020, reducing the block reward to 6.25 BTC. During this halving, Bitcoin cost US$9,734 and, within a year, it reached an all-time high of US$69,000.

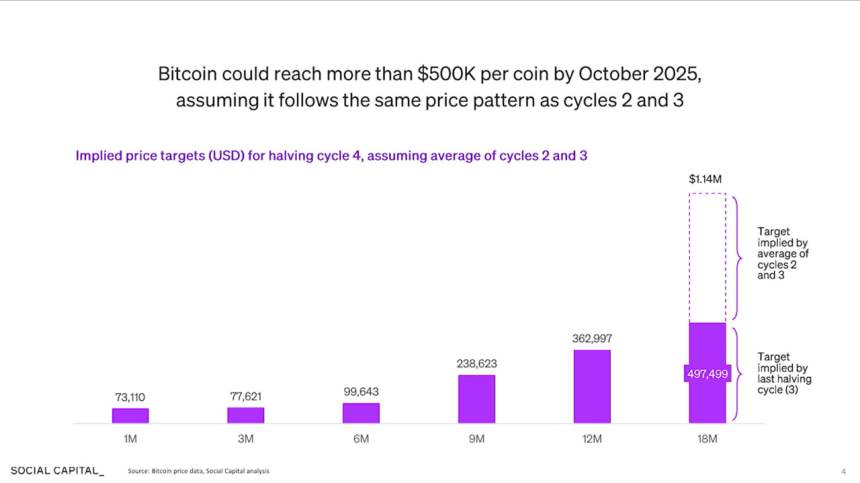

Based on these historical patterns and applying the average increases from previous halvings, Palihapitiya suggests that if Bitcoin continues to follow its performance from the last market cycle, it could skyrocket to around $500,000 by October 2025, as seen in the chart above.

Notably, the expert believes that as the value of Bitcoin appreciates to such levels, it has the potential to replace gold and serve as a transactional utility for tangible assets. This scenario, combined with concerns about the devaluation of fiat currencies, presents intriguing opportunities for the future of Bitcoin.

Increased demand for BTC?

Palihapitiya further argued during the interview that as more countries adopt a dual currency approach, with Bitcoin being recognized as a valuable asset alongside their local currency, demand for Bitcoin will increase.

This change would only occur when people recognize the need for Bitcoin in daily transactions of goods and services and as a store of value for permanent assets.

Overall, Palihapitiya’s analysis of Bitcoin historical patterns following the Halving events provides an optimistic outlook for the cryptocurrency price.

Bitcoin’s potential to reach $500,000 by October 2025 and its growing recognition as a dual currency asset alongside fiat currencies offers renewed prospects for investors and the broader cryptocurrency market.

Featured image of DALL-E, chart from TradingView.com