Blockchain

Germany Almost Done Selling Bitcoin, Holds Less Than 5K Tokens After Latest Moves

The German state of Saxony is rapidly running out of bitcoin {{BTC}} to sell after transferring another batch of its confiscated assets to cryptocurrency exchanges and brokers on Thursday.

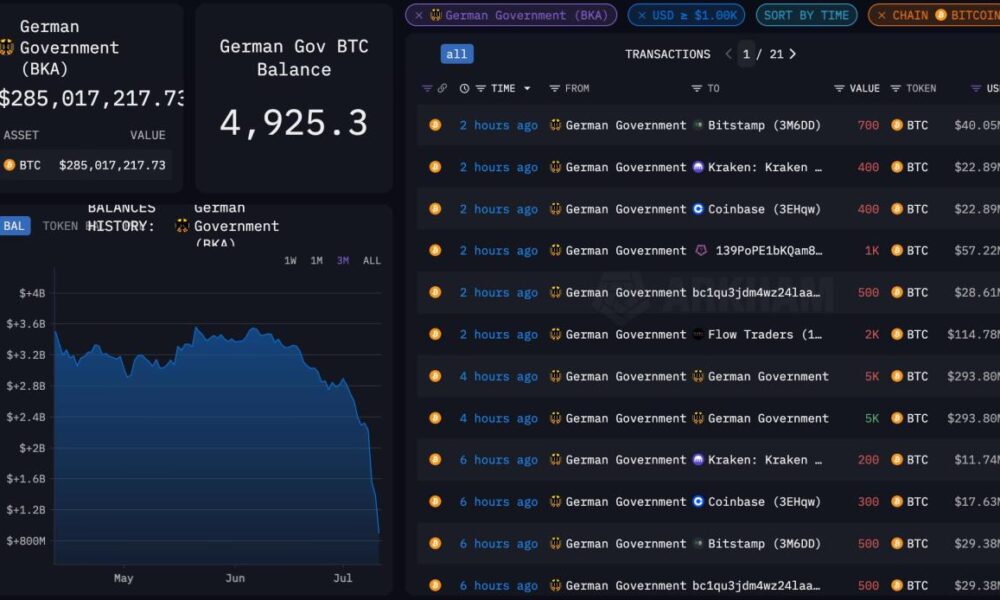

Bitcoin wallets linked to German authorities transferred a total of 10,567 BTC worth over $600 million in multiple batches throughout the day to cryptocurrency exchanges Bitstamp, Coinbase, Kraken and other service providers such as Flow Traders and Cumberland DRW, blockchain data from the Arkham Intelligence shows.

After today’s transactions, the wallets linked to the authorities held just 4,925 BTC, worth $285 million at current prices, down from 50,000 BTC, worth nearly $3 billion, since they began selling the assets three weeks ago.

This means that at the current rate, the bitcoin sell-off in Germany could end as early as Friday or early next week, as wallets have sold around 35,000 BTC this week.

To know more: It is not Germany that is selling Bitcoin. It is one of its states and has no choice.

The count could change in the final hours due to the wallet’s strange practice of receiving a portion of transferred assets, sometimes in the order of $10 million, from exchanges and brokers before the end of the day. (Greg Cipolaro, head of research at digital asset manager NYDIG, called the on-chain activity “staggering” in a Wednesday Note)

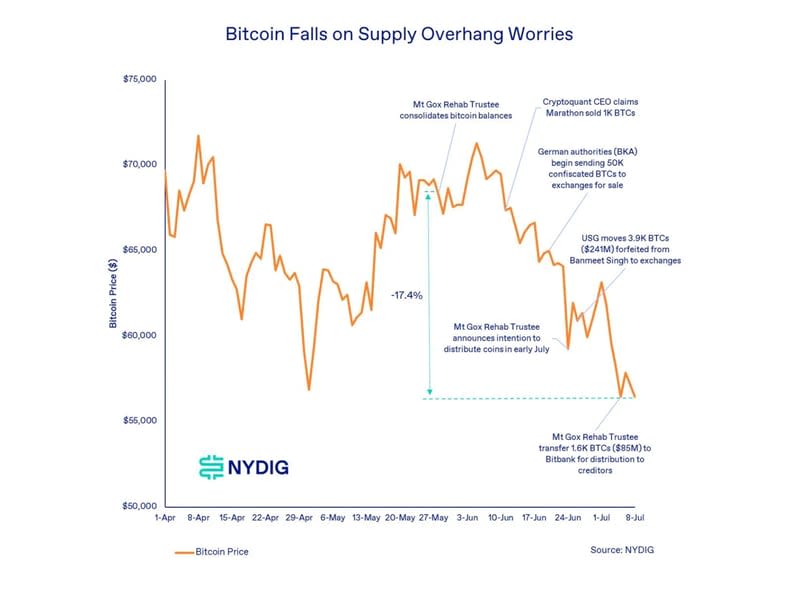

The imminent conclusion of Germany’s $3 billion sell-off could ease the fears of cryptocurrency investors, who in recent weeks have focused on the on-chain movements of large potential sellers in the market, linking the recent decline in asset prices to concerns about oversupply.

Bitcoin’s drop coincided with investors’ concerns about oversupply (NYDIG)

Bitcoin’s 15% correction last month coincided with the U.S. government, which holds more than $12 billion in seized bitcoin, transferring $240 million in Silk Road-related BTC to Coinbase and the defunct Japanese exchange’s assets. Mt. Gox Begins Refunds of 140,000 BTC to creditors this month, who may want to cash in after a decade of waiting.

Fears about impending selling pressure may have been overblown, NYDIG’s Cipolaro said in a report, as bitcoin’s decline outweighs the price impact if all potential selling materializes.