Blockchain

Grayscale presents Bitcoin Mini Trust ETF

Bitcoin Currency

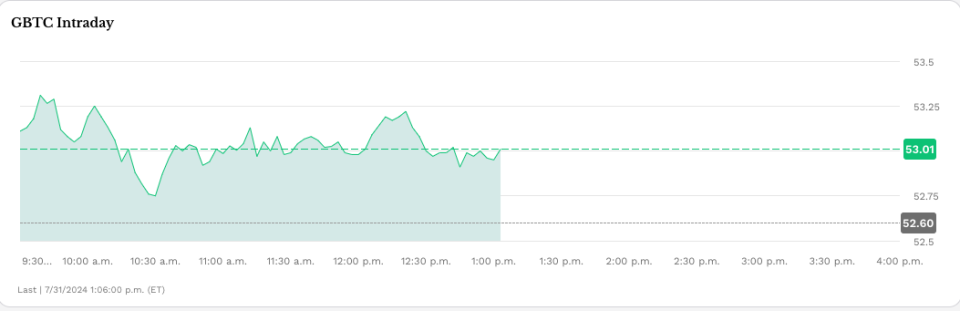

Grayscale Investments Bitcoin Mini Trust began trading on Wednesday with an expense ratio of 0.15%, offering a cheaper option for bitcoin exposure in the market.

The Mini Trust, which has the ticker BTC and is traded on the NYSE Arca, is structured as a spin-off of the Bitcoin Trust Grayscale (GBTC). The new shares will be distributed to existing GBTC shareholders with the trust contributing a portion of its bitcoin holdings to the new product. According to a Company press releaseBTC’s S-1 registration statement went into effect last week.

“The Grayscale team has believed in the transformative potential of Bitcoin since the initial launch of GBTC in 2013, and we are excited to launch the Grayscale Bitcoin Mini Trust to help further lower the barrier to entry to Bitcoin in an SEC-regulated investment vehicle,” said David LaValle, Senior Managing Director, Head of ETFs at Grayscale.

The Bitcoin Mini Trust’s debut comes amid growing interest in ETFs based on the current price of the two largest cryptocurrencies by market cap, bitcoin and ether. Spot bitcoin ETFs have attracted nearly $18 billion in inflows since the first ones began trading on Jan. 11, although GBTC has lost nearly $19 billion in assets.

This fund differs from other funds in that it is a conversion of an existing trust and carries a 1.5% fee, the highest among spot bitcoin products that have received SEC approval this year.

Mini Bitcoin Trust’s low commission

In a post X On Wednesday, Eric Balchunas, senior ETF analyst at Bloomberg, highlighted the Bitcoin Mini Trust’s “lowest-in-class fee.”

“[Important] to recognize how insanely cheap the 15 bps price is, about 10 times cheaper than spot ETFs in other countries and other vehicles,” Balchunas wrote, adding that this pricing strategy reflects the competitive nature of the U.S. ETF market, which he called the “ETF Terrordome.”

“Here’s what the Terrordome does to fund [cost]Enter at 1.5% [and] end up at 0.15%, how to go from [a] country club to the jungle. But that’s why all the flows are here, a paradise for investors,” he noted.

To know more: Spot Bitcoin ETF Inflows Hit Daily High Above $1 Billion

Bitcoin was recently trading at around $66,350, almost unchanged from when U.S. markets opened on Wednesday.

Grayscale also offers two spot Ethereum ETFs, the Grayscale Ethereum Trust (ETHE) and the Grayscale Ethereum (ETH) Mini Trustwhose performance is based on ETHE. ETHE outflows topped $1.8 billion in its first six days of trading, while ETH added more than $181 million in the same period, according to Farside. The remaining seven ETFs generated about $1.2 billion in inflows.

The story continues

To know more: Spot Ethereum ETFs Approved to Start Trading