News

Hong Kong Counterfeit Money Case Shows Convergence Between Crypto and Real-World Crime – DL News

Shipping to Asia

- Chainalysis’ Chengyi Ong says cryptocurrencies are becoming increasingly prevalent in various types of crimes.

- Law enforcement needs more training on cryptocurrencies.

- The physical aspect of cryptocurrency scams and scams alarms authorities.

Another week, another strange crime in Hong Kong involving cryptocurrencies.

In the latest incident, three individuals were arrested for defrauding a businessman of $400,000 in Tether (USDT) at an office in Mong Kok, a densely populated commercial district in Hong Kong.

Police seized more than 11,000 counterfeit notes during the raid, more than the total number of counterfeit notes seized in the entire last year, according to the South China Morning Post.

This case is just the latest to demonstrate how cybercrime is creeping into traditional crime.

Chengyi Ong, Chainalysis’s head of policy for the Asia-Pacific, or APAC, region, said he has seen cryptocurrency implicated in cases ranging from narcotics to fraud and scams to cybercrime.

“Cryptocurrencies will become increasingly prevalent as an element in many different types of crimes,” he said. DL News in an interview.

And while I recognize that progress is being made in educating law enforcement about cryptocurrencies, there is still much work to be done.

“As cryptocurrencies become increasingly common in a variety of crimes, there will be a need to increase awareness of and training on cryptocurrencies across law enforcement agencies,” he said.

Join the community to receive our latest stories and updates

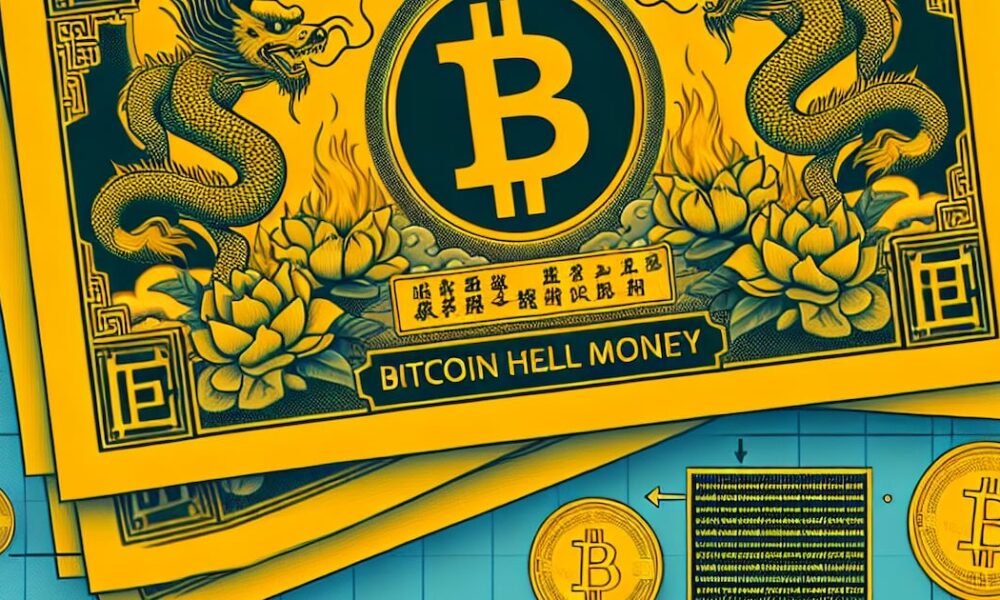

Money from hell

The Hong Kong counterfeiting episode is reminiscent another case in May, when police arrested three employees of a cryptocurrency exchange in the same area, accused of defrauding a customer of $128,000 in a USDT-to-Hong Kong dollar transaction, also in Mong Kok.

The scammers lured the victim by showing them a stack of “hell money,” fake money printed on incense paper used in traditional rituals.

In neither case was it revealed exactly why the victims were exchanging such large sums of money in shady offices in Mong Kok.

This type of exchange is very popular among mainland Chinese who want to get money out of China, which places strict limits on how much can be transferred abroad.

In any case, these incidents highlight the growing convergence between crypto and real-world crime in Hong Kong. As hacks, scams, and frauds continue to proliferate, the physical dimension of crypto crime is becoming more pronounced.

Two weeks ago, two women were arrested for kidnap a small child and demanding a ransom of $660,000 in USDT.

In another case, a 55-year-old investor was kidnapped in Sheung Shui after her attackers used a stun gun on her husband.

Brutal accident

A particularly brutal incident occurred in March, when a 19-year-old cryptocurrency trader was lured to a hotel in Hung Hom and beaten with baseball bats for his $23,000 in cryptocurrency earnings.

Similar incidents have been reported elsewhere.

In the Philippines, two Chinese businessmen were kidnapped last month, their captors demanding $2 million in USDT. Tragically, both victims were found dead near Manila.

These violent crimes stand in stark contrast to more typical online scams, highlighting the urgent need for law enforcement to adapt.

“The investment must be made on two fronts: on the one hand, to raise the starting base and, on the other, to develop in-depth skills.”

— Chengyi Ong, Chain Analysis

Law enforcement officials in the APAC region themselves seem to agree. Chainalysis recently examined law enforcement officials, revealing that significant knowledge gaps in cryptography remain.

A total of 42% admitted to having a low level of understanding of the asset class. Two-thirds believe cryptocurrency is primarily used by criminals.

Globally, over 90% of law enforcement agencies agree that more resources should be devoted to investigating cryptocurrency-related cases.

Capacities must keep pace through concerted and well-directed investments, Ong said.

She advocates a two-pronged approach.

“Investment must be made on two fronts, both to improve the baseline and to develop in-depth capabilities,” Ong said.

Callan Quinn, DL News Hong Kong correspondent covering the cryptocurrency industry in Asia. Got a tip? Contact the author at callan@dlnews.com.