News

India keeps controversial crypto tax rules unchanged in annual budget

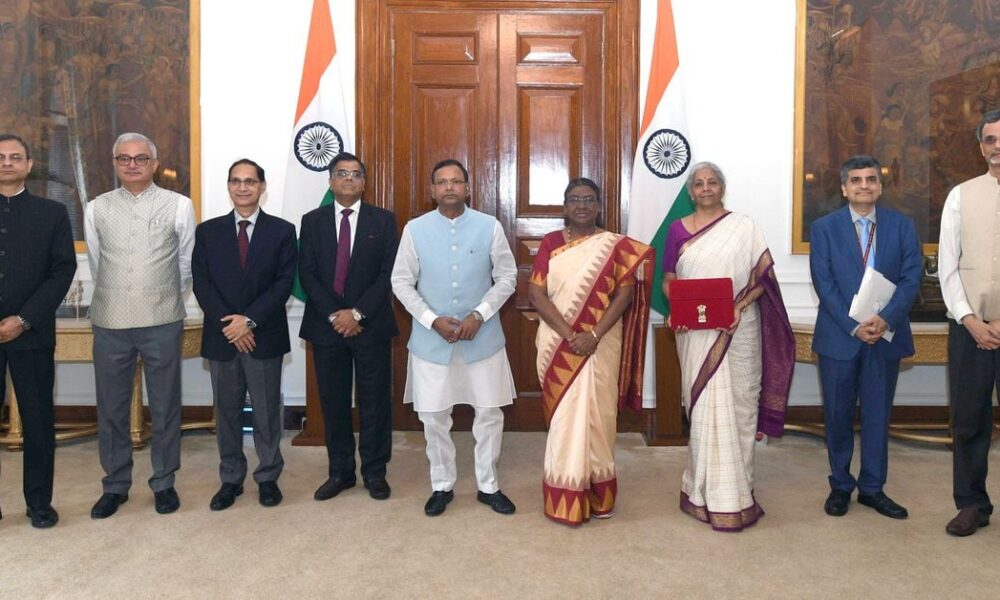

Indian Finance Minister Nirmala Sitharaman kept crypto tax rules unchanged in her speech Tuesday announcing the national budget for 2024-2025. This was expected, as CoinDesk reported on Monday.

The Indian cryptocurrency industry’s main demand was to reduce the controversial withholding tax (TDS) policy on cryptocurrency transactions from 1% to 0.01%. It submitted its claims to government officials with evidence from several sources, including a think tank study that provided evidence to support a reduction in the TDS.

The industry too asked the government to establish progressive taxes on earnings instead of the flat 30% rate, and allow losses to offset gains. They also pushed for multi-agency regulation.

“We were hoping for some relaxation in the tax framework on VDAs (Virtual Digital Assets) in this fiscal, but the absence of any announcement is not particularly discouraging given the government’s overall negative stance towards the sector,” said Dilip Chenoy, president of the Bharat Web3 Association, adding that they would “continue to push for rationalisation of the tax framework”.

Specifically, the government has increased the long-term capital gains tax from 10% to 12.5% and the short-term capital gains tax from 15% to 20%. It is unclear whether this will have an impact on cryptocurrency trading.

“The increase in long-term capital gains tax from 10% to 12.5% and short-term capital gains tax from 15% to 20% in Budget 2024 could incentivize retail investors to shift from traditional assets like stocks to cryptocurrencies. While this shift is possible, it is important to note that cryptocurrency gains are taxed at a flat rate of 30% and unlike stocks, cryptocurrency losses cannot be set off against gains,” said Rajat Mittal, a cryptocurrency tax advisor to the Supreme Court.

“On the positive side, the abolition of investor tax for all categories of investors will help strengthen the Indian startup ecosystem,” Chenoy said. “We look forward to more Web3 startups setting up base in India, given the immense Web3 talent and potential in India.”

“CoinDCX welcomes the Finance Minister’s announcement in today’s budget regarding the abolition of Angel tax for all categories of investors. We are confident that this will significantly strengthen the Indian tech startup ecosystem, especially in the Web3 space,” said Sumit Gupta, co-founder of Indian cryptocurrency exchange CoinDCX.

The budget is the first since Prime Minister Narendra Modi was elected to a third consecutive term. Modi’s Bharatiya Janata Party (BJP) failed to secure a majority in this year’s elections, pushing them to form a coalition government, together with the limitations that result from it.

Among other initiatives, the budget revealed financial support of Rs 26,000 crore ($3.1 billion) for road projects in Bihar, one of the states where Modi’s alliance partner is located, and Rs 15,000 crore ($1.8 billion) for another partner’s plans to develop a state capital in Andhra Pradesh.

This budget is seen as a roadmap for his vision for the next five years, which will take into account the sentiment reflected in the unexpected election results.

UPDATE (July 22, 07:54 UTC): Adds sentence to previous CoinDesk report. Adds quote from industry policy body and details on capital gains tax change.

UPDATE (July 22, 08:13 UTC): Adds details on the corner tax and a quote from Sumit Gupta.

UPDATE (July 22, 08:11 UTC): Adds an additional comment.

UPDATE (July 22, 11:00 UTC): Adds further context on coalition partners.