Ethereum

Is now a good time to buy Ethereum (ETH)? On-chain data says so

The price of Ethereum (ETH) suffered a similar fate to the rest of the crypto market when the altcoin fell below $3,000. However, this only further validated the uptrend that ETH is stuck in.

Moving closer to a potential breakout over the next few trading sessions, the altcoin presents ideal conditions for accumulation.

Ethereum sell-off slows

Investors should be optimistic about a substantial rebound in the Ethereum price, as some parts of the recent change in behavior show.

The exchange’s net position change shows that ETH outflows have stopped over the past 24 hours as investors refrain from taking profits. Historically, such slowdowns result in a price spike, after which sales continue.

Since selling has taken a back seat for now, Ethereum has a chance to bounce back to recover $3,000 in support.

Ethereum exchange net position change. Source: Glass knot

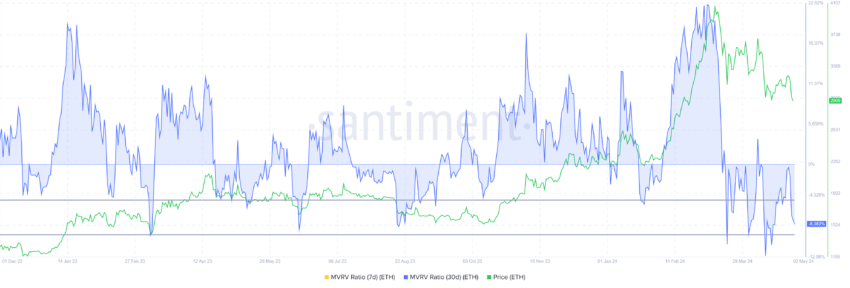

Derived from the market value to realized value ratio (MVRV), which assesses the investor’s profit or loss, the price of Ethereum could see an uptick.

Ethereum’s 30-day MVRV sits at -8%, signaling losses and potentially causing accumulation. Historically, ETH’s recovery has occurred within the -4% to -10% MVRV range, referred to as an opportunity zone.

If investors choose to make the most of it and stock up on ETH, the altcoin could see a stronger recovery.

ETH Price Prediction: 27% Rally

The price of Ethereum trading at $2,945 bounces off the lower trendline of a descending wedge. ETH has been stuck in this pattern for the past couple of months. The decline below $3,000 only further validated the bullish reversal trend.

The likely move from here is a slight uptick to cross the upper trendline. It would allow ETH notes potential 27% reboundplacing Ethereum’s target price at $4,000.

Learn more: Ethereum (ETH) Price Prediction 2024/2025/2030

On the other hand, the volatility Investor optimism could threaten the potential for a rally if broader market signals turn bearish. Failing to reclaim $3,000 could push ETH below $2,800, invalidating the bullish thesis and sending the altcoin to $2,740.

Disclaimer

In accordance with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to providing accurate and unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decision. Please note that our Terms and conditions, Privacy PolicyAnd Disclaimer have been updated.