Regulation

Lawmakers send new ‘Bitcoin ATM’ regulations to Gov. Phil Scott’s desk

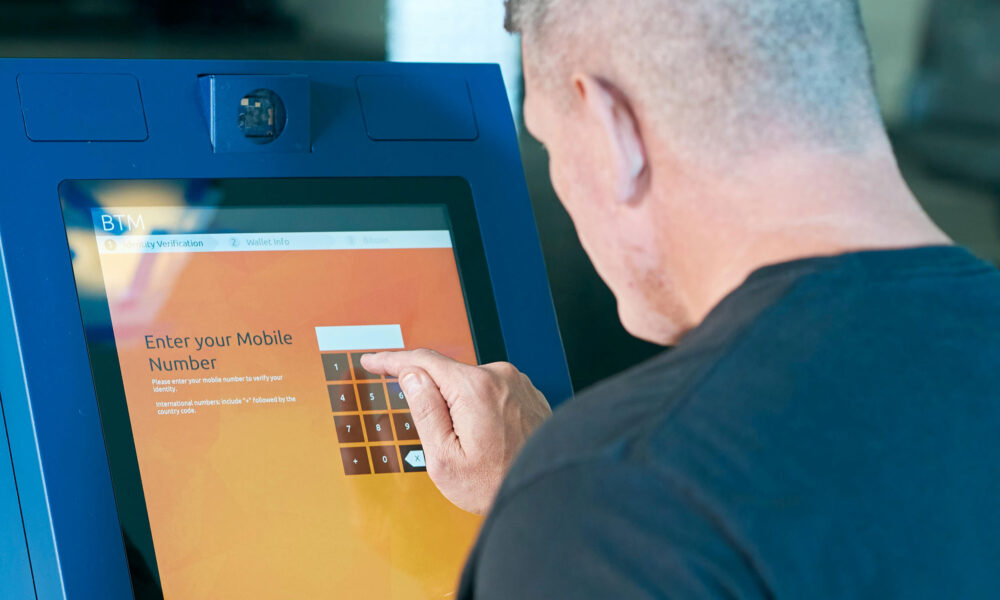

A man uses a Bitcoin kiosk. Photo via Pexels

In an effort to protect Vermonters from scammers, lawmakers recently passed what could become the state’s first-ever law regulating cryptocurrency kiosks, which allow people to quickly purchase virtual currencies in cash or debit card.

Among the provisions included in H.659 There is a daily transaction limit, a fee cap on exchanges and a one-year moratorium on the installation of any new machines in the state, which would take effect at the end of June.

Although Gov. Phil Scott has yet to see the final text of the bill, his spokesman Jason Maulucci said “the Department of Financial Regulation is comfortable” with its provisions.

Kiosks look like standard ATMs that allow consumers to connect to their banks from places like gas stations and bars, but they are actually very different. Instead, the machines sell “cryptocurrencies,” the nickname given to a wide range of digital currencies that don’t rely on banks to verify transactions.

There are currently 36 approved kiosks in Vermont, with seven more awaiting regulatory approval, according to the Department of Financial Regulation.

After exchanges of amendments between the two legislative chambers, the House passed the Senate’s version of the bill on April 25.

As of Monday morning, the governor had not yet received the bill but was expecting it shortly, Maulucci said. Once in his hands, Scott would have five days to sign it, veto it or let it pass without his signature.

When the House first passed H.659 in January, it was a routine measure, a updated Vermont captive insurance laws. However, within the Senate Finance Committee, a new section appeared called “Virtual Currency Kiosk Operators”, which introduced restrictions on the machines to prevent their use by fraudsters.

Sen. Ann Cummings, D-Montpelier, who chairs the committee, said lawmakers worked closely with the Department of Financial Regulation to find the right language. The Department warned of crypto scams several times in recent years.

“This is about protecting Vermonters’ savings,” Cummings said.

A vector of fraud

The difficulty of tracking both cryptocurrencies and cash has made “bitcoin ATMs” a powerful vector of fraud. If a scammer manages to convince a victim to exchange large sums of money for cryptocurrencies on one of these machines, there is no intermediary bank to freeze the transaction. Once the money is transferred to the fraudster’s virtual wallet, it is virtually impossible to get it back.

To prevent Vermonters from losing too much money at once, lawmakers included a $1,000 daily transaction limit in the bill.

“It’s about slowing the rate at which people are falling victim,” said Aaron Ferenc, deputy commissioner of banks at the Department of Financial Regulation.

The legislation would also impose a 3% cap on the fees kiosk operators can charge on each exchange.

In testimony to the House Commerce CommitteeRepresentatives for two Vermont kiosk operators argued that the regulations would effectively prevent them from operating in the state.

“Sometimes when you get to a very rural area, it’s more expensive to send an armed guard to collect the money,” said Larry Lipka, senior vice president of CoinFlip, which operates three kiosks in Vermont. He emphasized Californiawhere the fee limit is 15%, allowing businesses to recover more costs.

Mark Smalley, head of compliance at Bitcoin Depot, said the potential departure of kiosk operators would hurt small businesses. These companies pay rent for space to store their machines, usually in convenience stores or smoke shops.

Bitcoin Depot operates 23 staffed locations, which would not be subject to the new regulations, throughout Vermont. It also has three crypto kiosk registrations pending with the Department of Financial Regulation.

During more than an hour of testimony, lawmakers grilled executives about whether their companies were doing enough to protect customers from fraud.

A significant portion of crypto kiosk users are: in CoinFlip’s own words“underbanked and low-income people who want to transact primarily in cash,” putting them at particular risk of losing their savings if they fall prey to a scam.

Lipka said CoinFlip’s kiosk screens warn of scams and ask users to call its 24/7 hotline if a third party has sent them there to make a transaction.

“Additionally, CoinFlip permanently blacklists high-risk digital wallet addresses to prevent them from being used again at a CoinFlip kiosk,” he said.

When Rep. Kirk White, D/P-Bethel, asked if bad actors could easily create new wallets to avoid the blacklist, Lipka admitted they could.

“Companies always say, ‘If you do this to us, we’ll go out of business,'” Cummings said when asked about the House testimony. “You have to look at the numbers and make the best decision possible.”

“We are not an ATM”

The biggest point of contention, however, concerned the very nature of crypto kiosks and their relationship to traditional ATMs – which is short for “automated teller machine.”

“You know, we call them ATMs because that’s what they look like and they make people feel comfortable,” Lipka said. “But we are not an ATM. You don’t have access to your own money. We are selling you something that you buy voluntarily. »

Rep. Heather Chase, D-Chester, appeared stunned by his comments.

“Did you just say you call them ATMs, not that they are, so people will be comfortable with that? ” she asked.

“We have (called them ATMs) in the past,” Lipka said. “We prefer crypto kiosks… because that’s what it actually is. It’s not an ATM because it’s not connected to a bank.”

On his website, CoinFlip bills itself as “a coast-to-coast Bitcoin ATM network.” A photo of CoinFlip physical machine on the company’s landing page includes the words “Bitcoin ATM” written prominently below the touchscreen.

However, the legislation could have been even harsher towards kiosk operators. The House amendment to H.659 would have banned all kiosks from operating for two years. The Senate reduced this measure to a one-year moratorium on the registration of new machines.

“We have people who have put their money in the kiosks, so there was concern that they wouldn’t be able to access their savings,” Cummings said.

If the bill were to become law, the Commissioner of Financial Regulation would be required to report to lawmakers by January 2025 on whether the legislation does enough to protect Vermonters.

Cummings said the newness of cryptocurrency meant it took a while for lawmakers to get around to it.

“It’s a whole new world,” Cummings said. “We probably won’t get it right the first time.”