Bitcoin

Leak reveals that a ‘big’ Fed earthquake could suddenly destroy the price of Bitcoin, Ethereum, XRP and cryptocurrencies

Bitcoin

Bitcoin

surged again this week as excitement built ahead of former President Donald Trump’s appearance at the Bitcoin 2024 conference (with wild rumors of a major bitcoin announcement continuing to circulate).

Bitcoin price has risen again to $70,000 per bitcoin after Tesla billionaire Elon Musk warned the US dollar was at risk of “destruction” It is Billionaire investor Mark Cuban issues ‘crazy’ bitcoin price prediction.

Now, as controversial Project 2025 sets bitcoin up for $16 trillion price showdown with goldA leak has revealed that pro-bitcoin Republican Senator Cynthia Lummis is drafting legislation that would require the US Federal Reserve to hold bitcoin as a “strategic reserve asset” alongside gold and foreign fiat currencies.

Sign up for free CryptoCodex now—A daily five-minute newsletter for traders, investors, and crypto curious people that will keep you up to date and ahead of the bitcoin and crypto bull market

Republican presidential candidate and former US President Donald Trump to speak at Bitcoin… [+] 2024 conference this weekend, with traders betting on price volatility in bitcoin, ethereum, XRP and other cryptocurrencies.

Getty Images

Lummis will take the stage today at the Bitcoin 2024 conference in Nashville, Tennessee, ahead of Trump’s highly anticipated appearance tomorrow and may announce legislation that would require the Federal Reserve to hold some bitcoin as a strategic reserve asset, it was reported. reported by Fox Business, citing “three cryptocurrency executives with knowledge of the bill.”

Lummis goes to appear CT alongside fellow Republican Sen. Tim Scott, where she may announce the bill. Lummis’s team told Fox Business that they expect Trump to then endorse the bill during his speech.

“There are good things in store this week,” Lummis posted for X this week, using the bitcoin logo emoji in place of the letter B.

“Having the Fed hold bitcoin as a strategic reserve asset would be an important move that would bring stability to the U.S. dollar and our capital markets,” Alex Chizhik, chief commercial officer at HarrisX, told Fox Business. “It also sends a strong signal that our central bank is embracing innovation and, as an independent body, is the natural, nonpartisan home for bitcoin.”

Trump’s embrace of bitcoin and crypto in recent months has reinvigorated bitcoin’s price. Bitcoin’s price “seems to have rebounded on the positive sentiment that Donald Trump, who is likely the current favorite to win the election, is pro-crypto,” Daniel Polotsky, president and founder of bitcoin ATM operator CoinFlip, said in emailed comments.

This week, Wild rumors have swirled around the crypto community that Trump could announce he would create a strategic bitcoin reserve in the US during the Bitcoin 2024 conference.

“The U.S. could strategically incorporate bitcoin into its reserves, diversifying its portfolio and reducing reliance on traditional assets like gold and foreign currencies,” Markus Thielen, chief executive of institutional-focused analytics firm 10x Research, wrote in a note to clients, pointing to the roughly 212,000 bitcoins the U.S. government currently holds, worth about $15 billion, compared with its $600 billion in gold reserves.

“The Bitcoin 2024 conference is generating significant buzz,” Rachel Lin, CEO of decentralized derivatives exchange SynFutures, said in an email. “There is speculation that a U.S. presidential candidate may announce bitcoin as part of the U.S. strategic reserve at the conference. Even if that doesn’t happen, a presidential candidate speaking at the event highlights the growing acceptance of cryptocurrency by the general public. Regardless of what is announced, this conference will go down as a significant milestone in the history of cryptocurrency.”

Independent presidential candidate Robert F. Kennedy (RFK) Jr. has already appeared at the Bitcoin 2024 conference, doubling down on his support for bitcoin and revealing that he has “most of [his] bitcoin wealth”, calling himself “fully committed”, was reported by Coindesk.

Sign up for CryptoCodex now—A free daily newsletter for the crypto-curious

The price of Bitcoin has climbed back to near its all-time high of $70,000 per bitcoin, helping… [+] price of ethereum, XRP and other major cryptocurrencies are expected to rise.

Forbes Digital Assets

RFK Jr. also criticized the relationship between Congress and the Fed, calling it “both parasitic on our country and a symbiotic relationship. The Fed is not a public institution… The decision-makers are appointed by the banking industry,” he said during a conference panel hosted by TheStreet.

Meanwhile, presumptive 2024 Democratic presidential nominee Kamala Harris has ruled out an appearance in Nashville, cementing bitcoin and cryptocurrencies’ status as a partisan technology supported by Republicans and shunned by Democrats.

Conference organizer and Bitcoin Magazine editor David Bailey said in an X publish It was “no surprise” that Harris declined to attend the event, adding: “What can she tell us when she is actively locking up developers, forcing our industry overseas, attacking [proof-of-work]…it would have been a disaster for her.”

Bitcoin

‘This is huge’ — Billionaire Mark Cuban issues ‘incredible’ Bitcoin and crypto prediction amid price slump

Bitcoin has surged again this year under former President Donald Trump Cryptocurrency boosts US presidential election in November with ‘revolutionary’ plan.

The price of bitcoin has surged to more than its all-time high in recent months, surpassing $70,000 per bitcoin and triggering a wave of mega-optimistic predictions about the price of bitcoinalthough it fell again this week to below $65,000 after the Federal Reserve kept interest rates steady.

Now, as Elon Musk suddenly breaks his silence on bitcoin and cryptocurrenciesBillionaire investor Mark Cuban called a California plan to digitize 42 million car titles using blockchain an “incredible step forward” and “huge” for cryptocurrencies.

Sign up for free CryptoCodex now—A daily five-minute newsletter for traders, investors, and crypto curious people that will keep you up to date and ahead of the bitcoin and crypto bull market

Mark Cuban, famous Shark Tank investor and billionaire owner of the NBA team Dallas Mavericks, has… [+] called a cryptocurrency update “amazing” amid bitcoin’s price slump.

Getty Images

The California Department of Motor Vehicles (DMV) has digitized 42 million car titles using blockchain, it was reported by Reuters, through technology company Oxhead Alpha on the Avalanche blockchain and designed to detect fraud and facilitate the securities transfer process.

“This is an incredible development for crypto,” Cuban, best known as an investor on TV’s Shark Tank and owner of the Dallas Mavericks NBA team, posted on X, joking that U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler could sue the state as part of his hostility toward cryptocurrencies and blockchain technology.

“The reason this is huge for crypto is because people who hold the tokens will have an app with an Avalanche wallet,” Cuban said. “Tens of millions of Californians having and using a crypto wallet in the next five years, or however long it takes, normalizes the use of wallets and crypto.”

John Wu, president of Avalanche developer Ava Labs, told Reuters that California’s DMV is “creating a wallet that you can download on your phone.”

Sign up for CryptoCodex now—A free daily newsletter for the crypto-curious

Bitcoin’s price has rallied this year, triggering a wave of bullish bitcoin price predictions from… [+] people like billionaire Mark Cuban.

Forbes Digital Assets

Last month, Cuban predicted that if the US dollar falls as the global reserve currency, bitcoin could become “a global ‘safe haven’” and a “global currency.” potentially sending the price of bitcoin to a much higher level.

According to Cuban, bitcoin could become what its most ardent supporters “envision” — a means “of protecting our economies… This is already happening in countries facing hyperinflation.”

The price of bitcoin has skyrocketed over the past year, largely due to the world’s largest asset manager, BlackRock, leading a bitcoin attack on Wall Street.

Bitcoin

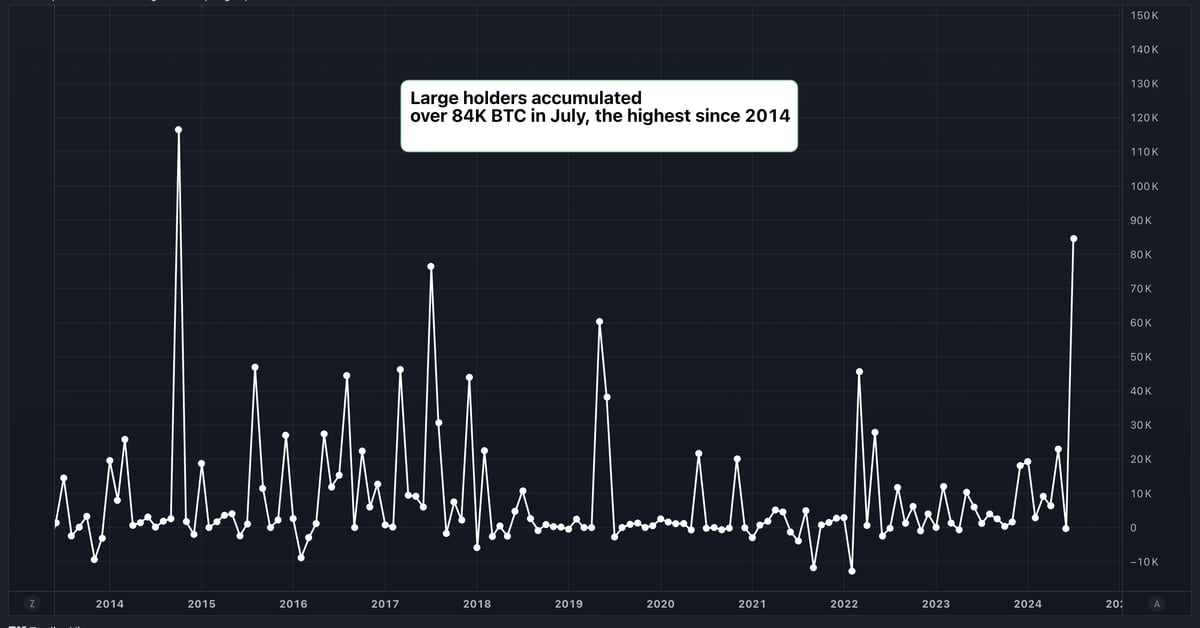

Large Bitcoin (BTC) Holders Added $5.4 Billion Worth of BTC in July, Data Shows

Please note that our Privacy Policy, terms of use, cookiesIt is do not sell my personal information Has been updated.

CoinDesk is a awarded media outlet that covers the cryptocurrency industry. Its journalists follow a strict set of editorial policies. In November 2023, CoinDesk has been acquired by the Bullish group, owner of Optimistica regulated digital asset exchange. The Bullish Group is majority owned by Block.one; both companies have interests CoinDesk has a portfolio of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as an independent subsidiary with an editorial board to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

Bitcoin

Peter Schiff criticizes Michael Saylor’s Bitcoin hype by U.Today

U.Today – Renowned economist and cryptocurrency critic Peter Schiff has criticized Michael Saylor’s recent hype about the growing adoption of cryptocurrencies as a strategic treasury asset by corporations.

Michael Saylor, a well-known Bitcoin advocate and president of MicroStrategy, recently shared his enthusiasm on X about the growing adoption of Bitcoin as a strategic treasury asset.

Citing a comment made by Bitcoin investor Bill Miller in a recent interview with CNBC, Saylor tweeted: “We now have more companies coming forward and saying we will put Bitcoin on our balance sheet as a strategic treasury asset.”

However, not everyone shares Saylor’s enthusiasm. Schiff, a vocal Bitcoin critic and gold bull, was quick to respond with his usual skepticism. In a pointed tweet, Schiff argued: “Bitcoin is neither strategic nor appropriate as a treasury asset. Companies should not risk shareholder funds. They should pay dividends and let shareholders risk their own money.”

Bitcoin enthusiasts are not intimidated

However, Schiff’s criticism shouldn’t deter Bitcoin enthusiasts, who often take Schiff’s words with a pinch of salt. To put things in context, Michael Saylor began buying Bitcoin in 2020 as an inflation hedge and alternative to money. Saylor’s company, MicroStrategy, is among the largest public holders of Bitcoin in the world. As of June 20, it held 226,331 BTC, purchased for around $8.33 billion at an average price of $36,798.

Over the weekend, Schiff was surprised when 87% of the more than 11,000 Bitcoin holders who responded to his X survey said they would not sell any of their Bitcoin even if the price dropped more than 99% to $120. They said not only would they not sell, but that they would continue to buy even when prices dropped.

Schiff unexpectedly revealed that “the main selling point for investors to buy Bitcoin is its excellent past performance record.”

At the time of writing, Bitcoin is trading at $66,067, having reached all-time highs of nearly $74,000 in mid-March.

Bitcoin

Bitcoin Falls as ETF Flows Reverse, Mt. Gox Moves Billions

In a week of drastic fluctuations, the price of Bitcoin (BTC) has retreated from its highs and is currently trading at US$66,250, down 0.9% in European trading.

This volatility comes on the heels of a significant surge above $70,000 earlier in the week, fueled by former President Donald Trump’s ambitious cryptocurrency plans announced in a Bitcoin Conference in Nashville.

Trump’s announcement to fire Securities and Exchange Commission Chairman Gary Gensler and establish a strategic Bitcoin reserve if elected president has temporarily sent the cryptocurrency market into a frenzy.

However, the excitement was short-lived as a series of events unfolded which caused investor sentiment to sour.

A significant sell-off of about 8% was triggered when the US Marshals Service moved $2 billion in Bitcoin for new wallets.

This move has reignited fears of a potential large-scale liquidation, compounded by lingering concerns over a possible Bitcoin liquidation from Mt. Gox. Early this morning, Mt. Gox administrator transferred US$2.2 billion value of your BTC assets in a new wallet.

Meanwhile, the US Bitcoin ETF spot market is showing signs of fluctuation, according to data from SoSo Value. On July 30, Bitcoin spot funds experienced their first net outflow in five days, totaling $18.3 million.

The Grayscale Bitcoin Trust (GBTC) saw outflows of $73.6 million, while the BlackRock iShares Bitcoin Trust (IBIT) attracted $74.9 million in inflows. But outflows from other funds left the category in the red at the end of Tuesday’s trading session. The total net asset value of spot Bitcoin ETFs currently stands at a substantial $58.5 billion.

In other crypto news, Ripple (XRP) is up 8.6% in the past 24 hours, hitting over 64 cents – its highest point since March 25, according to CoinGecko. data.

This rally comes amid a scheduled token unlock and growing optimism around a potential deal in the long-running SEC vs. Ripple lawsuit.

The crypto community is closely watching the SEC’s actions, particularly its intention to amend its complaint against Binance regarding “Third-Party Cryptocurrency Securities,” which some interpret as a positive sign for Ripple.

On a market analysis noteSingapore-based cryptocurrency trading desk QCP Capital wrote that while election headlines continue to dominate, several crucial macroeconomic events loom on the horizon.

“Election headlines will continue to be a key focus, but several key macroeconomic events are also on the horizon. Key events starting with the FOMC meeting on Wednesday, megacap tech earnings (Apple, Amazon, Meta) throughout the week, and unemployment data on Friday,” QCP Capital wrote.

Edited by Stacy Elliott.

-

Regulation11 months ago

Regulation11 months agoRipple CTO and Cardano founder clash over XRP’s regulatory challenges ⋆ ZyCrypto

-

Regulation10 months ago

Regulation10 months agoNancy Pelosi Considers Supporting Republican Crypto Bill FIT21 – London Business News

-

Videos11 months ago

Videos11 months agoCryptocurrency News: Bitcoin, ETH ETF, AI Crypto Rally, AKT, TON & MORE!!

-

Regulation11 months ago

Regulation11 months agoBitcoin’s future is ‘bleak’ and ripe for regulation, says lead developer

-

News8 months ago

News8 months agoAave Price Increases Following Whales Accumulation and V3.1 Launch

-

Regulation8 months ago

Regulation8 months agoSouth Korea Imposes New ‘Monitoring’ Fees on Cryptocurrency Exchanges

-

Regulation8 months ago

Regulation8 months agoA Blank Sheet for Cryptocurrencies: Kamala Harris’ Regulatory Opportunity

-

Regulation8 months ago

Regulation8 months agoCryptocurrency Regulations in Slovenia 2024

-

News11 months ago

News11 months agoThe trader earned $46 million with PEPE after reaching a new ATH

-

Regulation10 months ago

Regulation10 months agoCrypto needs regulation to thrive: Tyler Cowen

-

Blockchain11 months ago

Blockchain11 months agoSolana ranks the fastest blockchain in the world, surpassing Ethereum, Polygon ⋆ ZyCrypto

-

Blockchain10 months ago

Blockchain10 months agoSolana Surpasses Ethereum and Polygon as the Fastest Blockchain ⋆ ZyCrypto