Blockchain

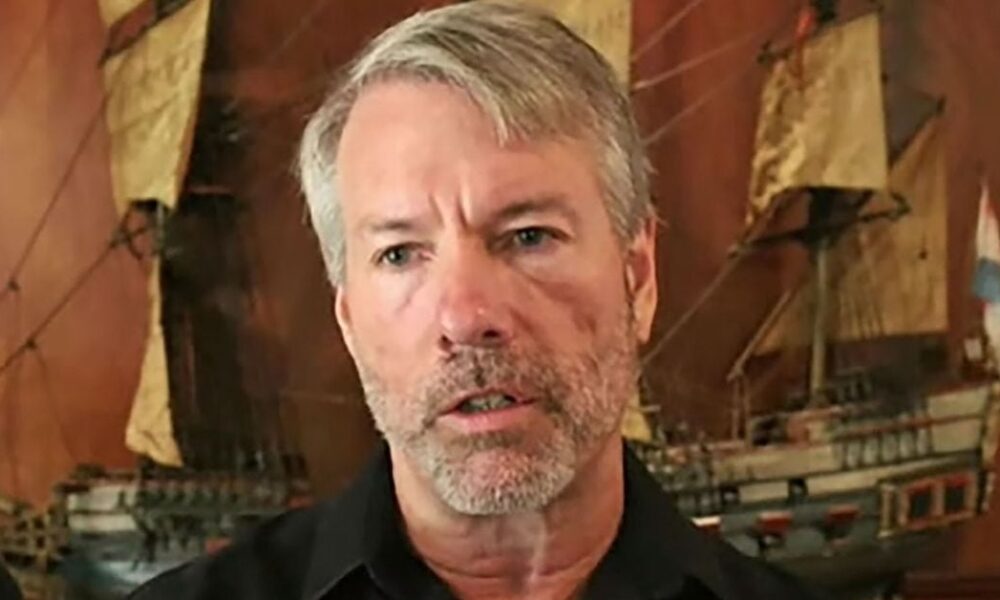

Michael Saylor’s MicroStrategy Acquires 11.9K More Bitcoins for $786 Million

Led by Executive Chairman Michael Saylor, the company held 214,400 bitcoins at the end of April. This latest acquisition brings the company’s total holdings to 226,331 tokens worth just under $15 billion at bitcoin’s current price of around $66,000. The company’s bitcoins were purchased at an average price of $36,798 each, or about $8.33 billion.

This most recent purchase followed the company’s $800 million purchase offering of convertible securities to institutional investors. The offering size was originally supposed to be $500, then increased to $700 million and finally closed at $800 million. In March, the company added 9,245 BTC for $623 million after raising funds in a similar debt issue.

Saylor and MicroStrategy began accumulating the largest and oldest cryptocurrency in 2020 and have since attempted to lead a movement to adopt BTC as a reserve asset for other corporate treasuries. While a handful of companies have added modest amounts of bitcoin to their balance sheets, of particular note is US-listed Semler Scientific (SMLR), which over the past three weeks has not only added bitcoin as a relatively sizable treasury asset, but – in similar way to MicroStrategy – is attempting to do so tap the capital markets buying bitcoin in much larger quantities than its current market capitalization might indicate.

MicroStrategy shares have risen about tenfold since the company began purchasing bitcoin four years ago. Semler shares have risen more than 60% since the company revealed its first bitcoin purchases in late May.

Last week, brokerage firm Bernstein initiated coverage of Microstrategy, setting a price target of $2,890 for shares of the company with an outperform rating. MSTR is currently up 2% pre-market at $1,507.