Blockchain

Michael Saylor’s MicroStrategy (MSTR) Increases Convertible Note Offering to $700 Million

MicroStrategy (MSTR), Nasdaq-listed software company, largest corporate holder of bitcoin (BTC)he increased his offering of convertible securities by 40% to $700 million and priced it to deliver an annual yield of 2.25%.

The notes, available to institutional investors in a private offering, will be senior unsecured notes and will mature in June 2032, the company said in a statement. Friday press release. The Tysons Corner, Virginia-based company also gave initial buyers an option to purchase an additional $100 million of notes within 13 days of the first issue. The company expects to close the offering on Monday. The proceeds from the issuance will be used to acquire more bitcoin and for general corporate business.

The company’s shares gained nearly 2% early in Friday’s session, trading at just above $1,500 after declining 7.5% yesterday. Today, brokerage firm Bernstein initiated coverage of Microstrategy, setting a price target of $2,890 and the assignment of an outperform rating.

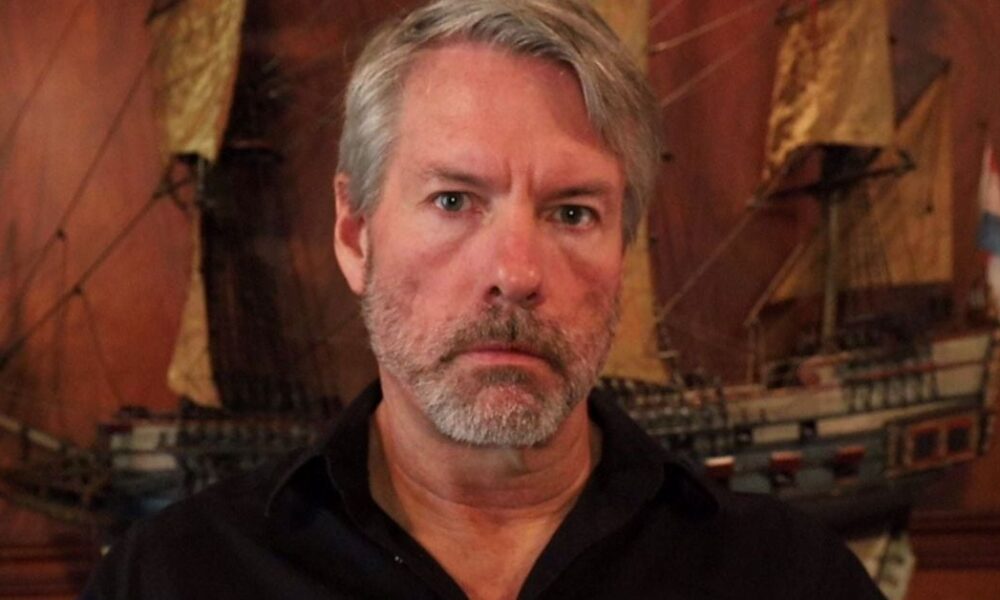

MicroStrategy began purchasing the oldest and largest cryptoasset in 2020 for its treasury. Now holds 214,400 BTC worth approximately $14 billion, making the company the largest publicly traded bitcoin holder. The company’s executive chairman, Michael Saylor, is a staunch supporter of bitcoin.