Ethereum

Over 33 Million ETH Staked in Ethereum Spot ETF Rollout: Will $4,000 Be Next?

Ethereum is outperforming Bitcoin at spot rates, holding firmly above the $3,000-$3,300 support zone. Although prices pulled back yesterday, with the July 29 bar closing with a long upper wick indicating weakness, ETH holders are bullish, expecting gains above $4,000.

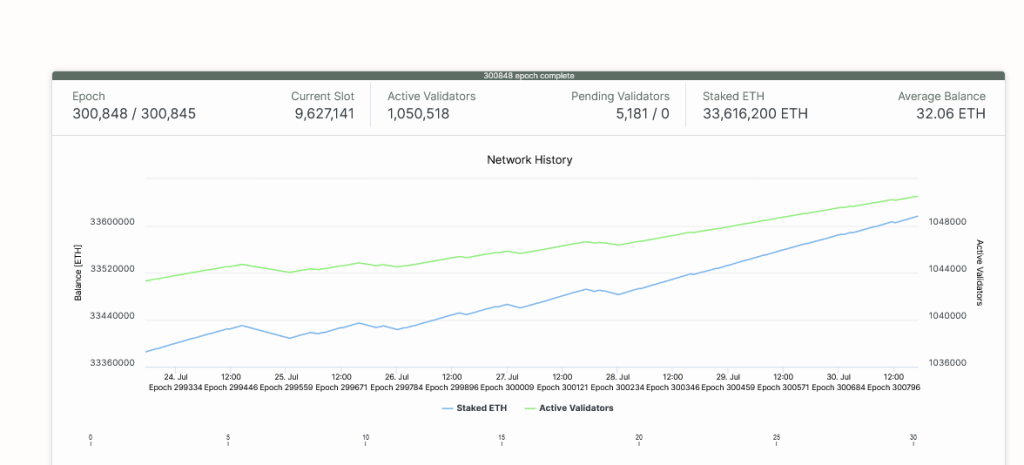

About 30% of all ETH staked, validators account for over 1 million

As Ethereum rejects lows and consolidates its position as the second largest market cap performer, further developments could boost demand in the coming sessions.

Speaking to X, analyst Leon Waidmann note A record 28% of all ETH in circulation has been locked, an all-time high. According to data from CryptoQuant, as of July 29, 33.3 million ETH were locked.

Parallel data from Beaconcha.in revealed There are over 1 million validators. At the same time, over 33.6 million ETH have been staked. Additionally, of all the validators helping to secure and process transactions, each operational node has locked an average of 32.06 ETH.

Holders Withdraw ETH from Exchanges, Ethereum ETF Issuers Demand for Spot

As more ETH continues to be staked, on-chain data also reveals that holders are simultaneously withdrawing more coins from major exchanges. As of July 30, data from CryptoQuant shows that all cryptocurrency exchanges detained only 16.6 million ETH. This is less than the 32.5 million under their control three years ago, in July 2021.

Typically, the more ETH is withdrawn from exchanges, the more confident holders are. Through Binance or Coinbase, users can easily exchange tokens for other assets, including bitcoin or stablecoins. Given this, the fact that they are moving their coins away from these platforms means that they either want to hold or engage in other ecosystem activities like decentralized finance (DeFi) through portals like Maker or even bet on an annual return.

The combination of ETH being moved from exchanges and holders choosing to stake is making the coin more scarce. Additionally, the availability of Ethereum spot ETFs in the US is also expected to increase demand for ETH. Therefore, as the coin becomes scarcer, demand for this derivative product may drive prices higher.

According to the daily chart, ETH has encountered resistance at $3,500. If the coin finds support around the $3,000-$3,300 area, ETH could likely float higher.

Main image of DALLE, chart from TradingView