Ethereum

Polygon Ranks Second After Ethereum For Tokenized Assets – Will This Help MATIC?

- The Polygon network has seen a resurgence of interest in RWA, notably with a recent ECB trial.

- MATIC’s traction on the price charts has slowed slightly, with $0.51 as the key price level.

Polygon [MATIC] Founder Sandeep Nailwal acknowledged the growing interest in real-world assets (RWA) for the Ethereum [ETH] L2 Network. Sound Remarks followed the recent attempt at issuing bonds by the European Central Bank (ECB).

“The fact that so many RWAs are launching organically on Polygon is very encouraging… Polygon POS is already second only to Ethereum mainnet in terms of RWA value created.”

However, according to RWA.xyz dataThe statement was exaggerated. The platform showed that Polygon was the fifth largest network in terms of total market capitalization, particularly in the US tokenized securities market.

Will RWA interest drive MATIC price up?

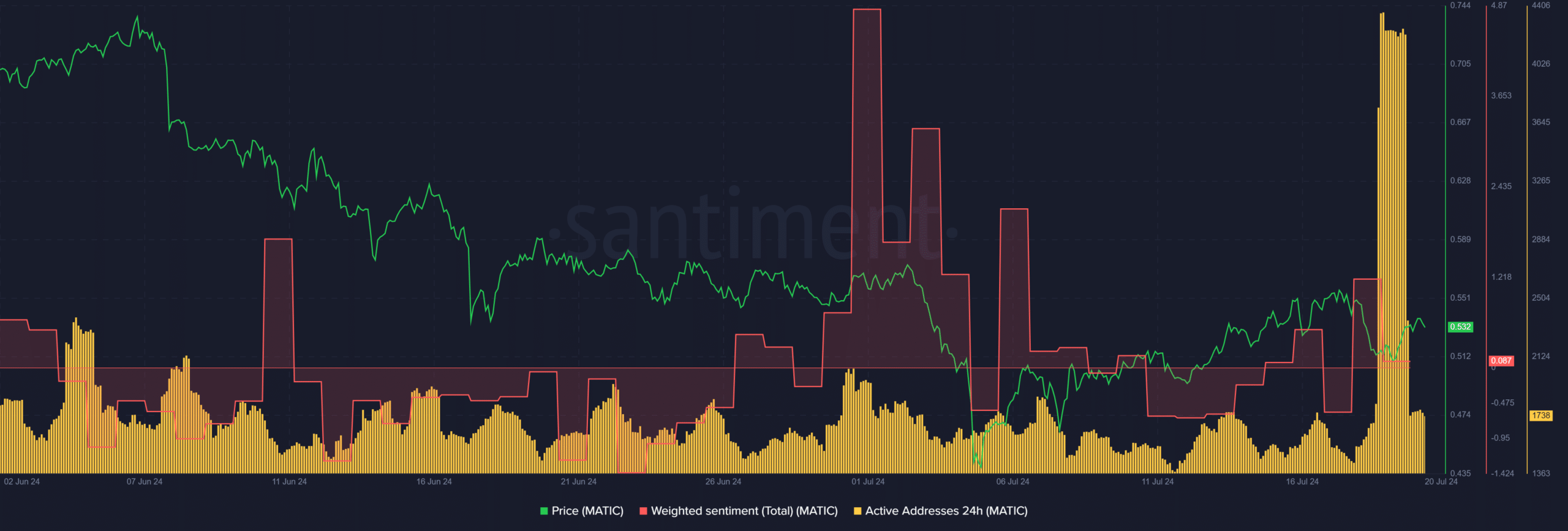

The growing interest in RWA has revealed some positive network effects, as evidenced by an increase in MATIC’s daily active addresses, according to sentiment data.

Source: Santiment

Additionally, the ECB lawsuit news update on the network has shifted MATIC’s weighted sentiment to positive. However, the indicator has fallen towards the neutral level at press time, which could hurt the market sentiment on MATIC.

At the time of writing, the daily active address has also dropped, which could derail a further price rally with fewer users interacting with the altcoin.

MATIC recovery slows

Source: MATIC/USDT, TradingView

On the price front, MATIC surged 3% on July 19 after Nailwal’s remarks. However, MATIC’s overall rally in July stalled above $0.55 and fell back to $0.51. Mixed readings from key chart price indicators signaled caution among traders.

The RSI (Relative Strength Index) has notably recovered, but it has remained below its average level (50). This means that the recent recovery has not generated enough buying pressure to guarantee a stronger rise.

Additionally, the CMF (Chaikin Money Flow) was above average but hovering near the equilibrium level, indicating that inflows have increased but stagnated over the past few days.

The above readings suggest that MATIC may struggle to clear the overhead hurdle and daily order block above $0.55 (red).

However, the $0.51 level was also a crucial demand interest level, as shown by the chart and whale order. data.

Source: Coinglass

The bounce to $0.51 was marked by approximately $26 million in buy orders on the derivatives market on the Binance exchange. Additionally, demand increased on the MATIC spot market, with over $500,000 in bids at this level.

Therefore, given the whale interest and massive volume at $0.51, this was a crucial level for any MATIC speculator looking to enter the altcoin market.