Bitcoin

Spot Bitcoin ETF Flows Drop as Crypto Price Drops

ETF Investing Tools

After rising for weeks, flows into spot bitcoin ETFs have sunk into negative territory on three of the last four days as the price of the asset on which it is based has fallen.

The 11 funds totaled more than $300 million in outflows during the week, according to research from U.K.-based asset manager Farside Investors. Tuesday’s outflows broke a 19-day streak of inflows for the just five-month-old products that track the largest cryptocurrency by market capitalization.

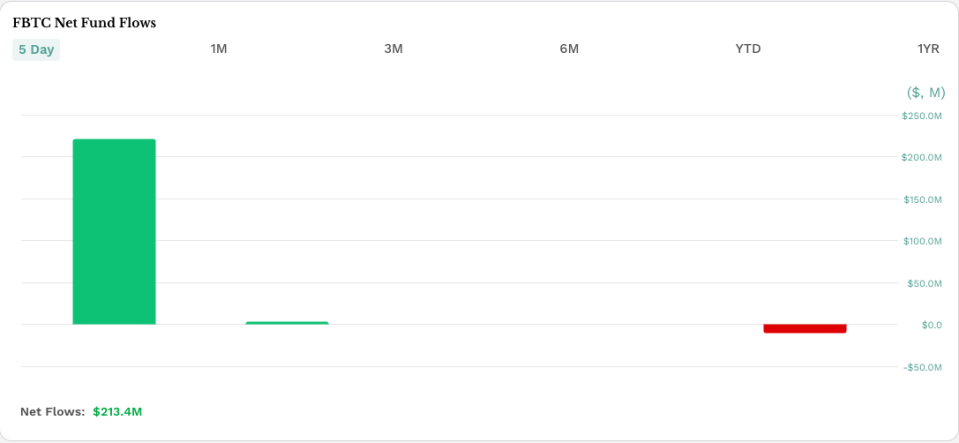

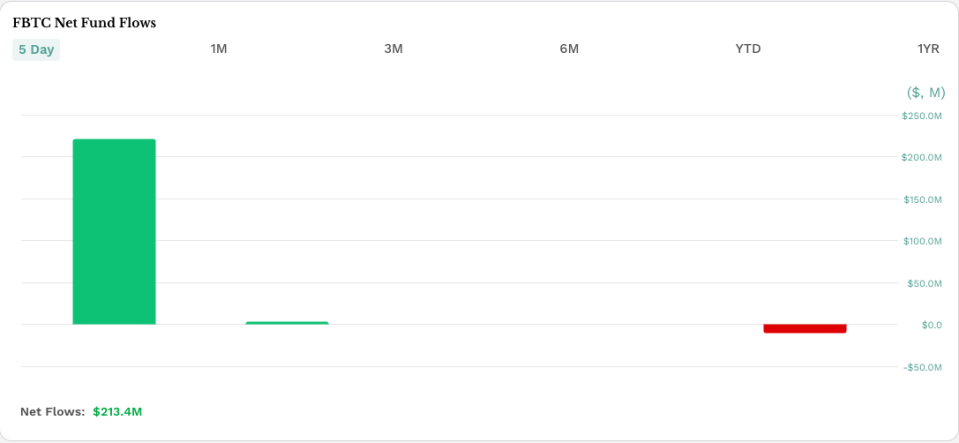

Grayscale Bitcoin Trust (GBTC) outflows totaled more than $226 million in outflows, the largest among spot bitcoin ETFs. The fund, a conversion of a trust, charges the highest fee among the products. But the highly successful Fidelity Wise Origin Bitcoin Fund (FBTC) also recorded rare outflows on three separate days totaling more than $116 million, including $106 million on Thursday. The fund has generated more than $9.5 million in inflows since its debut on January 11.

Even the BlackRock Bitcoin Trust (IBIT))which accumulated a cash bitcoin of $17.6 billion in assets, received only moderate interest, generating just $38 million in inflows for the week.

etf.com: FBTC streams

As of June 4, spot bitcoin ETFs generated $886 million in inflows, the second-highest total in the funds’ history. and US$ 1.8 billion in inflows in the week.

Bitcoin’s price fell more than 7% in the seven days to about $65,000, its lowest level in a month, according to crypto markets data provider CoinMarketCap. The drop is likely the result of miners selling stakes to improve their balance sheets and, to a lesser extent, profit-taking among large investors, market observers say.

“BTC spot ETF flows often tend to be a function of price,” wrote analyst Noelle Acheson, author of the Crypto Is Macro Now newsletter, via Telegram for etf.com. She added that miners were “probably” responsible for the bitcoin selling pressure.

“This is a typical feature of the post-halving cycle, as unprofitable miners shut down machines and sell BTC reserves, and optimistic miners who want to wait for the market to recover may be selling BTC to cover operating expenses.”

Bitcoin price drop

According to data from analytics firm CryptoQuant, on June 9, transfers from mining pools to Binance, the world’s largest cryptocurrency exchange, reached a 2-month high of more than 3,000 bitcoins. “This move aligns with a price correction, which dropped #Bitcoin to $66,000,” the company wrote in an X post on Thursday.

The company separately noted that on June 10, miners sold an additional 1,200 bitcoins at OTC counters, “the highest daily volume in more than two months.”

The story continues

The movement of tokens to trading platforms often signals that digital asset holders want to sell.

Permalink | © Copyright 2024 etf. with. All rights reserved