News

Struggling Bitcoin Miners Seek Deals With AI Firms

Unlock Editor’s Digest for free

FT editor Roula Khalaf selects her favourite stories in this weekly newsletter.

Bitcoin miners are rushing to sign deals with artificial intelligence developers in an attempt to revive their flagging revenues by finding new customers for their vast data centers.

Cryptocurrency miners operate massive processing sites, often spanning acres of land, where they solve complex mathematical puzzles to authenticate transactions and produce digital coins. But with high energy and processing costs, and mining rewards recently halved, many are struggling to turn a profit.

Now they’re hoping to capitalize on a surge in demand for powerful but rare chips, known as graphics processing units, or GPUs, that are used in both cryptocurrency mining and AI computing. Tech companies are racing to gain access to chip giant Nvidia’s GPUs as they seek to build more capable AI systems, and they’re increasingly striking deals to let them use miners’ chips or put their own chips in miners’ data centers.

Core Scientific, one of the world’s largest bitcoin miners, is “aggressively pursuing” artificial intelligence deals, Chief Executive Adam Sullivan told the Financial Times. “It’s an incredibly important part of the business,” he added.

© Elijah Nouvelage/Bloomberg

The Nasdaq-listed miner, which has data centers in Texas, North Carolina and Georgia, struck a deal with AI cloud provider CoreWeave last month that the companies estimate will be worth $4.7 billion in revenue over 12 years. Nvidia-backed CoreWeave, itself a former cryptocurrency miner that turned towards artificial intelligence several years ago and saw its valuation jump to $19 billion in May, will use Core Scientific’s data centers to house its artificial intelligence chips.

AI companies require a lot of power and computing infrastructure, two things bitcoin miners typically have access to. AI groups are betting that using miners’ high-performance computing (HPC) data centers will be faster and cheaper than building their own.

Big tech companies including Microsoft, Google and Amazon have said they plan to spend tens of billions of dollars to develop data center infrastructure to support their AI ambitions. Demand for AI capabilities has also fueled investor interest in new cloud startups like CoreWeave and Lambda Labsthat focus on leasing access to GPUs.

“It [normally] “It takes 3 to 5 years to build an HPC-grade data center from scratch,” JPMorgan analysts wrote in a recent note, adding that this timeline has been further extended by growing demand for artificial intelligence projects.

“This energy rush highlights companies that now have access to low-cost energy,” they added.

Other large bitcoin miners are using some of their data or processing power for artificial intelligence.

US hedge fund Coatue Management, founded by “Tiger cub” fund manager Philippe Laffont, recently invested $150 million in Hut 8 to help the bitcoin miner upgrade its infrastructure to meet the needs of AI companies. The mining firm also recently created a new AI division.

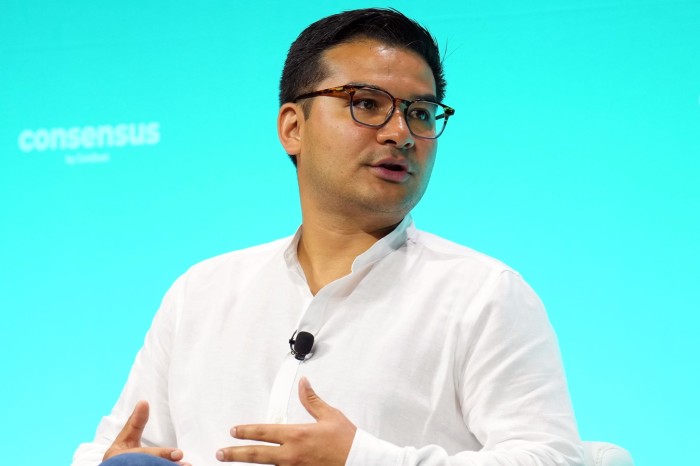

Asher Genoot, chief executive of Hut 8, said the company, named after a building in Bletchley Park where mathematician Alan Turing worked during World War II, was focused on “massive demand and growth in the data center segment, driven primarily by much of the demand for artificial intelligence.”

Bitcoin miners hope that shifting their strategy toward artificial intelligence will ensure higher and more stable revenues.

Many miners, including Core Scientific, went bankrupt in 2022 after the collapse of cryptocurrency exchange FTX and the price of bitcoin plummeted below $16,000.

While cryptocurrency prices have skyrocketed since then (bitcoin hit a record high of over $73,800 in March and is now trading around $63,800), the financial rewards they can earn from mining each new bitcoin block have been cut by four years. bitcoin halving event in April. The high cost of energy and technology has also hit their profitability.

Canadian mining firm Hive is also focusing on “growing revenue from its suite of Nvidia GPU chips that power data services for the AI revolution,” the company said, while New York-based Bit Digital signed a three-year, $275 million deal in January to lease its data center space to a company building large language models.

“We understood that the halving was imminent and we thought that with margins compressed by 50 percent overnight, it didn’t always make sense to hope that the value of bitcoin would go up, it’s just not good business practice,” said Sam Tabar, CEO of Bit Digital.

“We’re just renting computing power to people who are building AI models, and we do the hardware,” he added.

However, the rush to build new data centers is electrical networks under strain in some parts of the world, given the huge power requirements of HPC. Bitcoin mining is also energy intensiveand both sectors have been criticized for the enormous amount of energy they consume.

Google’s Greenhouse Gas Emissions increased by 48 percent over the past five years, as it expands its data centers for artificial intelligence processes, while bitcoin mining consumes more energy than Pakistan or Ukraine each year, according to data from the University of Cambridge.