News

The Bitcoin halving is over. 3 cryptocurrencies to buy now.

Fourth halving From Bitcoin (CRYPTO:BTC) mining rewards are in the books and the cryptocurrency world is abuzz. With Bitcoin’s inflation rate reduced and scarcity amplified, experts predict a price surge that could ripple through the entire market.

The halving means miners now receive fewer bitcoins to validate transactions, making each digital coin more valuable. This is expected to drive prices higher over the next year, assuming demand for Bitcoin remains stable or increases. Without this market reaction, mining becomes unprofitable and the transaction processing system collapses.

This is obviously good news for Bitcoin investors. The leading cryptocurrency should be first on your list if you are dipping your first toe into the cryptocurrency waters these days.

Growth investing mastermind Cathie Wood of ARK Invest agrees: The inflation-softening effect of halving cycles Furthermore, the arrival of Bitcoin Exchange Traded Funds (ETFs) is expected to push the price of Bitcoin to $1.5 million or higher by 2030.

According to Wood, a more aggressive adoption of Bitcoin in the financial community could push the coin’s price up to $3.8 million. And I don’t think he’s wrong about that. The only question is how quickly traditional bankers will embrace the increasingly digital global economy.

But Bitcoin isn’t the only cryptocurrency in play right now. Ethereum (CRYPTO: ETH) e Polka dot (CRYPTO:DOT) seems like a great long-term investment to me, for very different reasons.

Ethereum

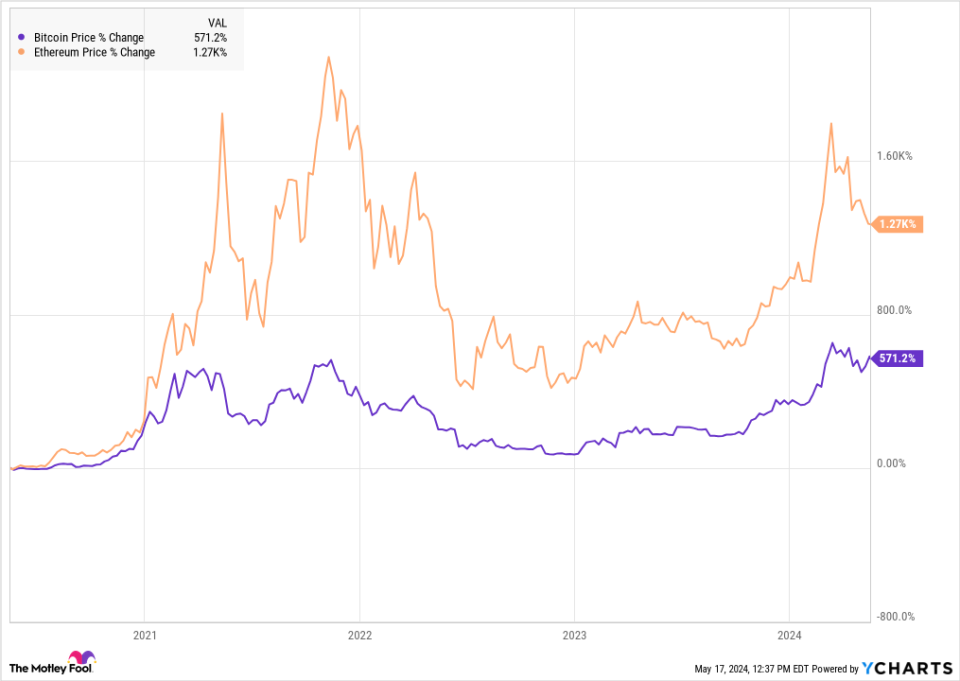

Bitcoin and Ethereum often move together. Their price charts are almost twins, except that Ethereum’s long-term gains tend to be a bit higher:

Bitcoin price chart

This happens for a couple of reasons:

-

Market sentiment towards Bitcoin tends to color the entire cryptocurrency market. When the oldest and biggest name in the industry makes headlines, the very idea of digital currencies gains space in public discussion. As such, Ethereum follows the lead of its larger cousin quite directly.

-

Ethereum is also a pioneer of cryptocurrencies. Its smart contracts add value to the broader industry, and many popular digital currencies are actually ERC20 tokens on the Ethereum network. Developers tend to get to work creating apps and programs that depend on smart contracts when cryptocurrencies inspire headlines, so it makes sense that the leading smart contract platform needs to move beyond Bitcoin’s simple value storage profile.

So I expect Ethereum to follow suit with Bitcoin’s impending price gains, with an additional dose of adrenaline added to the mix. Bearish analysts point out that Ethereum has many rivals these days, led by the fastest Solana (CRYPTO: G) e Cardan (CRYPTO: ADA).

The story continues

But Ethereum has a multi-year head start on these potential replacements and a much larger market footprint. And don’t forget that the Ethereum blockchain is in the midst of a long upgrade process, increasing the speed of contract execution and adding new features.

The king of digital contracts may end up sharing the cryptocurrency throne with a couple of rivals, but there’s room for several substantial winners up there.

Polka dot

If Ethereum is Bitcoin’s turbocharged graphics twin, Polkadot plays the role of an undervalued, low-priced alternative. Bitcoin prices have more than doubled over the past two years, but Polkadot is down 34% over the same period:

Bitcoin price chart

Yet, Polkadot seems ready to perform in the near future. This is the official blockchain ecosystem of the Web3 Foundation, and the Internet as we know it seems overdue for a new architecture. The era of social media giants is starting to tire.

By focusing on Web3 ideals and interoperability between different blockchain systems, Polkadot is uniquely prepared to win in the coming sea change. The Polkadot project aims to build a decentralized Internet, attracting developers and projects looking for advanced features in a more personal era of online interaction.

Polkadot is a little lost in the market noise right now, as investors don’t see much evidence that the Web3 revolution is coming. I see the sliding price as a wide open buying window, setting Polkadot up for larger percentage gains from a lower base.

With Bitcoin halving events boosting overall market sentiment, now could be the perfect time to invest in Polkadot at an absurd discount.

Should You Invest $1,000 in Polkadot Right Now?

Before you buy Polkadot stock, consider this:

The analyst team at Motley Fool Stock Advisor has just identified what they believe is the 10 best stocks for investors to buy now… and Polkadot wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia you created this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you would have $566,624!*

Stock Advisor provides investors with an easy-to-follow model of success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks every month. The stock advisory service has more than quadrupled the return of the S&P 500 Index since 2002*.

*Equity advisor will return starting May 13, 2024

Anders Bylund has positions in Bitcoin, Cardano, Ethereum, Polkadot and Solana. The Motley Fool has positions and recommends Bitcoin, Cardano, Ethereum and Solana. The Motley Fool has a disclosure policy.

The Bitcoin halving is over. 3 cryptocurrencies to buy now. was originally published by The Motley Fool